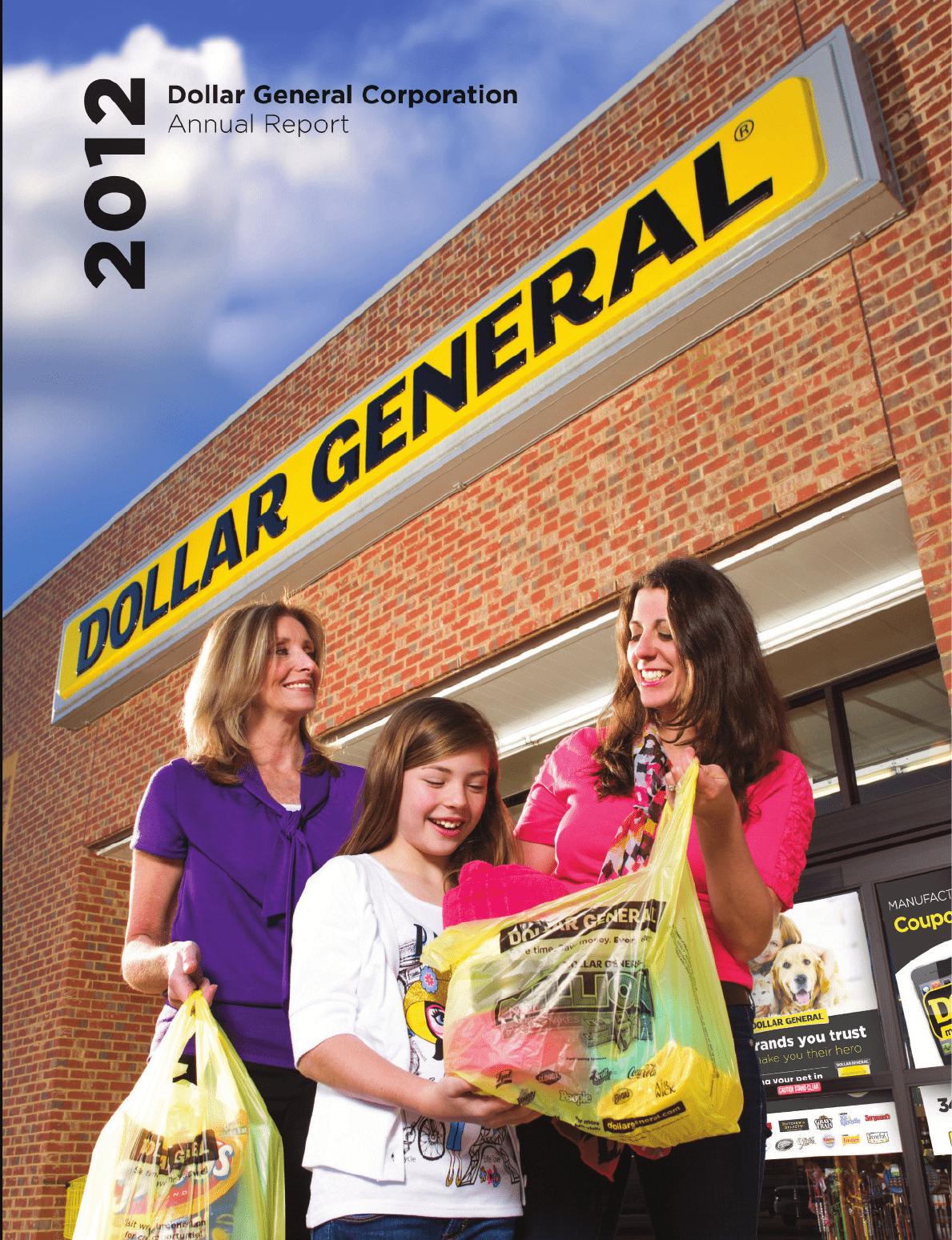

Dollar General 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

Table of contents

-

Page 1

-

Page 2

-

Page 3

... square foot. Excluding the 53rd week in 2011, net sales increased 10.4%. Same-store sales grew 4.7%, marking our 23rd consecutive year of same-store sales growth. Operating proï¬t increased 11% to $1.66 billion, or 10.3% of sales, setting a new record operating proï¬t rate. Net income increased...

-

Page 4

Proxy Statement & Meeting Notice

-

Page 5

... 2013 Annual Meeting of Shareholders of Dollar General Corporation will be held on Wednesday, May 29, 2013, at 9:00 a.m., Central Time, at Goodlettsville City Hall Auditorium, 105 South Main Street, Goodlettsville, Tennessee. All shareholders of record at the close of business on March 21, 2013 are...

-

Page 6

...

Dollar General Corporation 100 Mission Ridge Goodlettsville, Tennessee 37072

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

DATE: TIME: PLACE: Wednesday, May 29, 2013 9:00 a.m., Central Time Goodlettsville City Hall Auditorium 105 South Main Street Goodlettsville, Tennessee 1) 2) To elect as directors...

-

Page 7

... ...Corporate Governance ...Director Compensation ...Director Independence ...Transactions with Management and Others ...Executive Compensation ...Compensation Discussion and Analysis ...Compensation Committee Report ...Summary Compensation Table ...Grants of Plan-Based Awards in Fiscal 2012...

-

Page 8

... stores with more than 10,557 locations in 40 states as of March 1, 2013. Our principal executive offices are located at 100 Mission Ridge, Goodlettsville, TN 37072. Our telephone number is 615-855-4000. Where is Dollar General common stock traded? Our stock is traded on the New York Stock Exchange...

-

Page 9

...is entitled to vote at the annual meeting? You may vote if you owned shares of Dollar General common stock at the close of business on March 21, 2013. As of that date, there were 327,212,294 shares of Dollar General common stock outstanding and entitled to vote. Each share is entitled to one vote on...

-

Page 10

... independent registered public accounting firm for 2013. Can I change my mind and revoke my proxy? Yes. If you are a shareholder of record, to revoke a proxy given pursuant to this solicitation you must sign a later-dated proxy card and submit it so that it is received before the annual meeting in...

-

Page 11

...public accounting firm, are considered to be non-routine matters. ''Broker non-votes'' occur when shares held of record by a broker are not voted on a matter because the broker has not received... within Dollar General or to third parties, except (1) as necessary to meet applicable legal requirements...

-

Page 12

... common stock through their investment in Buck Holdings, L.P. and related entities. Mr. Agrawal is a director of Colonial Pipeline Company and Bayonne Water JV Parent, LLC. Mr. Bryant served as the President and Chief Executive Officer of Longs Drug Stores Corporation, a retail drugstore chain on...

-

Page 13

...common stock through their investment in Buck Holdings, L.P. and related entities. Mr. Calbert is a director of Toys ''R'' Us, Inc., US Foods, Pets at Home, and Academy, Ltd.

Proxy

Ms. Cochran has served as a director and as President and Chief Executive Officer of Cracker Barrel Old Country Store...

-

Page 14

... served as the Executive Vice President, Chief Financial Officer and Chief Administrative Officer of CVS Caremark Corporation, a retail pharmacy chain and provider of healthcare services and pharmacy benefits management, from September 1999 until his retirement in December 2009. Prior to joining...

-

Page 15

...Board. Mr. Calbert, like all of our director nominees, is subject to election by our shareholders at the annual meeting. In addition, our employment agreement with Mr. Dreiling requires Dollar General to (1) nominate him to serve as a member of our Board each year that he is slated for reelection to...

-

Page 16

... and executive experience provides leadership, consensus-building, strategic planning, risk management and budgeting skills. Ms. Cochran also has significant financial experience, having served as the Chief Financial Officer of two public companies and as the Vice President, Corporate Finance...

-

Page 17

..., including over 5.5 years with Dollar General. His 19 years at Goldman, Sachs & Co. have provided him with extensive understanding of corporate finance and strategic business planning activities. In addition, his experience as a director of public companies outside of the retail industry and his...

-

Page 18

... includes the nominee's name, age, business and residence addresses, and principal occupation or employment; the class and number of shares of Dollar General stock beneficially owned by the nominee and by the shareholder proposing the nominee; any other information relating to the nominee that is...

-

Page 19

... or the retirement of our CEO. Our Board formally reviews our management succession plan at least annually. Our comprehensive program encompasses not only our CEO and other executive officers but all employees through the front-line supervisory level. The program focuses on key succession elements...

-

Page 20

...) to be achieved within 5 years of the later of April 1, 2013 or the April 1 next following such person's hire or promotion date. Officer Level CEO EVP SVP Multiple of Base Salary 5X 3X 2X

Proxy

What is Dollar General's policy regarding Board member attendance at the annual meeting? Our Board of...

-

Page 21

... policies regarding the hiring of current and former employees of the independent registered public accounting firm • Discusses the annual audited and quarterly unaudited financial statements with management and the independent registered public accounting firm • Discusses types of information...

-

Page 22

... with management, prior to the filing of the proxy statement, the disclosure regarding executive compensation, including the Compensation Discussion and Analysis and compensation tables (in addition to preparing a report on executive compensation for the proxy statement) • Provides information to...

-

Page 23

... parties to contact the Board, a particular director, or the non-management directors or the independent directors as a group is described on www.dollargeneral.com under ''Investor Information-Corporate Governance.'' Where can I find more information about Dollar General's corporate governance...

-

Page 24

... 11 of the annual consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended February 1, 2013, filed with the SEC on March 25, 2013 (our ''2012 Form 10-K''). As of February 1, 2013, each director had 1,757 total unvested restricted stock units outstanding, except...

-

Page 25

... continuing education seminars and for travel and related expenses related to Dollar General business. For 2012, each non-employee director received quarterly payment (prorated as applicable) of the following cash compensation, as applicable 75,000 annual retainer for service as a Board member; $17...

-

Page 26

... in our Corporate Governance Guidelines which are posted on the ''Investor Information-Corporate Governance'' portion of our website located at www.dollargeneral.com. The Board first analyzes whether any director or director nominee has a relationship covered by the NYSE listing standards that...

-

Page 27

...of applicable financial performance measures for 2012) and on March 18, 2013 an equity award of 2,999 non-qualified stock options to purchase shares of the Company's Common Stock, between 0 and 1,414 performance share units, with a targeted amount of 707 (the exact amount to be determined based upon...

-

Page 28

...total annual receipts and no related party who is an individual participates in the grant decision or receives any special compensation or benefit as a result. Transactions where the interest arises solely from share ownership in Dollar General and all of our shareholders receive the same benefit on...

-

Page 29

... public offering in 2009, we amended the Management Stockholder's Agreements to exclude from the transfer restrictions any shares acquired in the open market or through the directed share program administered as part of the initial public offering. Shares acquired by executive officers in the open...

-

Page 30

... the number of shares that such Senior Management Shareholders could have required us to register in connection with our initial public offering. See ''Director Independence'' for a discussion of a familial relationship between Ms. Cochran and one of our non-executive officers and compensation paid...

-

Page 31

... with the 2012 and April 2013 secondary offerings. Concurrent with the closing of the April 2012 secondary offering and pursuant to a Share Repurchase Agreement between Dollar General and Buck Holdings L.P., dated March 25, 2012, Dollar General purchased 6,817,311 shares of Common Stock from Buck...

-

Page 32

... or affiliates of each of KKR and Goldman Sachs & Co. received an equivalent share of approximately $2.3 million during fiscal 2012. Dollar General paid approximately $185,000 to Goldman, Sachs & Co. for brokerage services in connection with the Company's open market share repurchases in September...

-

Page 33

..., to pay for performance and to maintain our competitive position in the market in which we compete for executive talent. We believe the success of our program is evidenced by the following key financial and operating results for 2012 (2012 was a 52-week year and 2011 was a 53-week year Total sales...

-

Page 34

... executive officers, in exchange for the elimination of tax reimbursements and tax gross-ups on Company-provided life insurance and financial services, as applicable. Mr. Dreiling received a further one-time base salary adjustment in exchange for waiving his rights under his employment agreement...

-

Page 35

... offered to named executive officers at other companies and help to ensure continuity and aid in retention. The employment agreements also provide for standard protections to both the executive and Dollar General should the executive's employment terminate. Named Executive Officer Compensation...

-

Page 36

... 2011 and 2012 (Mr. Sparks was hired in 2012; accordingly, he was only subject to a performance evaluation for 2012). The performance evaluation results also may impact the amount of an officer's annual base salary increase. Any named executive officer who receives a satisfactory performance rating...

-

Page 37

... the 2011 market comparator group as a reference point in our 2012 base salary and short-term incentive decisions (other than for the CEO), as described below. For 2012 base salary and short-term cash incentive compensation decisions for the named executive officers, the Company averaged market data...

-

Page 38

...1 of the applicable year. In March 2012, Mr. Sparks was hired as our Executive Vice President of Store Operations. The Compensation Committee determined his base salary based on consideration of the 2011 market comparator group data provided by Meridian, his compensation with his prior employer, the...

-

Page 39

... return on our invested capital and managing investments necessary to achieve superior performance. For purposes of the 2012 Teamshare program, adjusted EBITDA is computed in accordance with our credit agreements, and ROIC is calculated as total return (calculated as the sum of operating income...

-

Page 40

... set at 21.95%, or 100 basis points higher than the threshold level. The bonus payable to each named executive officer if we reached the 2012 target performance levels for each of the financial performance measures is equal to the applicable percentage of salary as set forth in the chart below. For...

-

Page 41

..., the 2013 performance measure has been determined to be adjusted EBIT, as the Committee believed that this was a more comprehensive measure of the Company's performance since it includes the cost of capital investments in achieving the current year's financial results and should provide a different...

-

Page 42

...-time stock option grant that fully vested in April 2011. The options granted to the named executive officers prior to 2012 (other than Mr. Dreiling's April 2010 option award) are divided so that half are time-vested (over 5 years) and half are performance-vested (generally over 5 or 6 years) based...

-

Page 43

... public company equity structures. The new structure was finalized and implemented in March 2012. Under the new program, each of the named executive officers received a grant of time-based stock options and a grant of performance share units. The combination of time and performance-based vesting...

-

Page 44

... level since that will help ensure that capital invested is providing an appropriate return over time. Benefits and Perquisites. Along with certain benefits offered to named executive officers on the same terms that are offered to all of our salaried employees (such as health and welfare benefits...

-

Page 45

... insurance benefits effective December 31, 2012 in exchange for one-time base salary adjustments for the named executive officers. We also provide a relocation assistance program to named executive officers under a policy applicable to officer-level employees, which policy is similar to that offered...

-

Page 46

... over $1 million paid in any taxable year to each of the persons who were, at the end of the fiscal year, Dollar General's CEO or one of the other named executive officers (other than our Chief Financial Officer). Section 162(m) specifically exempts certain performance-based compensation from the...

-

Page 47

... President, Chief Merchandising Officer Susan S. Lanigan, Executive Vice President & General Counsel Gregory A. Sparks, Executive Vice President, Store Operations

Year

Salary ($)(2)

Stock Awards ($)(3)

Option Awards ($)(4)

Total ($)

2012 1,235,626 16,554,441 3,091,549 2011 1,196,947 - - 2010...

-

Page 48

... fiscal year reported. See the discussion of the ''Short-Term Cash Incentive Plan'' in ''Compensation Discussion and Analysis'' above. Mr. Vasos deferred 10% of his fiscal 2012 bonus payment under our CDP. No named executive officer deferred any portion of his or her fiscal 2011 or fiscal 2010 bonus...

-

Page 49

... vest over time based upon the named executive officer's continued employment by our Company. All of the awards listed in this table were granted pursuant to our Amended and Restated 2007 Stock Incentive Plan. See ''Long-Term Equity Incentive Program'' in ''Compensation Discussion & Analysis'' above...

-

Page 50

... part of a grant of performance-based options which vested 20% per year on each of February 1, 2008, January 30, 2009, January 29, 2010, January 28, 2011 and February 3, 2012, as a result of our achievement of annual adjusted EBITDA-based targets for the applicable fiscal year. These options vested...

-

Page 51

... a grant of performance-based options that vested or are scheduled to vest (a) as to 8,333 shares on January 30, 2009, 50,000 shares on each of January 29, 2010, January 28, 2011, February 3, 2012 and February 1, 2013, and 41,667 shares on January 31, 2014, if we achieve annual adjusted EBITDA-based...

-

Page 52

... of the Internal Revenue Code. We currently match base pay deferrals at a rate of 100%, up to 5% of annual salary, with annual salary offset by the amount of match-eligible salary under the 401(k) plan. All named executive officers are 100% vested in all compensation and matching deferrals and...

-

Page 53

... the extent a benefit or payment is available generally to all salaried employees and does not discriminate in favor of our executive officers. Payments Upon Termination Due to Death or Disability Mr. Dreiling's 2012 Performance-Based Restricted Stock. If Mr. Dreiling's employment with us terminates...

-

Page 54

... due to death or disability occurs before February 1, 2013, a pro-rated portion (based on months employed during the 1 year performance period) of one-third of any performance share units earned based on performance during the entire performance period that have not previously become vested and...

-

Page 55

... times the named executive officer's annual base salary, rounded to the next highest $1,000. We have excluded from the tables below amounts that the named executive officer would receive under our disability insurance program since the same benefit level is provided to all of our salaried employees...

-

Page 56

...purposes of each named executive officer's agreements governing stock options and performance share units granted in 2012, ''retirement'' means such officer's voluntary termination of employment with us on or after reaching the minimum age of 62 and achieving 5 consecutive years of service, but only...

-

Page 57

... to Renew the Employment Agreement. If any named executive officer resigns with good reason, he or she will forfeit all then unvested options, all then unvested performance-based restricted stock and all then unvested performance share units held by that officer. He or she generally may exercise any...

-

Page 58

... Inc. and Dollar Tree Stores (Sam's Club, Big Lots, Walgreens, Rite-Aid and CVS are not specifically listed in Mr. Dreiling's employment agreement), or any person then planning to enter the discount consumable basics retail business, if the named executive officer is required to perform services for...

-

Page 59

... to the performance of the executive's duties; Any material breach of any securities or other law or regulation or any Dollar General policy governing securities trading or inappropriate disclosure or ''tipping'' relating to any stock, security and investment; Any activity or public statement, other...

-

Page 60

... cause, he or she: • • Will forfeit all then unvested options, all then unvested performance-based restricted stock and all unvested performance share units held by that officer. Generally may exercise any vested options that were granted in 2012 up to 90 days following the resignation date and...

-

Page 61

...least 2â„3 of our Board members who served as directors at the beginning of the period; or upon the consummation of a merger, other business combination or sale of assets of, or cash tender or exchange offer or contested election with respect to, Dollar General if less than a majority of our voting...

-

Page 62

... each of our named executive officers in various termination and change in control scenarios based on compensation, benefit, and equity levels in effect on, and assuming the scenario was effective as of, February 1, 2013. For stock valuations, we have used the closing price of our stock on the NYSE...

-

Page 63

... year 2014 and using the closing market price of our common stock on February 1, 2013. Calculated as the combined Company and employee cost for the benefit option selected by Mr. Dreiling for 2013. Estimated based on the actual cost of outplacement services historically provided to other officers...

-

Page 64

..., Agrawal and Jones serve as managers. Compensation Risk Considerations In March 2013, our Compensation Committee, with the assistance of its compensation consultant and management, reviewed our compensation policies and practices for all employees, including executive officers, to assess the risks...

-

Page 65

... Class 16.5%

Proxy

(1) Based solely on Statements on Schedule 13G/A filed on February 14, 2013. Buck Holdings, L.P. (''Buck LP'') directly holds 54,145,011 shares. The membership interests of Buck Holdings, LLC (''Buck LLC''), the general partner of Buck L.P., are held by a private investor group...

-

Page 66

..., New York, NY 10019. The address for Mr. Roberts is c/o Kohlberg Kravis Roberts & Co. L.P., 2800 Sand Hill Road, Suite 200, Menlo Park, CA 94025. The Goldman Sachs Group, Inc. (''GS Group'') may be deemed to share voting power with respect to 12,055,569 shares held by Buck LP and investment power...

-

Page 67

... Mr. Jones holds the shares reported in the table for the benefit of the GS Group. (4) Includes the following number of shares underlying restricted stock units that are settleable within 60 days of March 21, 2013, over which the person will not have voting or investment power until the restricted...

-

Page 68

...person and by the group, but not for the purpose of computing the percentage ownership of any other person. (5) Mr. Rhodes shares voting and investment power of 16,871 shares with his spouse, Amy Rhodes. (6) Includes 326,037 shares of performance-based restricted common stock over which Mr. Dreiling...

-

Page 69

...his or her election exceed the number of votes cast ''against'' his or her election. How are director nominees currently elected to our Board of Directors? The Tennessee Business Corporation Act provides that, unless otherwise specified in a company's charter, a director is elected by a plurality of...

-

Page 70

... in an uncontested election, we intend to implement a director resignation policy to be set forth in our Corporate Governance Guidelines. This policy will require a director to tender his or her resignation upon receiving, in an uncontested election, a greater number of votes cast against his or her...

-

Page 71

... amendment will become effective upon the filing of articles of amendment with the Tennessee Secretary of State. We would make such a filing promptly after the annual meeting. If approved, nominees to our Board of Directors will be elected under a majority voting standard beginning at the next...

-

Page 72

...from Dollar General and its management.

•

•

Based on these reviews and discussions, the Audit Committee unanimously recommended to the Board of Directors that Dollar General's audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended February 1, 2013...

-

Page 73

... employee benefit plan audit. (3) 2012 and 2011 fees relate primarily to tax compliance services, which represented $1,896,318 and $1,414,000 in 2012 and 2011, respectively, for work related to work opportunity tax credit assistance, HIRE Act payroll tax services, and foreign sourcing offices' tax...

-

Page 74

... 4 to report 2, 2 and 1 acquisitions, respectively, of stock options to purchase shares of Dollar General common stock resulting from the accelerated vesting in connection with the sale of shares of our common stock by certain of our shareholders pursuant to a Rule 10b5-1 trading plan; and (2) Mr...

-

Page 75

-

Page 76

10-K

-

Page 77

-

Page 78

...-11421

DOLLAR GENERAL CORPORATION

(Exact name of registrant as specified in its charter) TENNESSEE (State or other jurisdiction of incorporation or organization) 61-0502302 (I.R.S. Employer Identification No.)

10-K

100 MISSION RIDGE GOODLETTSVILLE, TN 37072 (Address of principal executive offices...

-

Page 79

10-K

-

Page 80

... each of the years listed will be or were 52-week years, with the exception of 2011 which consisted of 53 weeks. All of the discussion and analysis in this report should be read with, and is qualified in its entirety by, the Consolidated Financial Statements and related notes. Solely for convenience...

-

Page 81

... investment funds affiliated with Kohlberg Kravis Roberts & Co. L.P., or KKR. In November 2009 our common stock again became publicly traded. Our Business Model Our long history of profitable growth is founded on a commitment to a relatively simple business model: providing a broad base of customers...

-

Page 82

...sales per square foot, based on total stores, increased to $216 in 2012 from $213 in 2011 (which included a contribution of approximately $4 from the 53rd week) and $201 in 2010. We believe we have opportunities to increase our store productivity in 2013 through continued improvement in our in-stock...

-

Page 83

.... Growing Our Store Base. After slowing our growth rate in 2007 and 2008 to focus on significantly improving the sales and profitability of our stores, we accelerated our expansion in 2009 and have grown our retail square footage by approximately 7% annually since that time. In 2012, we made...

-

Page 84

... continuing to test the Plus and Market concepts and look for areas to increase sales productivity and lower our costs to open and operate. We generally have had good success in locating suitable store sites in the past, and we believe that there is ample opportunity for new store growth in existing...

-

Page 85

.... To attract new and retain existing customers, we continue to focus on product quality and selection, in-stock levels and pricing, targeted advertising, improved store standards, convenient site locations, and a pleasant overall customer experience. Our Suppliers We purchase merchandise from a wide...

-

Page 86

... the timing of certain holidays, the timing of new store openings and store closings, the amount of sales contributed by new and existing stores, as well as financial transactions such as debt repurchases, common stock offerings and stock repurchases. We purchase substantial amounts of inventory in...

-

Page 87

... offer competitive everyday low prices to our customers. See ''-Our Business Model'' above for further discussion of our competitive situation. Our Employees As of March 1, 2013, we employed approximately 90,500 full-time and part-time employees, including divisional and regional managers, district...

-

Page 88

..., coffee, groundnuts, resin), and increasing diesel fuel costs. These costs generally stabilized in 2012. We will be diligent in our efforts to keep product costs as low as possible in the face of these increases while still working to optimize gross profit and meet the needs of our customers. In...

-

Page 89

... growth opportunities and adversely impact our financial performance. The retail business is highly competitive with respect to price, store location, merchandise quality, assortment and presentation, in-stock consistency, customer service, aggressive promotional activity, customers, and employees...

-

Page 90

... could also negatively affect our business. We maintain a network of distribution facilities and have plans to build new facilities to support our growth objectives. Delays in opening distribution centers could adversely affect our future operations by slowing store growth, which may in turn reduce...

-

Page 91

... financial performance. Our business is subject to numerous and increasing federal, state and local laws and regulations. We routinely incur costs in complying with these regulations. New laws or regulations, particularly those dealing with healthcare reform, product safety, and labor and employment...

-

Page 92

... affect our business, financial condition and results of operations. See Note 9 to the consolidated financial statements for further details regarding certain of these pending matters. If we cannot open, relocate or remodel stores profitably and on schedule, our planned future growth will be...

-

Page 93

... of our distribution centers, a significant number of stores, or our corporate headquarters or impact one or more of our key suppliers, our operations and financial performance could be materially adversely affected through an inability to make deliveries or provide other support functions to our...

-

Page 94

... affect our financial performance. Our future growth and performance depends on our ability to attract, retain and motivate qualified employees, many of whom are in positions with historically high rates of turnover such as field managers and distribution center managers. Our ability to meet our...

-

Page 95

... which could, in turn, adversely affect our sales and profitability. Our success depends on our executive officers and other key personnel. If we lose key personnel or are unable to hire additional qualified personnel, our business may be harmed. Our future success depends to a significant degree on...

-

Page 96

... credit card sales, we transmit confidential credit and debit card information. We also have access to, collect or maintain private or confidential information regarding our customers, employees and vendors, as well as our business. We have procedures and technology in place to safeguard such data...

-

Page 97

... future enter into agreements limiting our exposure to higher interest rates, any such agreements may not offer complete protection from this risk. Our debt agreements contain restrictions that could limit our flexibility in operating our business. Our credit facilities and the indenture governing...

-

Page 98

...' agreement that we entered into with Buck Holdings, L.P., based on the current ownership by Buck Holdings, L.P. of our common stock, KKR has certain rights to appoint directors to our Board. The Investors are also in the business of making investments in companies and may from time to time acquire...

-

Page 99

... percentage of our new stores have been subject to build-to-suit arrangements. As of March 1, 2013, we operated eleven distribution centers, as described in the following table:

Year Opened Approximate Square Footage Approximate Number of Stores Served

Location

Scottsville, KY . . Ardmore...

-

Page 100

...of Lowe's Companies, Inc. Mr. Tehle joined Dollar General in June 2004 as Executive Vice President and Chief Financial Officer. He served from 1997 to June 2004 as Executive Vice President and Chief Financial Officer of Haggar Corporation, a manufacturing, marketing and retail corporation. From 1996...

-

Page 101

... joined Dollar General as Senior Vice President, Global Supply Chain, in May 2008. He was promoted to Executive Vice President in March 2010. He has 25 years of management experience in retail logistics. Prior to joining Dollar General, he was group vice president of logistics and distribution for...

-

Page 102

...'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information Our common stock is traded on the New York Stock Exchange under the symbol ''DG.'' The high and low sales prices during each quarter in fiscal 2012 and 2011 were as follows:

2012 First Quarter...

-

Page 103

... and the S&P Retailing index. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in our common stock and in each of the indexes on 11/13/2009, the date of our initial public offering. COMPARISON OF CUMULATIVE TOTAL RETURN* Among Dollar General Corporation, the...

-

Page 104

... financial information of Dollar General Corporation as of the dates and for the periods indicated. The selected historical statement of operations data and statement of cash flows data for the fiscal years ended February 1, 2013, February 3, 2012 and January 28, 2011, and balance sheet data...

-

Page 105

..., excluding per share data, number of stores, selling square feet, and net sales per square foot) February 1, 2013 February 3, 2012(1) Year Ended January 28, 2011 January 29, 2010 January 30, 2009

Statement of Operations Data: Net sales ...Cost of goods sold ...Gross profit ...Selling, general and...

-

Page 106

... Same-store sales are calculated based upon stores that were open at least 13 full fiscal months and remain open at the end of the reporting period. When applicable, we exclude the sales in the non-comparable week of a 53-week year from the same-store sales calculation. (3) Net sales per square foot...

-

Page 107

...our category management processes which help us determine the most productive merchandise offerings for our customers. Specific sales growth initiatives in 2012 included: continued improvement in merchandise in-stock levels; the expansion of the number of coolers for refrigerated and frozen foods in...

-

Page 108

... Dollar General's culture of serving others. For customers this means helping them ''Save time. Save money. Every day!'' by providing clean, well-stocked stores with quality products at low prices. For employees, this means creating an environment that attracts and retains key employees throughout...

-

Page 109

...of our 2012 new stores, remodels and relocations, and in 2013 we plan to open 635 new stores and remodel or relocate an additional 550 stores. Key Financial Metrics. We have identified the following as our most critical financial metrics:

10-K

• Same-store sales growth; • Sales per square foot...

-

Page 110

... of sales; • Selling, general and administrative expenses, as a percentage of sales; • Operating profit; • Inventory turnover; • Cash flow; • Net income; • Earnings per share; • Earnings before interest, income taxes, depreciation and amortization; • Return on invested capital; and...

-

Page 111

... months and remain open at the end of the reporting period. Same-store sales increases are calculated based on the comparable calendar weeks in the prior year. The remainder of the increase in sales in 2012 was attributable to new stores, partially offset by sales from closed stores. The increase in...

-

Page 112

... gross profit include the selective price increases noted above as well as lower inventory shrinkage and distribution center costs, as a percentage of sales. SG&A Expense. SG&A expense was 21.4% as a percentage of sales in 2012 compared to 21.7% in 2011, an improvement of 25 basis points. Retail...

-

Page 113

... store data network and store properties purchased. SG&A in 2010 includes expenses totaling $19.7 million for expenses (primarily share-based compensation) incurred in connection with secondary offerings of our common stock. Interest Expense. The decrease in interest expense in 2012 compared to 2011...

-

Page 114

... financial statements. Other than the foregoing, we are not party to any off balance sheet arrangements. Effects of Inflation We experienced little or no overall product cost inflation in 2012 or 2010. In 2011, we experienced increased commodity cost pressures mainly related to food, housewares...

-

Page 115

... commitment to $1.2 billion. Interest Rates and Fees. Borrowings under the Credit Facilities bear interest at a rate equal to an applicable margin plus, at our option, either (a) LIBOR or (b) a base rate (which is usually equal to the prime rate). The applicable margin for borrowings under the Term...

-

Page 116

... pay dividends and distributions or repurchase our capital stock; • make investments or acquisitions; • repay or repurchase subordinated indebtedness; • amend material agreements governing our subordinated indebtedness; or • change our lines of business. The senior secured credit agreements...

-

Page 117

... under our Credit Facilities. We may redeem some or all of the Senior Notes at any time at redemption prices described or set forth in the Senior Indenture. We also may seek, from time to time, to retire some or all of the Senior Notes through cash purchases on the open market, in privately...

-

Page 118

...53.3 - 143.3 $1,837.6

EBITDA ...Adjustments: Loss on debt retirement ...(Gain) loss on hedging instruments ...Non-cash expense for share-based awards . Litigation settlement and related costs, net Indirect merger-related costs ...Other non-cash charges (including LIFO) . Other ...

Total Adjustments...

-

Page 119

... our own credit spread are based on implied spreads from our publicly-traded debt. For counterparties with publicly available credit information, the credit spreads over LIBOR used in the calculations represent implied credit default swap spreads obtained from a third party credit data provider. In...

-

Page 120

... rent and closed store obligations in our consolidated balance sheets. (d) Commercial commitments include information technology license and support agreements, supplies, fixtures, letters of credit for import merchandise, and other inventory purchase obligations. (e) Purchase obligations include...

-

Page 121

... outlook, and in February 2013, Moody's placed our corporate rating of Ba1 on review for upgrade. Our current credit ratings, as well as future rating agency actions, could (i) impact our ability to fund our operations on satisfactory terms; (ii) affect our financing costs; and (iii) affect our...

-

Page 122

... closely monitor and manage our inventory balances, and they may fluctuate from period to period based on new store openings, the timing of purchases, and other factors. Merchandise inventories increased by 19% during 2012, compared to a 14% increase in 2011. The increase in inventories in 2012 was...

-

Page 123

... 20 new Dollar General Market stores and approximately 40 Dollar General Plus stores, which will expand our presence in markets such as California and Nevada. The Market and Plus stores require higher investments than our traditional stores which can vary depending on numbers of coolers, square feet...

-

Page 124

... the inventory balance include: • applying the RIM to a group of products that is not fairly uniform in terms of its cost and selling price relationship and turnover; • applying the RIM to transactions over a period of time that include different rates of gross profit, such as those relating to...

-

Page 125

... in greater detail below, and other assumptions. Projections are based on management's best estimates given recent financial performance, market trends, strategic plans and other available information which in recent years have been materially accurate. Although not currently anticipated, changes...

-

Page 126

... value or impairment. Insurance Liabilities. We retain a significant portion of the risk for our workers' compensation, employee health, property loss, automobile and general liability. These represent significant costs primarily due to our large employee base and number of stores. Provisions are...

-

Page 127

... management periodically evaluates the need to close underperforming stores. Liabilities are established at the point of closure for the present value of any remaining operating lease obligations, net of estimated sublease income, and at the communication date for severance and other exit costs. Key...

-

Page 128

... statement of operations or be accumulated in other comprehensive income, and requires that a company formally document, designate, and assess the effectiveness of transactions that receive hedge accounting. We use derivative instruments to manage our exposure to changing interest rates, primarily...

-

Page 129

...Interest Rate Risk We manage our interest rate risk through the strategic use of fixed and variable interest rate debt and, from time to time, derivative financial instruments. Our principal interest rate exposure relates to outstanding amounts under our Credit Facilities. As of February 1, 2013, we...

-

Page 130

...DATA Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders of Dollar General Corporation We have audited the accompanying consolidated balance sheets of Dollar General Corporation and subsidiaries as of February 1, 2013 and February 3, 2012, and the related...

-

Page 131

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In thousands, except per share amounts)

February 1, 2013 February 3, 2012

ASSETS Current assets: Cash and cash equivalents ...Merchandise inventories ...Prepaid expenses and other current assets ...Total current assets ...

$

...

-

Page 132

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share amounts)

For the Year Ended February 3, January 28, 2012 2011

February 1, 2013

Net sales ...Cost of goods sold ...Gross profit ...Selling, general and administrative expenses ...Operating ...

-

Page 133

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands)

For the Year Ended February 1, February 3, January 28, 2013 2012 2011

Net income ...Unrealized net gain on hedged transactions, net of related income tax expense of $1,448, $9,692 and $9,406, ...

-

Page 134

... 29, 2010 Net income ...Unrealized net gain on hedged transactions ...Share-based compensation expense ...Tax benefit from stock option exercises ...Issuance of common stock under stock incentive plans ...Exercise of stock options . . Other equity transactions . Balances, January 28, 2011 Net income...

-

Page 135

... ...Deferred income taxes ...Tax benefit of stock options ...Loss on debt retirement, net ...Noncash share-based compensation ...Other noncash gains and losses ...Change in operating assets and liabilities: Merchandise inventories ...Prepaid expenses and other current assets . Accounts payable...

-

Page 136

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of presentation and accounting policies Basis of presentation These notes contain references to the years 2012, 2011 and 2010, which represent fiscal years ended February 1, 2013, February 3, 2012, and ...

-

Page 137

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued) For the years ended February 1, 2013, February 3, 2012, and January 28, 2011, gross realized gains and losses on the sales of available-for...

-

Page 138

...assets, other than goodwill, in relation to the operating performance and future cash flows or the appraised values of the underlying assets. In accordance with accounting standards for long-lived assets, the Company reviews for impairment stores open more than two years for which current cash flows...

-

Page 139

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued) estimated based primarily upon estimated future cash flows (discounted at the Company's credit adjusted risk-free rate) or other reasonable...

-

Page 140

...' compensation and non-property general liability exposures. Pursuant to South Carolina insurance regulations, ARIC is required to maintain certain levels of cash and cash equivalents related to its self-insured exposures. ARIC currently insures no unrelated third-party risk. The Company's policy is...

-

Page 141

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued) The Company recognizes contingent rental expense when the achievement of specified sales targets are considered probable, in accordance ...

-

Page 142

... GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued) fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability. The valuation of the Company...

-

Page 143

... for retail merchandise returns is based on the Company's prior experience. The Company records gain contingencies when realized. The Company recognizes gift card sales revenue at the time of redemption. The liability for the gift cards is established for the cash value at the time of purchase. The...

-

Page 144

... stock on the grant date and the purchase price, if any. Such expense is recognized on a straight-line basis for graded awards or an accelerated basis for performance awards over the period in which the recipient earns the awards. Store pre-opening costs Pre-opening costs related to new store...

-

Page 145

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued) Accounting standards In July 2012, the Financial Accounting Standards Board (FASB) issued new accounting guidance relating to impairment ...

-

Page 146

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. Goodwill and other intangible assets As of February 1, 2013 and February 3, 2012, the balances of the Company's intangible assets were as follows:

Remaining Life As of February 1, 2013 Accumulated ...

-

Page 147

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

4. Earnings per share (Continued)

2011 Weighted Average Shares

Net Income

Per Share Amount

Basic earnings per share ...Effect of dilutive share-based awards ...Diluted earnings per share ...

$766,...

-

Page 148

... as follows:

(Dollars in thousands) 2012 2011 2010

U.S. federal statutory rate on earnings before income taxes ...State income taxes, net of federal income tax benefit ...Jobs credits, net of federal income taxes ...Increase (decrease) in valuation allowances . . Income tax related interest expense...

-

Page 149

... 3, 2012

Deferred tax assets: Deferred compensation expense ...Accrued expenses and other ...Accrued rent ...Accrued insurance ...Accrued bonuses ...Interest rate hedges ...Tax benefit of income tax and interest reserves related to uncertain tax positions ...Other ...State tax net operating loss...

-

Page 150

...allowance has been provided for state tax credit carry forwards and federal capital losses. The 2012, 2011, and 2010 decreases of $3.1 million, $2.2 million and $1.0 million, respectively, were recorded as a reduction in income tax expense. Based upon expected future income, management believes that...

-

Page 151

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

5. Income taxes (Continued) A reconciliation of the uncertain income tax positions from January 29, 2010 through February 1, 2013 is as follows:

(In thousands) 2012 2011 2010

10-K

Beginning balance ...

-

Page 152

... statement of income for the year ended February 1, 2013. The Company was reimbursed for these fees as further discussed in Note 12. Borrowings under the Credit Facilities bear interest at a rate equal to an applicable margin plus, at the Company's option, either (a) LIBOR or (b) a base rate...

-

Page 153

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

6. Current and long-term obligations (Continued) As of February 1, 2013 and February 3, 2012, the respective letter of credit amounts related to the ABL Facility were $40.1 million and $38.4 million, ...

-

Page 154

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

6. Current and long-term obligations (Continued) Scheduled debt maturities, including capital lease obligations, for the Company's fiscal years listed below are as follows (in thousands): 2013-$892; ...

-

Page 155

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

8. Derivative financial instruments (Continued) risks, including interest rate, liquidity, and credit risk, primarily by managing the amount, sources, and duration of its debt funding and the use of ...

-

Page 156

... or posted any collateral related to these agreements. 9. Commitments and contingencies Leases As of February 1, 2013, the Company was committed under operating lease agreements for most of its retail stores. Many of the Company's stores are subject to build-to-suit arrangements with landlords which...

-

Page 157

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

9. Commitments and contingencies (Continued) The land and buildings of the Company's DCs in Fulton, Missouri and Indianola, Mississippi are subject to operating lease agreements and the leased Ardmore...

-

Page 158

... former store managers. The Company opposed the plaintiff's motion. On March 23, 2007, the court conditionally certified a nationwide class. On December 2, 2009, notice was mailed to over 28,000 current or former Dollar General store managers. Approximately 3,950 individuals opted into the lawsuit...

-

Page 159

... the claims. The Company paid approximately $2.8 million to the third party claims administrator. In addition, the Company agreed to make, and, effective April 1, 2012, has made, certain adjustments to its pay setting policies and procedures for new store managers. Because it deemed settlement...

-

Page 160

... to the Company's financial statements taken as a whole. In September 2011, the Chicago Regional Office of the United States Equal Employment Opportunity Commission (''EEOC'' or ''Commission'') notified the Company of a cause finding related to the Company's criminal background check policy. The...

-

Page 161

... in May 2011. From time to time, the Company is a party to various other legal actions involving claims incidental to the conduct of its business, including actions by employees, consumers, suppliers, government agencies, or others through private actions, class actions, administrative proceedings...

-

Page 162

... General Corporation CDP/SERP Plan, for a select group of management and other key employees. The Company incurred compensation expense for these plans of approximately $1.4 million, $1.7 million and $1.7 million in 2012, 2011 and 2010, respectively. The CDP/SERP Plan assets are invested in accounts...

-

Page 163

... certain public offerings of the Company's common stock. Each of these options, whether Time Options or Performance Options, have a contractual term of 10 years and an exercise price equal to the fair value of the underlying common stock on the date of grant. The weighted average for key assumptions...

-

Page 164

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. Share-based payments (Continued) Company's option at an amount equal to the lesser of fair value or the amount paid for the shares (i.e., the exercise price). In such cases, because the employee ...

-

Page 165

...based upon the Company's annual financial performance as specified in the award agreement. A summary of performance stock unit award activity during the year ended February 1, 2013 is as follows:

(Intrinsic value amounts reflected in thousands) Units Issued Intrinsic Value

Balance, February 3, 2012...

-

Page 166

... restricted stock units were granted in 2010. In March 2012, the Company issued a performance-based award of 326,037 shares of restricted stock to its Chairman and Chief Executive Officer. This restricted stock award had a fair value on the grant date of $45.25 per share and a purchase price of zero...

-

Page 167

... Company may conduct business with related parties including KKR and Goldman, Sachs and Co., and references herein to these entities include their affiliates. KKR and Goldman, Sachs & Co. indirectly own a significant portion of the Company's common stock. Two of KKR's members and a managing director...

-

Page 168

... GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

12. Related party transactions (Continued) The Company repurchased common stock held by Buck Holdings, L.P during 2012 as further discussed in Note 2. 13. Segment reporting The Company manages its business...

-

Page 169

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. Quarterly financial data (unaudited) (Continued) As discussed in Note 6, in the second quarter of 2012, the Company repurchased $450.7 million principal amount of its outstanding senior ...

-

Page 170

...owned subsidiary of the Company. The following consolidating schedules present condensed financial information on a combined basis, in thousands.

February 1, 2013 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL BALANCE SHEET: ASSETS Current assets...

-

Page 171

...FINANCIAL STATEMENTS (Continued)

16. Guarantor subsidiaries (Continued)

February 3, 2012 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL BALANCE SHEET: ASSETS Current assets: Cash and cash equivalents ...Merchandise inventories ...Deferred income...

-

Page 172

...Comprehensive income ...

For the year ended February 3, 2012 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL

STATEMENTS OF INCOME: Net sales ...Cost of goods sold ...Gross profit ...Selling, general and administrative expenses ...Operating profit...

-

Page 173

...FINANCIAL STATEMENTS (Continued)

16. Guarantor subsidiaries (Continued)

For the year ended January 28, 2011 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL

STATEMENTS OF INCOME: Net sales ...Cost of goods sold ...Gross profit ...Selling, general...

-

Page 174

...Tax benefit of stock options ...Loss on debt retirement, net ...Noncash share-based compensation ...Other noncash gains and losses ...Equity in subsidiaries' earnings, net ...Change in operating assets and liabilities: Merchandise inventories ...Prepaid expenses and other current assets ...Accounts...

-

Page 175

...Tax benefit of stock options ...Loss on debt retirement, net ...Noncash share-based compensation ...Other noncash gains and losses ...Equity in subsidiaries' earnings, net ...Change in operating assets and liabilities: Merchandise inventories ...Prepaid expenses and other current assets ...Accounts...

-

Page 176

...Tax benefit of stock options ...Loss on debt retirement, net ...Noncash share-based compensation ...Other noncash gains and losses ...Equity in subsidiaries' earnings, net ...Change in operating assets and liabilities: Merchandise inventories ...Prepaid expenses and other current assets ...Accounts...

-

Page 177

...as amended (the ''Exchange Act''). Based on this evaluation, our principal executive officer and our principal financial officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this report. (b) Management's Annual Report on Internal Control...

-

Page 178

... standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Dollar General Corporation and subsidiaries as of February 1, 2013 and February 3, 2012, and the related consolidated statements of income, comprehensive income, shareholders' equity, and...

-

Page 179

... ended February 1, 2013 in our internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)) that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. ITEM 9B. OTHER INFORMATION

Not applicable.

10-K

100

-

Page 180

... to Dollar General Corporation, c/o Investor Relations Department, 100 Mission Ridge, Goodlettsville, TN 37072. We intend to provide any required disclosure of an amendment to or waiver from the Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial...

-

Page 181

...exercise price in column (b). Column (c) consists of shares reserved for issuance pursuant to the Amended and Restated 2007 Stock Incentive Plan, whether in the form of stock, restricted stock, share units, or other share-based awards or upon the exercise of an option or right. (b) Other Information...

-

Page 182

.... (a) EXHIBITS AND FINANCIAL STATEMENT SCHEDULES Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Income Consolidated Statements of Comprehensive Income Consolidated Statements of Shareholders' Equity Consolidated Statements of Cash Flows...

-

Page 183

... caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. DOLLAR GENERAL CORPORATION

Date: March 25, 2013

By:

/s/ RICHARD W. DREILING Richard W. Dreiling, Chairman and Chief Executive Officer

10-K

We, the undersigned directors and officers of the registrant...

-

Page 184

...

Title

Date

/s/ PATRICIA FILI-KRUSHEL PATRICIA FILI-KRUSHEL

Director

March 25, 2013

/s/ ADRIAN JONES ADRIAN JONES

Director

March 25, 2013

/s/ WILLIAM C. RHODES, III WILLIAM C. RHODES, III

Director

March 25, 2013

10-K

/s/ DAVID B. RICKARD DAVID B. RICKARD

Director

March 25, 2013

105

-

Page 185

... SEC on July 12, 2007 (file no. 001-11421)) Amended and Restated Credit Agreement, dated as of March 30, 2012, among Dollar General Corporation, as Borrower, CitiCorp North American, N.A. as Administrative Agent, and the other financial institutions from time to time party thereto (incorporated by...

-

Page 186

... to Dollar General Corporation's Current Report on Form 8-K dated July 6, 2007, filed with the SEC on July 12, 2007 (file no. 001-11421)) Supplement No.1, dated as of September 11, 2007, to the Guarantee to the Credit Agreement, between DC Financial, LLC, as New Guarantor, and Citicorp North America...

-

Page 187

... as Subsidiary Borrowers, The CIT Group/Business Credit Inc., as ABL Administrative Agent, and the other lending institutions from time to time party thereto (incorporated by reference to Exhibit 4.6 to Dollar General Corporation's Current Report on Form 8-K dated July 6, 2007, filed with the SEC on...

-

Page 188

... Exhibit 4.29 to Dollar General Corporation's Registration Statement on Form S-4 (file no. 333-148320)) Supplement No. 1, dated as of December 31, 2007, to the Guarantee to the ABL Credit Agreement, between Retail Risk Solutions, LLC, as New Guarantor, and The CIT Group/ Business Credit Inc., as ABL...

-

Page 189

... Performance Share Unit Award Agreement in connection with grants made to certain employees of Dollar General Corporation pursuant to the Amended and Restated 2007 Stock Incentive Plan (approved March 20, 2012) (incorporated by reference to Exhibit 10.2 to Dollar General Corporation's Current Report...

-

Page 190

... Company's Amended and Restated 2007 Stock Incentive Plan (incorporated by reference to Exhibit 10.15 to Dollar General Corporation's Registration Statement on Form S-1 (file no. 333-161464)) Form of Restricted Stock Unit Award Agreement, adopted on May 24, 2011, for Grants to Non-Employee Directors...

-

Page 191

... Policy for Officers (incorporated by reference to Exhibit 10.21 to Dollar General Corporation's Annual Report on Form 10-K for the fiscal year ended January 28, 2011, filed with the SEC on March 22, 2011 (file no. 001-11421))* Summary of Non-Employee Director Compensation effective February 4, 2012...

-

Page 192

... March 24, 2009 (file no. 001-11421))* Employment Agreement, effective March 24, 2010, by and between Dollar General Corporation and John Flanigan (incorporated by reference to Exhibit 10.33 to Dollar General Corporation's Annual Report on Form 10-K for the fiscal year ended January 28, 2011, filed...

-

Page 193

... 10.38 to Dollar General Corporation's Annual Report on Form 10-K for the fiscal year ended January 28, 2011, filed with the SEC on March 22, 2011 (file no. 001-11421))* Employment Agreement, effective March 24, 2010, by and between Dollar General Corporation and Robert Ravener (incorporated by...

-

Page 194

...Exhibit 1.1 to Dollar General Corporation's Current Report on Form 8-K dated September 25, 2012, filed with the SEC on September 27, 2012 (file no. 001-11421)) Indemnification Agreement, dated July 6, 2007, among Buck Holdings, L.P., Dollar General Corporation, Kohlberg Kravis Roberts & Co L.P., and...

-

Page 195

... Compensation Committee Nominating & Governance Committee Committee Chairman

Adrian Jones†Michael M. Calbertâ€

Member Kohlberg Kravis Roberts & Co. Managing Director Goldman, Sachs & Co.

Ofï¬cers

Executive Vice Presidents

John W. Flaniganâ€

Global Supply Chain

Robert D. Ravenerâ€

Chief...

-

Page 196

-

Page 197