Dollar General 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of presentation and accounting policies

Basis of presentation

These notes contain references to the years 2012, 2011 and 2010, which represent fiscal years

ended February 1, 2013, February 3, 2012, and January 28, 2011, respectively. The Company’s fiscal

year ends on the Friday closest to January 31. 2012 and 2010 were 52-week accounting periods, while

2011 was a 53-week accounting period. The consolidated financial statements include all subsidiaries of

the Company, except for its not-for-profit subsidiary which the Company does not control.

Intercompany transactions have been eliminated.

Business description

The Company sells general merchandise on a retail basis through 10,506 stores (as of February 1,

2013) in 40 states covering most of the southern, southwestern, midwestern and eastern United States.

The Company owns distribution centers (‘‘DCs’’) in Scottsville, Kentucky; South Boston, Virginia;

Alachua, Florida; Zanesville, Ohio; Jonesville, South Carolina; Marion, Indiana, and Bessemer,

Alabama, and leases DCs in Ardmore, Oklahoma; Fulton, Missouri; Indianola, Mississippi; and Lebec,

California.

The Company purchases its merchandise from a wide variety of suppliers. Approximately 8% and

7% of the Company’s purchases in 2012 were made from the Company’s largest and second largest

suppliers, respectively.

Cash and cash equivalents

Cash and cash equivalents include highly liquid investments with insignificant interest rate risk and

original maturities of three months or less when purchased. Such investments primarily consist of

money market funds, bank deposits, certificates of deposit (which may include foreign time deposits),

and commercial paper. The carrying amounts of these items are a reasonable estimate of their fair

value due to the short maturity of these investments.

Payments due from processors for electronic tender transactions classified as cash and cash

equivalents totaled approximately $45.2 million and $38.7 million at February 1, 2013 and February 3,

2012, respectively.

At February 1, 2013, the Company maintained cash balances to meet a $20 million minimum

threshold set by insurance regulators, as further described below under ‘‘Insurance liabilities.’’

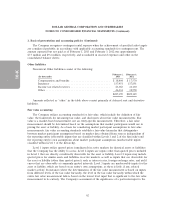

Investments in debt and equity securities

The Company accounts for investments in debt and marketable equity securities as

held-to-maturity, available-for-sale, or trading, depending on their classification. Debt securities

categorized as held-to-maturity are stated at amortized cost. Debt and equity securities categorized as

available-for-sale are stated at fair value, with any unrealized gains and losses, net of deferred income

taxes, reported as a component of Accumulated other comprehensive loss. Trading securities (primarily

mutual funds held pursuant to deferred compensation and supplemental retirement plans, as further

discussed below in Notes 7 and 10) are stated at fair value, with changes in fair value recorded as a

component of Selling, general and administrative (‘‘SG&A’’) expense.

57