Dollar General 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

connection with the 2012 secondary offerings and expects to pay resulting aggregate expenses of

approximately $0.5 million in connection with the April 2013 secondary offering. Certain members of

our management, including certain of our executive officers, exercised registration rights in connection

with such offerings. The underwriters, including affiliates of KKR and Goldman, Sachs & Co., waived

their fee for members of our management who participated in the October 2012 and the April 2013

secondary offerings. To the extent additional secondary offerings of our common stock are completed in

fiscal 2013, we expect affiliates of KKR and Goldman, Sachs & Co. to serve as underwriters and for us

to pay resulting expenses, in each case consistent with the 2012 and April 2013 secondary offerings.

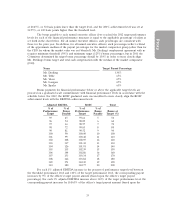

Concurrent with the closing of the April 2012 secondary offering and pursuant to a Share

Repurchase Agreement between Dollar General and Buck Holdings L.P., dated March 25, 2012, Dollar

General purchased 6,817,311 shares of Common Stock from Buck Holdings L.P. for an aggregate

purchase price of $300 million, or $44.00562 per share which represents the per share price to the

public in the secondary offering less underwriting discounts and commissions. Of such shares, affiliates

of KKR and Goldman, Sachs & Co. sold to Dollar General 3,552,787 and 1,478,274 shares for proceeds

of $156.3 million and $65.1 million, respectively.

In addition, pursuant to a Share Repurchase Agreement between Dollar General and Buck

Holdings, L.P., dated September 25, 2012, Dollar General purchased 4,929,508 shares of Common

Stock from Buck Holdings, L.P. for an aggregate purchase price of $250 million, or $50.715 per share

which represents the per share price to the public in the October 2012 secondary offering less

underwriting discounts and commissions. Of such shares, affiliates of KKR and Goldman, Sachs & Co.

sold to Dollar General 2,567,370 and 1,068,254 shares for proceeds of approximately $130.2 million and

$54.2 million, respectively. The closing of such share repurchase was conditioned upon the receipt of

the consent of the requisite lenders under our senior secured credit facilities and the consummation of

the October 2012 secondary offering. In connection with the closing of such repurchase transaction,

Buck Holdings, L.P. reimbursed Dollar General approximately $1.7 million for lender fees incurred in

obtaining such consent as further described below. Affiliates of KKR are and affiliates of Goldman,

Sachs & Co. may be lenders under the term loan and, as such, each would have received a pro-rata

portion of such fee.

Each of the share repurchase transactions with Buck Holdings, L.P. described above was part of

an overall Board-authorized share repurchase program and was specifically reviewed and approved by a

special committee of our Board made up entirely of independent directors.

Affiliates of KKR are and Goldman, Sachs & Co. may be lenders under our senior secured

term loan facility, which had a $2.3 billion principal amount at inception and a principal balance as of

February 1, 2013 of approximately $2.0 billion. Goldman Sachs Credit Partners L.P. also served as

syndication agent and joint lead arranger for the term loan facility. This term loan facility was entered

into and subsequently amended (as discussed below) in the ordinary course of business and, as of the

loan origination and subsequent amendment, was made on substantially the same terms, including

interest rates and collateral, as those prevailing at the time for comparable loans with persons not

related to the lender and did not involve more than the normal risk of collectability or present other

unfavorable features. We paid approximately $62.0 million of interest on the term loan during fiscal

2012.

We amended this term loan facility in March 2012 to, among other things, extend the maturity

of a portion of such facility from 2014 to 2017. An affiliate of each of KKR and Goldman,

Sachs & Co., along with a third unaffiliated entity, acted as a joint lead arranger in connection with

such term loan facility amendment for which each of the KKR and Goldman, Sachs & Co. affiliates

received a fee from Dollar General of approximately $440,000. As disclosed above, in connection with

the October 2012 share repurchase from Buck Holdings, L.P., we further amended this term loan

facility in October 2012 to add additional capacity for Dollar General to repurchase, redeem or

24