Dollar General 2012 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

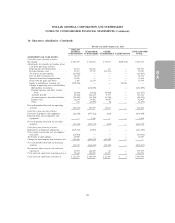

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

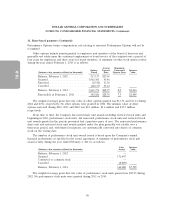

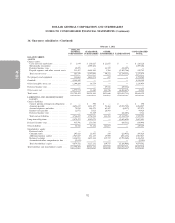

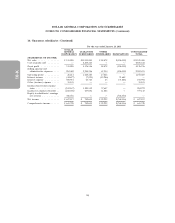

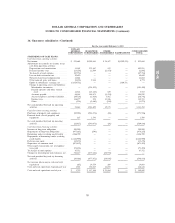

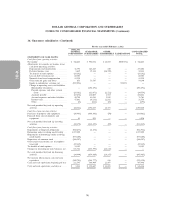

16. Guarantor subsidiaries (Continued)

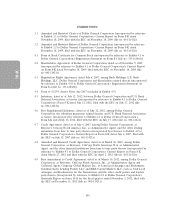

For the year ended February 3, 2012

DOLLAR

GENERAL GUARANTOR OTHER CONSOLIDATED

CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL

STATEMENTS OF CASH FLOWS:

Cash flows from operating activities:

Net income .................... $ 766,685 $ 901,032 $ 18,019 $(919,051) $ 766,685

Adjustments to reconcile net income to net

cash from operating activities:

Depreciation and amortization ....... 31,793 243,485 130 — 275,408

Deferred income taxes ............ 1,649 25,328 (16,745) — 10,232

Tax benefit of stock options ......... (33,102) — — — (33,102)

Loss on debt retirement, net ......... 60,303 — — — 60,303

Noncash share-based compensation .... 15,250 — — — 15,250

Other noncash gains and losses ....... 653 53,537 — — 54,190

Equity in subsidiaries’ earnings, net .... (919,051) — — 919,051 —

Change in operating assets and liabilities:

Merchandise inventories .......... — (291,492) — — (291,492)

Prepaid expenses and other current

assets .................... (19,361) (12,671) (2,522) — (34,554)

Accounts payable .............. (17,678) 120,607 1,513 — 104,442

Accrued expenses and other liabilities . . 20,799 45,015 5,949 — 71,763

Income taxes ................. 47,681 (8,233) 12,102 — 51,550

Other ..................... (3) (121) (71) — (195)

Net cash provided by (used in) operating

activities ..................... (44,382) 1,076,487 18,375 — 1,050,480

Cash flows from investing activities:

Purchases of property and equipment ..... (30,403) (484,388) (70) — (514,861)

Proceeds from sales of property and

equipment .................... 33 993 — — 1,026

Net cash provided by (used in) investing

activities ..................... (30,370) (483,395) (70) — (513,835)

Cash flows from financing activities:

Repayments of long-term obligations ..... (910,677) (1,274) — — (911,951)

Borrowings under revolving credit facility . . 1,157,800 — — — 1,157,800

Repayments of borrowings under revolving

credit facility .................. (973,100) — — — (973,100)

Repurchase of common stock ......... (186,597) — — — (186,597)

Other equity transactions, net of employee

taxes paid .................... (27,219) — — — (27,219)

Tax benefit of stock options ........... 33,102 — — — 33,102

Changes in intercompany note balances, net . 871,742 (853,595) (18,147) — —

Net cash provided by (used in) financing

activities ..................... (34,949) (854,869) (18,147) — (907,965)

Net increase (decrease) in cash and cash

equivalents ................... (109,701) (261,777) 158 — (371,320)

Cash and cash equivalents, beginning of year 111,545 364,404 21,497 — 497,446

Cash and cash equivalents, end of year .... $ 1,844 $ 102,627 $ 21,655 $ — $ 126,126

96