Dollar General 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

PART II

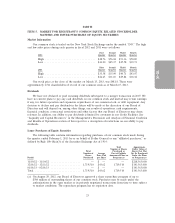

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

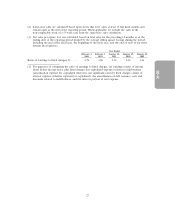

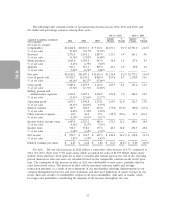

Our common stock is traded on the New York Stock Exchange under the symbol ‘‘DG.’’ The high

and low sales prices during each quarter in fiscal 2012 and 2011 were as follows:

First Second Third Fourth

2012 Quarter Quarter Quarter Quarter

High ................................ $48.76 $56.04 $53.36 $50.80

Low................................. $41.20 $45.37 $45.58 $39.73

First Second Third Fourth

2011 Quarter Quarter Quarter Quarter

High ................................ $33.58 $35.09 $40.71 $43.07

Low................................. $26.65 $31.10 $29.84 $38.32

Our stock price at the close of the market on March 15, 2013, was $48.18. There were

approximately 1,511 shareholders of record of our common stock as of March 15, 2013.

Dividends

We have not declared or paid recurring dividends subsequent to a merger transaction in 2007. We

have no current plans to pay any cash dividends on our common stock and instead may retain earnings,

if any, for future operation and expansion, repurchases of our common stock, or debt repayment. Any

decision to declare and pay dividends in the future will be made at the discretion of our Board of

Directors and will depend on, among other things, our results of operations, cash requirements,

financial condition, contractual restrictions and other factors that our Board of Directors may deem

relevant. In addition, our ability to pay dividends is limited by covenants in our Credit Facilities. See

‘‘Liquidity and Capital Resources’’ in the Management’s Discussion and Analysis of Financial Condition

and Results of Operations section of this report for a description of restrictions on our ability to pay

dividends.

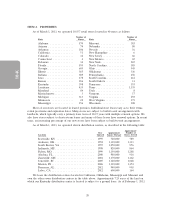

Issuer Purchases of Equity Securities

The following table contains information regarding purchases of our common stock made during

the quarter ended February 1, 2013 by or on behalf of Dollar General or any ‘‘affiliated purchaser,’’ as

defined by Rule 10b-18(a)(3) of the Securities Exchange Act of 1934:

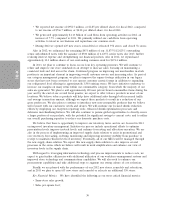

Total Approximate

Number of Shares Dollar Value of

Total Purchased as Shares that May

Number of Average Part of Publicly Yet Be Purchased

Shares Price Paid Announced Plans or Under the Plans

Period Purchased per Share Programs(a) or Programs(a)

11/03/12 - 11/30/12 ................... — $ — — $218,565,000

12/01/12 - 12/31/12 ................... 1,719,510 $43.62 1,719,510 $143,565,000

01/01/13 - 02/01/13 ................... — $ — — $143,565,000

Total ............................. 1,719,510 $43.62 1,719,510 $143,565,000

(a) On August 29, 2012, our Board of Directors approved a share repurchase program of up to

$500 million of outstanding shares of our common stock. Purchases may be made under the

authorizations in the open market or in privately negotiated transactions from time to time subject

to market conditions. The repurchase program has no expiration date.

23