Dollar General 2012 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

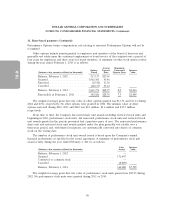

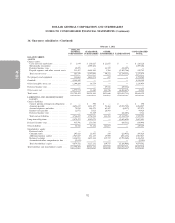

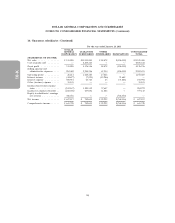

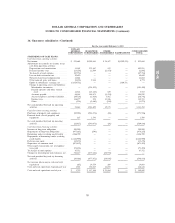

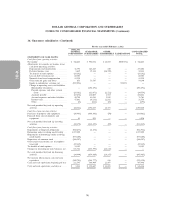

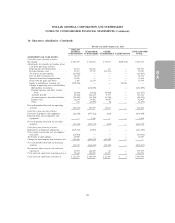

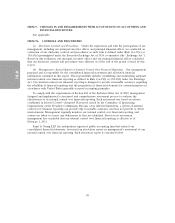

16. Guarantor subsidiaries (Continued)

February 3, 2012

DOLLAR

GENERAL GUARANTOR OTHER CONSOLIDATED

CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL

BALANCE SHEET:

ASSETS

Current assets:

Cash and cash equivalents .......... $ 1,844 $ 102,627 $ 21,655 $ — $ 126,126

Merchandise inventories ........... — 2,009,206 — — 2,009,206

Deferred income taxes ............ 10,078 — 21,729 (31,807) —

Prepaid expenses and other current assets 551,457 4,685,263 5,768 (5,102,746) 139,742

Total current assets .............. 563,379 6,797,096 49,152 (5,134,553) 2,275,074

Net property and equipment .......... 113,661 1,681,072 227 — 1,794,960

Goodwill ...................... 4,338,589 — — — 4,338,589

Other intangible assets, net ........... 1,199,200 36,754 — — 1,235,954

Deferred income taxes .............. — — 49,531 (49,531) —

Other assets, net ................. 6,575,574 13,260 323,736 (6,868,627) 43,943

Total assets .................... $12,790,403 $8,528,182 $422,646 $(12,052,711) $9,688,520

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Current portion of long-term obligations . $ — $ 590 $ — $ — $ 590

Accounts payable ............... 4,654,237 1,451,277 52,362 (5,093,789) 1,064,087

Accrued expenses and other ......... 79,010 264,575 62,447 (8,957) 397,075

Income taxes payable ............. 12,972 5,013 26,443 — 44,428

Deferred income taxes ............ — 35,529 — (31,807) 3,722

Total current liabilities ............ 4,746,219 1,756,984 141,252 (5,134,553) 1,509,902

Long-term obligations .............. 2,879,475 3,340,075 — (3,601,659) 2,617,891

Deferred income taxes .............. 435,791 270,736 — (49,531) 656,996

Other liabilities .................. 54,336 33,156 141,657 — 229,149

Shareholders’ equity:

Preferred stock ................. — — — — —

Common stock ................. 295,828 23,855 100 (23,955) 295,828

Additional paid-in capital .......... 2,967,027 431,253 19,900 (451,153) 2,967,027

Retained earnings ............... 1,416,918 2,672,123 119,737 (2,791,860) 1,416,918

Accumulated other comprehensive loss . . (5,191) — — — (5,191)

Total shareholders’ equity .......... 4,674,582 3,127,231 139,737 (3,266,968) 4,674,582

Total liabilities and shareholders’ equity . . . $12,790,403 $8,528,182 $422,646 $(12,052,711) $9,688,520

92