Dollar General 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

For the years ended February 1, 2013, February 3, 2012, and January 28, 2011, gross realized gains

and losses on the sales of available-for-sale securities were not material. The cost of securities sold is

based upon the specific identification method.

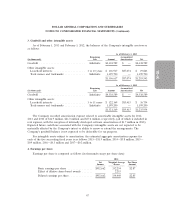

Merchandise inventories

Inventories are stated at the lower of cost or market with cost determined using the retail last-in,

first-out (‘‘LIFO’’) method as this method results in a better matching of costs and revenues. Under the

Company’s retail inventory method (‘‘RIM’’), the calculation of gross profit and the resulting valuation

of inventories at cost are computed by applying a calculated cost-to-retail inventory ratio to the retail

value of sales at a department level. Costs directly associated with warehousing and distribution are

capitalized into inventory. The excess of current cost over LIFO cost was approximately $101.9 million

and $100.5 million at February 1, 2013 and February 3, 2012, respectively. Current cost is determined

using the RIM on a first-in, first-out basis. Under the LIFO inventory method, the impacts of rising or

falling market price changes increase or decrease cost of sales (the LIFO provision or benefit). The

Company recorded a LIFO provision of $1.4 million in 2012, $47.7 million in 2011, and $5.3 million in

2010.

The 2011 LIFO provision was impacted by increased commodity costs related to food, housewares

and apparel products which were driven by increases in cotton, sugar, coffee, groundnut, resin,

petroleum and other raw material commodity costs. These costs were relatively stable in 2012 and 2010.

Vendor rebates

The Company accounts for all cash consideration received from vendors in accordance with

applicable accounting standards pertaining to such arrangements. Cash consideration received from a

vendor is generally presumed to be a rebate or an allowance and is accounted for as a reduction of

merchandise purchase costs as earned. However, certain specific, incremental and otherwise qualifying

SG&A expenses related to the promotion or sale of vendor products may be offset by cash

consideration received from vendors, in accordance with arrangements such as cooperative advertising,

when earned for dollar amounts up to but not exceeding actual incremental costs.

Prepaid expenses and other current assets

Prepaid expenses and other current assets include prepaid amounts for rent, maintenance,

advertising, and insurance, as well as amounts receivable for insurance related to a litigation settlement

discussed in greater detail in Note 9, and certain vendor rebates (primarily those expected to be

collected in cash) and coupons.

58