Dollar General 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

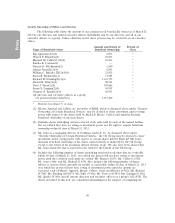

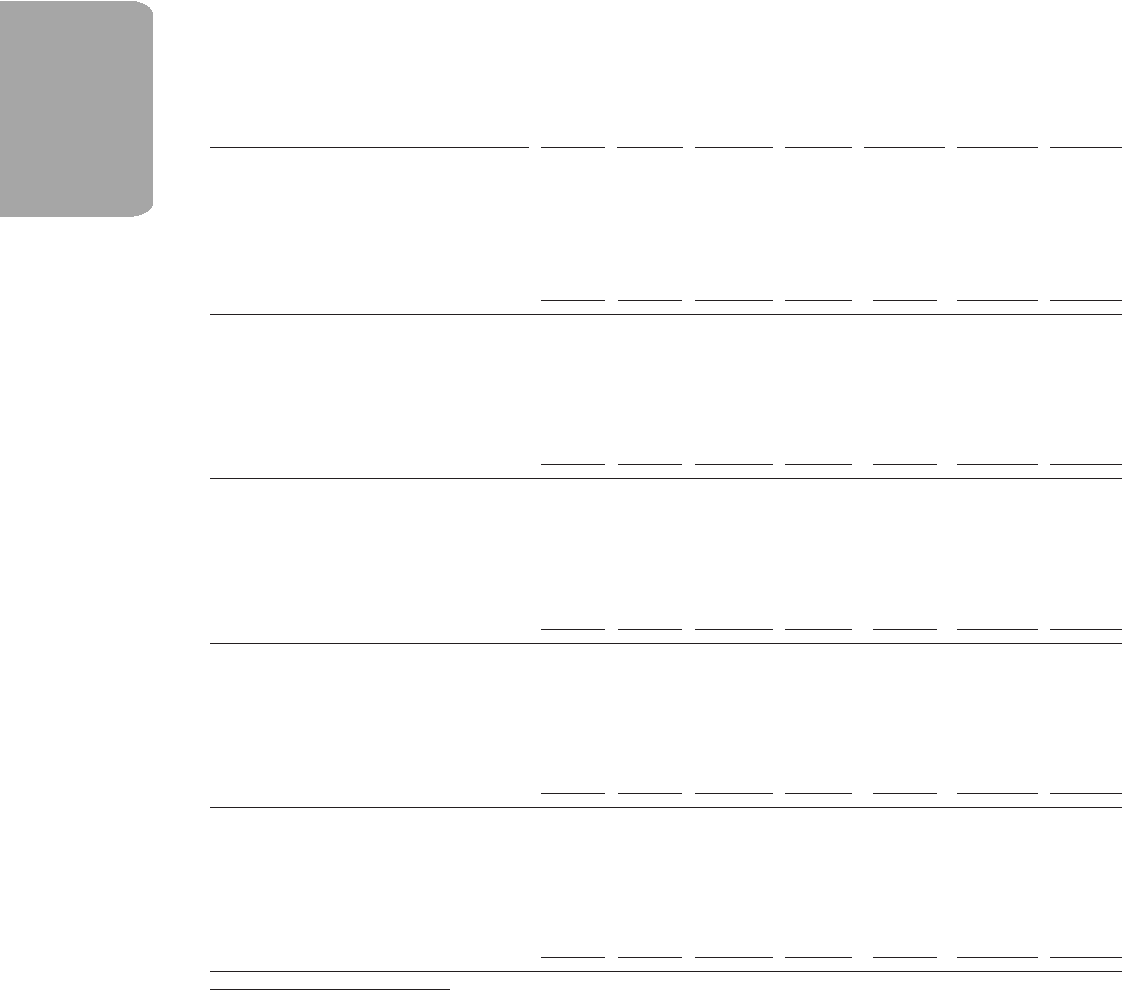

Proxy

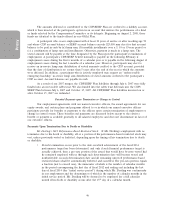

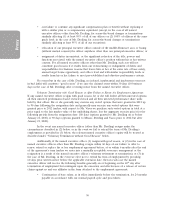

Potential Payments to Named Executive Officers Upon Occurrence of

Various Termination Events As of February 1, 2013

Involuntary

Without

Voluntary Cause or

Without Voluntary Involuntary

Good with Good With Change in

Death Disability Retirement Reason Reason Cause Control

Name/Item ($) ($) ($)(1) ($) ($) ($) ($)

Mr. Dreiling

Equity Vesting Due to Event(2) 4,592,196 4,592,196 — n/a n/a n/a 17,166,333

Cash Severance — 1,591,956 n/a n/a 7,399,603 n/a 7,399,603

Health Continuation(3) n/a 26,774 n/a n/a 26,774 n/a 26,774

Outplacement(4) n/a n/a n/a n/a 10,000 n/a 10,000

280(G) Excise Tax and Gross-Up n/a n/a n/a n/a n/a n/a —

Life Insurance Proceeds 3,000,000 n/a n/a n/a n/a n/a n/a

Total 7,592,196 6,210,926 — — 7,436,377 — 24,602,710

Mr. Tehle

Equity Vesting Due to Event 340,772 340,772 — n/a n/a n/a 340,772

Cash Severance n/a n/a n/a n/a 2,605,058 n/a 2,605,058

Health Payment n/a n/a n/a n/a 25,320 n/a 25,320

Outplacement(4) n/a n/a n/a n/a 10,000 n/a 10,000

280(G) Excise Tax and Gross-Up n/a n/a n/a n/a n/a n/a —

Life Insurance Proceeds 1,734,000 n/a n/a n/a n/a n/a n/a

Total 2,074,772 340,772 — — 2,640,378 — 2,981,149

Mr. Vasos

Equity Vesting Due to Event 2,296,357 2,296,357 — n/a n/a n/a 2,296,357

Cash Severance n/a n/a n/a n/a 2,511,989 n/a 2,511,989

Health Payment n/a n/a n/a n/a 15,202 n/a 15,202

Outplacement(4) n/a n/a n/a n/a 10,000 n/a 10,000

280(G) Excise Tax and Gross-Up n/a n/a n/a n/a n/a n/a —

Life Insurance Proceeds 1,672,000 n/a n/a n/a n/a n/a n/a

Total 3,968,357 2,296,357 — — 2,537,191 — 4,833,548

Ms. Lanigan

Equity Vesting Due to Event 340,772 340,772 — n/a n/a n/a 340,772

Cash Severance n/a n/a n/a n/a 2,127,728 n/a 2,127,728

Health Payment n/a n/a n/a n/a 16,436 n/a 16,436

Outplacement(4) n/a n/a n/a n/a 10,000 n/a 10,000

280(G) Excise Tax and Gross-Up n/a n/a n/a n/a n/a n/a —

Life Insurance Proceeds 1,417,000 n/a n/a n/a n/a n/a n/a

Total 1,757,772 340,772 — — 2,154,164 — 2,494,935

Mr. Sparks

Equity Vesting Due to Event 340,772 340,772 — n/a n/a n/a 340,772

Cash Severance n/a n/a n/a n/a 2,277,377 n/a 2,277,377

Health Payment n/a n/a n/a n/a 16,436 n/a 16,436

Outplacement(4) n/a n/a n/a n/a 10,000 n/a 10,000

280(G) Excise Tax and Gross-Up n/a n/a n/a n/a n/a n/a —

Life Insurance Proceeds 1,516,000 n/a n/a n/a n/a n/a n/a

Total 1,856,772 340,772 — — 2,303,813 — 2,644,584

(1) None of the named executive officers were eligible for retirement on February 1, 2013.

(2) Includes, in addition to vesting of performance share units and stock options, an estimate of pro-rata vesting to occur

during fiscal year 2015 of performance-based restricted stock upon death or disability for Mr. Dreiling, assuming

achievement of the required performance target for fiscal year 2014 and using the closing market price of our common

stock on February 1, 2013.

(3) Calculated as the combined Company and employee cost for the benefit option selected by Mr. Dreiling for 2013.

(4) Estimated based on the actual cost of outplacement services historically provided to other officers.

56