Dollar General 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

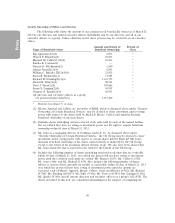

Security Ownership of Officers and Directors

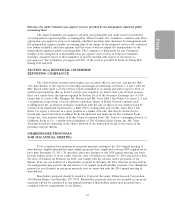

The following table shows the amount of our common stock beneficially owned as of March 21,

2013 by our directors and named executive officers individually and by our directors and all of our

executive officers as a group. Unless otherwise noted, these persons may be contacted at our executive

offices.

Amount and Nature of Percent of

Name of Beneficial Owner Beneficial Ownership Class

Raj Agrawal(1)(2)(4) 6,833 *

Warren F. Bryant(2)(4) 10,833 *

Michael M. Calbert(1)(2)(4) 16,833 *

Sandra B. Cochran(2) — *

Patricia D. Fili-Krushel(2) 2,500 *

Adrian Jones(2)(3)(4) 6,833 *

William C. Rhodes, III(2)(4)(5) 21,833 *

David B. Rickard(2)(4) 11,085 *

Richard W. Dreiling(2)(4)(6) 1,323,753 *

David M. Tehle(2)(4) 88,941 *

Todd J. Vasos(2)(4) 149,866 *

Susan S. Lanigan(2)(4) 50,955 *

Gregory A. Sparks(2)(4) 10,933 *

All directors and executive officers as a group

(16 persons)(1)(2)(3)(4)(5)(6) 1,917,440 *

* Denotes less than 1% of class.

(1) Messrs. Agrawal and Calbert are executives of KKR, which as discussed above under ‘‘Security

Ownership of Certain Beneficial Owners’’ may be deemed to share investment and/or voting

power with respect to the shares held by Buck LP. Messrs. Calbert and Agrawal disclaim

beneficial ownership of any such shares.

(2) Excludes shares underlying certain restricted stock units held by each of the named holders,

but over which they have no voting or investment power nor the right to acquire beneficial

ownership within 60 days of March 21, 2013.

(3) Mr. Jones is a managing director of Goldman, Sachs & Co. As discussed above under

‘‘Security Ownership of Certain Beneficial Owners,’’ the GS Group may be deemed to share

investment and/or voting power with respect to certain shares held by Buck LP. Mr. Jones

disclaims beneficial ownership of the shares owned directly or indirectly by the GS Group

except to the extent of his pecuniary interest therein, if any. We also have been advised that

Mr. Jones holds the shares reported in the table for the benefit of the GS Group.

(4) Includes the following number of shares underlying restricted stock units that are settleable

within 60 days of March 21, 2013, over which the person will not have voting or investment

power until the restricted stock units are settled: Mr. Bryant (1,017); Mr. Calbert (1,525);

Mr. Jones (346); and Mr. Rickard (1,459). Also includes the following number of shares

subject to options either currently exercisable or exercisable within 60 days of March 21, 2013

over which the person will not have voting or investment power until the options are

exercised: each of Messrs. Agrawal, Bryant, Calbert, Jones and Rhodes (4,962); Mr. Rickard

(4,780); Mr. Dreiling (665,007); Mr. Tehle (9,360); Mr. Vasos (143,983); Ms. Lanigan (9,360);

Mr. Sparks (9,360); and all current directors and executive officers as a group (1,023,870). The

shares described in this note are considered outstanding for the purpose of computing the

60