Dollar General 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

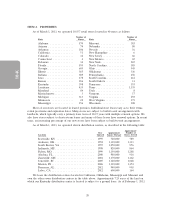

The information set forth below should be read in conjunction with, and is qualified by reference

to, the Consolidated Financial Statements and related notes included in Part II, Item 8 of this report

and the Management’s Discussion and Analysis of Financial Condition and Results of Operations

included in Part II, Item 7 of this report.

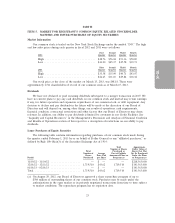

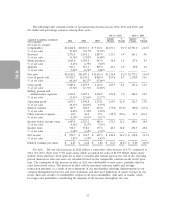

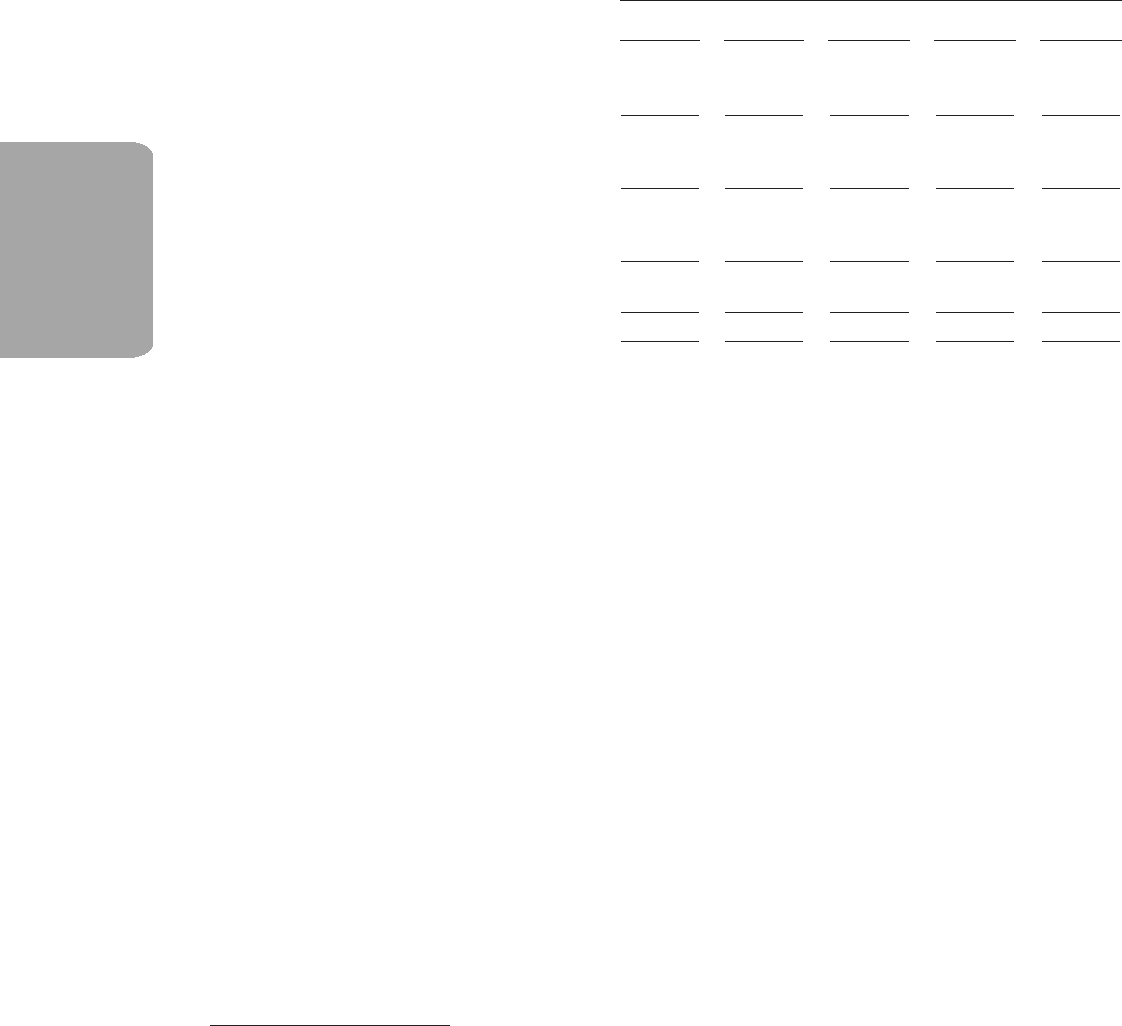

Year Ended

(Amounts in millions, excluding per share data, February 1, February 3, January 28, January 29, January 30,

number of stores, selling square feet, and net sales 2013 2012(1) 2011 2010 2009

per square foot)

Statement of Operations Data:

Net sales .......................... $16,022.1 $14,807.2 $13,035.0 $11,796.4 $10,457.7

Cost of goods sold ................... 10,936.7 10,109.3 8,858.4 8,106.5 7,396.6

Gross profit ........................ 5,085.4 4,697.9 4,176.6 3,689.9 3,061.1

Selling, general and administrative expenses . 3,430.1 3,207.1 2,902.5 2,736.6 2,448.6

Litigation settlement and related costs, net . — — — — 32.0

Operating profit .................... 1,655.3 1,490.8 1,274.1 953.3 580.5

Interest expense ..................... 127.9 204.9 274.0 345.6 388.8

Other (income) expense ............... 30.0 60.6 15.1 55.5 (2.8)

Income before income taxes ............ 1,497.4 1,225.3 985.0 552.1 194.4

Income tax expense .................. 544.7 458.6 357.1 212.7 86.2

Net income ........................ $ 952.7 $ 766.7 $ 627.9 $ 339.4 $ 108.2

Earnings per share—basic ............. $ 2.87 $ 2.25 $ 1.84 $ 1.05 $ 0.34

Earnings per share—diluted ............ 2.85 2.22 1.82 1.04 0.34

Dividends per share .................. — — — 0.7525 —

Statement of Cash Flows Data:

Net cash provided by (used in):

Operating activities ................. $ 1,131.4 $ 1,050.5 $ 824.7 $ 672.8 $ 575.2

Investing activities ................. (569.8) (513.8) (418.9) (248.0) (152.6)

Financing activities ................. (546.8) (908.0) (130.4) (580.7) (144.8)

Total capital expenditures .............. (571.6) (514.9) (420.4) (250.7) (205.5)

Other Financial and Operating Data:

Same store sales growth(2) ............. 4.7% 6.0% 4.9% 9.5% 9.0%

Same store sales(2) .................. $14,992.7 $13,626.7 $12,227.1 $11,356.5 $10,118.5

Number of stores included in same store

sales calculation ................... 9,783 9,254 8,712 8,324 8,153

Number of stores (at period end) ........ 10,506 9,937 9,372 8,828 8,362

Selling square feet (in thousands at period

end) ........................... 76,909 71,774 67,094 62,494 58,803

Net sales per square foot(3) ............ $ 216 $ 213 $ 201 $ 195 $ 180

Consumables sales ................... 73.9% 73.2% 71.6% 70.8% 69.3%

Seasonal sales ...................... 13.6% 13.8% 14.5% 14.5% 14.6%

Home products sales ................. 6.6% 6.8% 7.0% 7.4% 8.2%

Apparel sales ....................... 5.9% 6.2% 6.9% 7.3% 7.9%

Rent expense ....................... $ 614.3 $ 542.3 $ 489.3 $ 428.6 $ 389.6

Balance Sheet Data (at period end):

Cash and cash equivalents and short-term

investments ...................... $ 140.8 $ 126.1 $ 497.4 $ 222.1 $ 378.0

Total assets ........................ 10,367.7 9,688.5 9,546.2 8,863.5 8,889.2

Long-term debt ..................... 2,772.2 2,618.5 3,288.2 3,403.4 4,137.1

Total shareholders’ equity .............. 4,985.3 4,674.6 4,063.6 3,408.8 2,845.6

(1) The fiscal year ended February 3, 2012 was comprised of 53 weeks.

26