Dollar General 2012 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

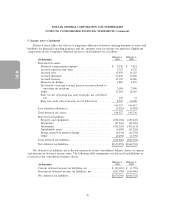

8. Derivative financial instruments (Continued)

risks, including interest rate, liquidity, and credit risk, primarily by managing the amount, sources, and

duration of its debt funding and the use of derivative financial instruments. Specifically, the Company

enters into derivative financial instruments to manage exposures that arise from business activities that

result in the receipt or payment of future known and uncertain cash amounts, the value of which are

determined primarily by interest rates. The Company’s derivative financial instruments are used to

manage differences in the amount, timing, and duration of the Company’s known or expected cash

receipts and its known or expected cash payments principally related to the Company’s borrowings.

The Company is exposed to certain risks arising from uncertainties of future market values caused

by the fluctuation in the prices of commodities. From time to time the Company may enter into

derivative financial instruments to protect against future price changes related to these commodity

prices.

Cash flow hedges of interest rate risk

The Company’s objectives in using interest rate derivatives are to add stability to interest expense

and to manage its exposure to interest rate changes. To accomplish this objective, the Company

primarily uses interest rate swaps as part of its interest rate risk management strategy. Interest rate

swaps designated as cash flow hedges involve the receipt of variable-rate amounts from a counterparty

in exchange for the Company making fixed-rate payments over the life of the agreements without

exchange of the underlying notional amount.

The effective portion of changes in the fair value of derivatives designated and that qualify as cash

flow hedges is recorded in Accumulated other comprehensive income (loss) (also referred to as ‘‘OCI’’)

and is subsequently reclassified into earnings in the period that the hedged forecasted transaction

affects earnings. These transactions represent the only amounts reflected in Accumulated other

comprehensive income (loss) in the consolidated statements of shareholders’ equity. During the years

ended February 1, 2013, February 3, 2012 and January 28, 2011, such derivatives were used to hedge

the variable cash flows associated with existing variable-rate debt. The ineffective portion of the change

in fair value of the derivatives is recognized directly in earnings.

As of February 1, 2013, the Company had three interest rate swaps with a combined notional value

of $875 million that were designated as cash flow hedges of interest rate risk. Amounts reported in

Accumulated other comprehensive income (loss) related to derivatives will be reclassified to interest

expense as interest payments are made on the Company’s variable-rate debt. During the next 52-week

period, the Company estimates that an additional $3.1 million will be reclassified as an increase to

interest expense for all of its interest rate swaps.

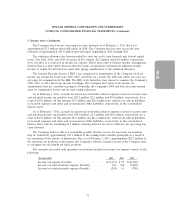

Non-designated hedges of commodity risk

Derivatives not designated as hedges are not speculative and are used to manage the Company’s

exposure to commodity price risk but do not meet strict hedge accounting requirements. Changes in

the fair value of derivatives not designated in hedging relationships are recorded directly in earnings.

As of February 1, 2013, the Company had no such non-designated hedges.

76