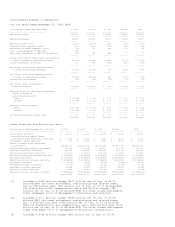

Delta Airlines 2002 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consolidated Summary of Operations

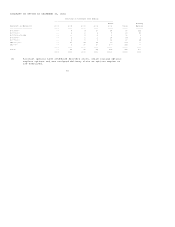

For the years ended December 31, 2002-1998

(in millions, except per share data) 2002(1) 2001(2) 2000(3) 1999(4) 1998

----------------------------------- -------- -------- -------- -------- --------

Operating revenues $ 13,305 $ 13,879 $ 16,741 $ 14,883 $ 14,312

-------- -------- -------- -------- --------

Operating expenses 14,614 15,481 15,104 13,565 12,509

-------- -------- -------- -------- --------

Operating income (loss) (1,309) (1,602) 1,637 1,318 1,803

Interest income (expense), net(5) (610) (410) (257) (126) (66)

Miscellaneous income (expense), net(6) (2) 80 328 901 39

Loss on extinguishment of ESOP Notes (42) -- -- -- --

Fair value adjustments of SFAS 133 derivatives (39) 68 (159) -- --

-------- -------- -------- -------- --------

Income (loss) before income taxes and cumulative

effect of change in accounting principle (2,002) (1,864) 1,549 2,093 1,776

Income tax benefit (provision) 730 648 (621) (831) (698)

-------- -------- -------- -------- --------

Net income (loss) before cumulative effect

of change in accounting principle (1,272) (1,216) 928 1,262 1,078

-------- -------- -------- -------- --------

Net income (loss) after cumulative effect

of change in accounting principle (1,272) (1,216) 828 1,208 1,078

Preferred stock dividends (15) (14) (13) (12) (11)

-------- -------- -------- -------- --------

Net income (loss) attributable to

common shareowners $ (1,287) $ (1,230) $ 815 $ 1,196 $ 1,067

-------- -------- -------- -------- --------

Earnings (loss) per share before cumulative

effect of change in

accounting principle(7)

Basic $ (10.44) $ (9.99) $ 7.39 $ 9.05 $ 7.22

Diluted $ (10.44) $ (9.99) $ 7.05 $ 8.52 $ 6.87

-------- -------- -------- -------- --------

Earnings (loss) per share(7)

Basic $ (10.44) $ (9.99) $ 6.58 $ 8.66 $ 7.22

Diluted $ (10.44) (9.99) $ 6.28 $ 8.15 $ 6.87

-------- -------- -------- -------- --------

Dividends declared per common share $ 0.10 $ 0.10 $ 0.10 $ 0.10 $ 0.10

======== ======== ======== ======== ========

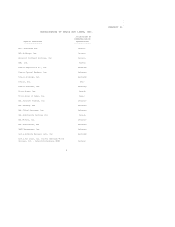

Other Financial and Statistical Data

For the years ended December 31, 2002-1998 2002(1) 2001(2) 2000(3) 1999(4) 1998

------------------------------------------- ------------ ------------ ------------ ------------ ------------

Total assets (millions) $ 24,720 $ 23,605 $ 21,931 $ 19,942 $ 14,727

Long-term debt and capital leases

(excluding current maturities) (millions) $ 10,174 $ 8,347 $ 5,896 $ 4,303 $ 1,720

Shareowners' equity (millions) $ 893 $ 3,769 $ 5,343 $ 4,908 $ 4,077

Shares of common stock outstanding

at year end(7) 123,359,205 123,245,666 123,013,372 132,893,470 141,514,262

Revenue passengers enplaned (thousands) 107,048 104,943 119,930 110,083 105,304

Available seat miles (millions) 141,719 147,837 154,974 147,073 142,154

Revenue passenger miles (millions) 102,029 101,717 112,998 106,165 103,342

Operating revenue per available seat mile 9.39(cents) 9.39(cents) 10.80(cents) 10.12(cents) 10.07(cents)

Passenger mile yield 12.08(cents) 12.74(cents) 13.86(cents) 13.14(cents) 12.99(cents)

Operating cost per available seat mile 10.31(cents) 10.47(cents) 9.75(cents) 9.22(cents) 8.80(cents)

Passenger load factor 71.99% 68.80% 72.91% 72.18% 72.70%

Breakeven passenger load factor 79.64% 77.31% 65.29% 65.37% 62.94%

Available ton miles (millions) 21,548 22,282 22,925 21,245 20,312

Revenue ton miles (millions) 11,698 11,752 13,058 12,227 12,052

Operating cost per available ton miles 67.82(cents) 69.48(cents) 65.88(cents) 63.85(cents) 61.58(cents)

============ ============ ============ ============ =============

(1) Includes a $439 million charge ($277 million net of tax, or $2.25

diluted EPS) for asset writedowns, restructuring and related items,

net; a $34 million gain ($22 million net of tax, or $0.17 diluted EPS)

for Stabilization Act compensation; and a $94 million charge ($59

million net of tax, or $0.47 diluted EPS) for other income and expense

items (seepages 16-17 of Management's Discussion and Analysis).

(2) Includes a $1.1 billion charge ($695 million net of tax, or $5.63

diluted EPS) for asset writedowns, restructuring and related items,

net; a $634 million gain ($392 million net of tax, or $3.18 diluted

EPS) for Stabilization Act compensation; and a $186 million gain ($114

million net of tax, or $0.92 diluted EPS) for other income and expense

items (see pages 16-17 of Management's Discussion and Analysis).

(3) Includes a $108 million charge ($66 million net of tax, or $0.50