Dollar General 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

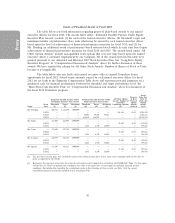

officer’s target payout percentage). For ROIC, each .477% increase in the percent of performance

target level between the threshold performance level and 104.77% of the target performance level

increases the payout percentage by 1% of the officer’s target payout amount (based upon the officer’s

target payout percentages). For each .477% increase in ROIC above the 104.77% of the target

performance level, the bonus payout increases by 1.207% of the officer’s target payout amount (based

upon the officer’s target payout percentage). Payout percentages greater than 200% of the target

payout levels are based on an approximate sharing between Dollar General (80%) and the Teamshare

participants (20%) of the incremental adjusted EBITDA dollars earned above 110% of the adjusted

EBITDA performance level, split 90% to adjusted EBITDA and 10% to ROIC.

This proration schedule, through 110% of the target performance level, is consistent with the

schedule approved by the Committee in 2007 in reliance upon benchmarking data which, at that time,

indicated that the typical practice was to set the threshold payout percentage at half of the target and

the maximum payout percentage at twice the target. The Committee determined in 2008 that the

proration schedule for adjusted EBITDA performance above 110% of target should approximate a

sharing between Dollar General (80%) and the Teamshare participants (20%) of the adjusted EBITDA

dollars earned above that level.

(b) 2012 Teamshare Results. The Compensation Committee approved the adjusted EBITDA

and ROIC performance results at $1,986,617,000 (97.3% of target) and 21.06% (111.0% of target),

respectively, which equate to a payout of 98.67% of individual bonus targets under the 2012 Teamshare

program. Accordingly, a 2012 Teamshare payout was made to each named executive officer at the

following percentages of base salary earned: Mr. Dreiling, 128.3%; and each of Mr. Tehle, Mr. Vasos,

Ms. Lanigan and Mr. Sparks, 64.1%. Such amounts are reflected in the ‘‘Non-Equity Incentive Plan

Compensation’’ column of the Summary Compensation Table.

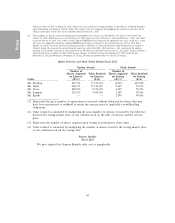

(c) 2013 Teamshare Structure. The Compensation Committee has approved a 2013

Teamshare structure similar to that which was approved for 2012. However, the 2013 performance

measure has been determined to be adjusted EBIT, as the Committee believed that this was a more

comprehensive measure of the Company’s performance since it includes the cost of capital investments

in achieving the current year’s financial results and should provide a different, but complementary,

focus for the short-term incentive program than that used for the long-term incentive program.

Adjusted EBIT is defined as the Company’s operating profit as calculated in accordance with

United States general accepted accounting principles (‘‘GAAP’’), but shall exclude:

• the impact of (a) all consulting, accounting, legal, valuation, banking, filing, disclosure and

similar costs, fees and expenses directly related to the consideration, negotiation, approval

and consummation of the proposed acquisition and related financing of the Company by

affiliates of KKR (including without limitation any costs, fees and expenses relating to any

refinancings) and any litigation or settlement of any litigation related thereto; (b) any costs,

fees and expenses directly related to the consideration, negotiation, preparation, or

consummation of any asset sale, merger or other transaction that results in a Change in

Control (within the meaning of our Amended and Restated 2007 Stock Incentive Plan) of

the Company or any primary or secondary offering of our common stock or other security;

(c) any gain or loss recognized as a result of derivative instrument transactions or other

hedging activities; (d) any gains or losses associated with the early retirement of debt

obligations; (e) charges resulting from significant natural disasters; and (f) any significant

gains or losses associated with our LIFO computation; and

• unless the Committee disallows any such item, (a) non-cash asset impairments; (b) any

significant loss as a result of an individual litigation, judgment or lawsuit settlement

(including a collective or class action lawsuit and security holder lawsuit, among others);

(c) charges for business restructurings; (d) losses due to new or modified tax or other

34