Dollar General 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

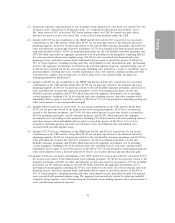

(5) Represents amounts earned pursuant to our Teamshare bonus program for each fiscal year reported. See the

discussion of the ‘‘Short-Term Cash Incentive Plan’’ in ‘‘Compensation Discussion and Analysis’’ above.

Mr. Vasos deferred 10% of his fiscal 2012 bonus payment under our CDP. No named executive officer

deferred any portion of his or her fiscal 2011 or fiscal 2010 bonus payments under the CDP.

(6) Includes $292,727 for our contribution to the SERP and $49,048 and $12,722, respectively, for our match

contributions to the CDP and the 401(k) Plan; $9,751 for tax gross-ups related to the financial and estate

planning perquisite, $8,744 for tax gross-ups related to life and disability insurance premiums, and $3,487 for

other miscellaneous tax gross-ups related to perquisites; $7,775 for premiums paid under personal portable

long-term disability policies; $2,983 for premiums paid under our life and disability insurance programs; and

$299,388 which represents the aggregate incremental cost of providing certain perquisites, including $266,311

for costs associated with personal airplane usage, $19,318 for costs associated with financial and estate

planning services, and other amounts which individually did not equal or exceed the greater of $25,000 or

10% of total perquisites, including sporting and other entertainment events, miscellaneous gifts, and framing

projects. The aggregate incremental cost related to the personal airplane usage was calculated using costs we

would not have incurred but for the personal usage (including costs incurred as a result of ‘‘deadhead’’ legs of

personal flights), including fuel costs, variable maintenance costs, crew expenses, landing, parking and other

associated fees, supplies and catering costs, as well as plane lease costs incurred while our plane was

undergoing mandatory maintenance.

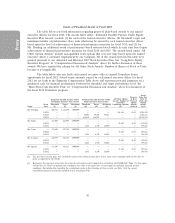

(7) Includes $112,227 for our contribution to the SERP and $21,222 and $12,629, respectively, for our match

contributions to the CDP and the 401(k) Plan; $9,751 for tax gross-ups related to the financial and estate

planning perquisite, $5,045 for tax gross-ups related to life and disability insurance premiums, and $1,122 for

other miscellaneous tax gross-ups related to perquisites; $1,956 for premiums paid under our life and

disability insurance programs; and $27,963 which represents the aggregate incremental cost of providing

certain perquisites, including $19,318 for financial and estate planning services, and other amounts which

individually did not equal or exceed the greater of $25,000 or 10% of total perquisites, including sporting and

other entertainment events and miscellaneous gifts.

(8) Includes $20,108 and $12,611, respectively, for our match contributions to the CDP and the 401(k) Plan;

$9,751 for tax gross-ups related to the financial and estate planning perquisite, $2,310 for a tax gross-up

related to life insurance premiums, and $1,440 for other miscellaneous tax gross-ups related to perquisites;

$924 for premiums paid under our life insurance program; and $29,291 which represents the aggregate

incremental cost of providing certain perquisites, including $19,318 for financial and estate planning services,

and other amounts which individually did not equal or exceed the greater of $25,000 or 10% of total

perquisites, including sporting and other entertainment events, miscellaneous gifts and minimal costs

associated with personal airplane usage.

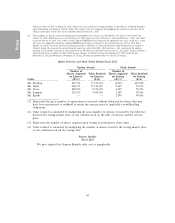

(9) Includes $72,379 for our contribution to the SERP and $15,048 and $12,344, respectively, for our match

contributions to the CDP and the 401(k) Plan; $9,751 for tax gross-ups related to the financial and estate

planning perquisite, $2,358 for tax gross-ups related to life and disability insurance premiums, and $1,122 for

other miscellaneous tax gross-ups related to perquisites; $1,548 for premiums paid under our life and

disability insurance programs; and $38,284 which represents the aggregate incremental cost of providing

certain perquisites, including $19,318 for financial and estate planning services, and other amounts which

individually did not equal or exceed the greater of $25,000 or 10% of total perquisites, including sporting and

other entertainment events, a directed donation to charity, an executive physical and miscellaneous gifts.

(10) Includes $2,526 for our match contributions to the CDP; $6,680 for tax gross-ups related to relocation; $4,539

for tax gross-ups related to the financial and estate planning perquisite; $1,722 for tax gross-ups related to life

insurance premiums; and $667 for other miscellaneous tax gross-ups related to perquisites; $777 for premiums

paid under our life insurance program; and $48,493 which represents the aggregate incremental cost of

providing certain perquisites, including $27,559 for costs related to relocation, $16,356 for financial and estate

planning services, and other amounts which individually did not equal or exceed the greater of $25,000 or

10% of total perquisites, including sporting and other entertainment events, miscellaneous gifts and minimal

costs associated with personal airplane usage The aggregate incremental cost related to relocation included

temporary living expenses, costs of transporting his automobile, home finding expenses and a cash payment to

cover miscellaneous relocation expenses.

41