Dollar General 2012 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

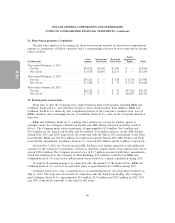

11. Share-based payments (Continued)

Performance Options, future compensation cost relating to unvested Performance Options will not be

recognized.

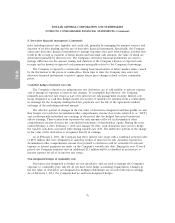

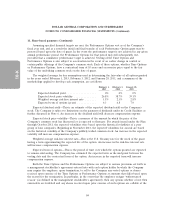

Other options include awards granted to employees and members of the board of directors and

generally vest solely upon the continued employment or board service of the recipient over a period of

four years for employees and three years for board members. A summary of other stock option activity

during the year ended February 1, 2013 is as follows:

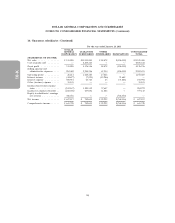

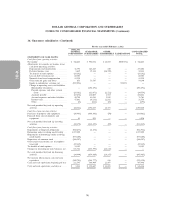

Average Remaining

Options Exercise Contractual Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Price Term in Years Value

Balance, February 3, 2012 ........... 217,137 $29.05

Granted ........................ 1,063,303 45.46

Exercised ....................... (8,532) 13.36

Canceled ....................... (60,137) 45.14

Balance, February 1, 2013 ........... 1,211,771 $42.77 8.9 $4,416

Exercisable at February 1, 2013 ....... 142,026 $28.76 7.3 $2,489

The weighted average grant date fair value of other options granted was $13.54 and $13.14 during

2012 and 2011, respectively. No other options were granted in 2010. The intrinsic value of other

options exercised during 2012, 2011 and 2010 was $0.3 million, $1.6 million and $15.5 million,

respectively.

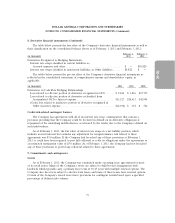

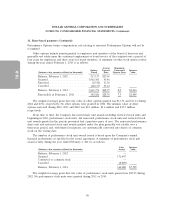

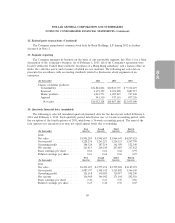

From time to time, the Company has issued share unit awards including restricted stock units and,

beginning in 2012, performance stock units. All nonvested performance stock unit and restricted stock

unit awards granted in the periods presented had a purchase price of zero. The nonvested performance

share unit and restricted stock unit awards granted under the plan generally vest ratably over a

three-year period, and, with limited exceptions, are automatically converted into shares of common

stock on the vesting date.

The number of performance stock unit awards issued is based upon the Company’s annual

financial performance as specified in the award agreement. A summary of performance stock unit

award activity during the year ended February 1, 2013 is as follows:

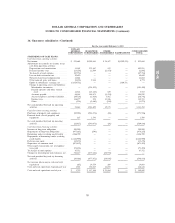

Units Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Value

Balance, February 3, 2012 ............................. —

Granted .......................................... 171,497

Converted to common stock ........................... —

Canceled ......................................... (8,809)

Balance, February 1, 2013 ............................. 162,688 $7,529

The weighted average grant date fair value of performance stock units granted was $45.25 during

2012. No performance stock units were granted during 2011 or 2010.

86