Dollar General 2012 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

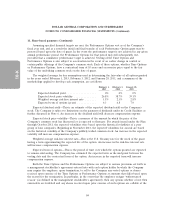

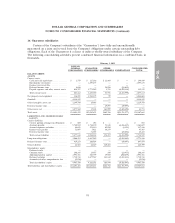

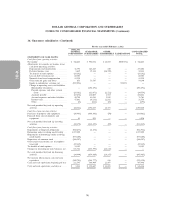

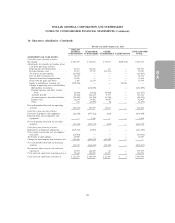

11. Share-based payments (Continued)

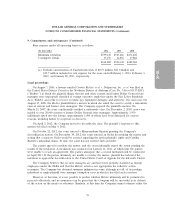

The fair value method of accounting for share-based awards resulted in share-based compensation

expense (a component of SG&A expenses) and a corresponding reduction in net income before income

taxes as follows:

Equity

Stock Performance Restricted Appreciation

(In thousands) Options Stock Units Stock Units Rights Total

Year ended February 1, 2013

Pre-tax ........................... $14,078 $4,082 $3,504 $ — $21,664

Net of tax ........................ $ 8,578 $2,487 $2,135 $ — $13,200

Year ended February 3, 2012

Pre-tax ........................... $15,121 $ — $ 129 $ 8,731 $23,981

Net of tax ........................ $ 9,208 $ — $ 79 $ 5,317 $14,604

Year ended January 28, 2011

Pre-tax ........................... $12,722 $ — $ 83 $17,366 $30,171

Net of tax ........................ $ 7,755 $ — $ 51 $10,587 $18,393

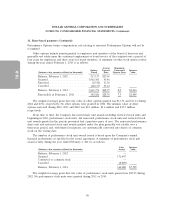

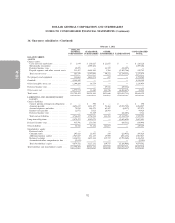

12. Related party transactions

From time to time the Company may conduct business with related parties including KKR and

Goldman, Sachs and Co., and references herein to these entities include their affiliates. KKR and

Goldman, Sachs & Co. indirectly own a significant portion of the Company’s common stock. Two of

KKR’s members and a managing director of Goldman, Sachs & Co. serve on the Company’s Board of

Directors.

KKR and Goldman, Sachs & Co. (among other entities) are or may be lenders, agents or

arrangers under the Company’s Term Loan Facility and ABL Facility discussed in further detail in

Note 6. The Company made interest payments of approximately $62.0 million, $66.4 million and

$53.4 million on the Term Loan Facility, and $6.0 million, $2.8 million and zero on the ABL Facility,

during 2012, 2011 and 2010, respectively. In connection with the March 2012 amendment to the Term

Loan Facility, KKR received $0.4 million. In connection with the March 2012 ABL Facility and Term

Loan Facility amendments, Goldman, Sachs & Co. received $0.1 million and $0.4 million, respectively.

On October 9, 2012, the Term Loan and ABL Facilities were further amended to add additional

capacity for the Company to repurchase, redeem or otherwise acquire shares of its capital stock, not to

exceed $250.0 million. The Company incurred a fee of $1.7 million associated with these amendments,

which was reimbursed to the Company by Buck Holdings, L.P. (which is controlled by KKR and

Goldman Sachs & Co.) and such reimbursement was recorded as a capital contribution during 2012.

As joint book-running managers in connection with the issuance of the Senior Notes, KKR and

Goldman Sachs & Co. received an equivalent share of approximately $2.3 million during 2012.

Goldman, Sachs & Co. was a counterparty to an amortizing interest rate swap which matured on

July 31, 2012. The swap was entered into in connection with the Term Loan Facility. The Company

paid Goldman, Sachs & Co. approximately $2.5 million, $13.9 million and $12.9 million in 2012, 2011

and 2010, respectively, pursuant to this interest rate swap.

88