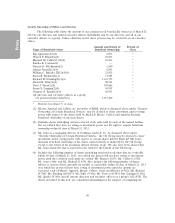

Dollar General 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

For purposes of the equity awards granted in 2012, ‘‘cause’’ shall be as defined in the

applicable employment agreement or change-in-control agreement (in the absence of an employment

agreement) or, in the absence of either of such agreements, ‘‘cause’’ is defined materially consistent

with the definition set forth above.

Involuntary Termination for Cause. If the named executive officer is involuntarily terminated

for cause, he or she will forfeit all unvested equity grants and all vested but unexercised options.

Involuntary Termination without Cause. If any named executive officer is involuntarily

terminated without cause, he or she:

• Will forfeit all then unvested options, all then unvested performance-based restricted stock

and all unvested performance share units held by that officer.

• Generally may exercise any vested options that were granted in 2012 up to 90 days

following the resignation date and generally may exercise any vested options that were

granted prior to 2012 (unless, with respect to Mr. Vasos we purchase such vested options in

total at a price equal to the fair market value of the underlying shares, less the aggregate

exercise price) for the following periods from the resignation date: 180 days (options

granted to Mr. Dreiling on or before January 21, 2008) or 90 days (options granted to

Messrs. Dreiling and Vasos prior to 2012 but after January 21, 2008).

• Will receive the same severance payments and benefits, as described under ‘‘Voluntary

Termination with Good Reason or After Failure to Renew the Employment Agreement’’

above.

Payments After a Change in Control

Upon a change in control (as defined under each applicable governing document), regardless

of whether the named executive officer’s employment terminates:

• All time-vested options will vest and become immediately exercisable as to 100% of the

shares subject to such options immediately prior to a change in control.

• All performance-vested options will vest and become immediately exercisable as to 100%

of the shares subject to such options immediately prior to a change in control if, as a result

of the change in control, (x) investment funds affiliated with KKR realize a specified

internal rate of return on 100% of their aggregate investment, directly or indirectly, in our

equity securities (the ‘‘Sponsor Shares’’) and (y) the investment funds affiliated with KKR

earn a specified cash return on 100% of the Sponsor Shares; provided, however, that in the

event a change in control occurs in which more than 50% but less than 100% of our

common stock or other voting securities or the common stock or other voting securities of

Buck Holdings, L.P. is sold or otherwise disposed of, then the performance-vested options

will become vested up to the same percentage of Sponsor Shares on which investment

funds affiliated with KKR achieve a specified internal rate of return on their aggregate

investment and earn a specified return on their Sponsor Shares.

• If the change in control occurs prior to the completion of the applicable performance

period, all unvested performance share units that have not previously become vested and

nonforfeitable, or have not previously been forfeited, will immediately be deemed earned

at the target level and shall vest, become nonforfeitable and be paid upon the change in

control.

53