Delta Airlines 2002 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

As discussed above, the 2001 Warrant provides us with the right to purchase up

to an additional 26.9 million shares of priceline common stock for $2.97 per

share. We may exercise the 2001 Warrant, in whole or in part, at any time prior

to the close of business on February 6, 2007, unless all of the shares of Series

B Preferred Stock owned by us are redeemed in an Optional Redemption, in which

case we may not exercise the 2001 Warrant after the date of the Optional

Redemption. The exercise price may be paid by us only by the surrender of shares

of Series B Preferred Stock, valued at $1,000 per share.

The 2001 Warrant also provides that it will automatically be deemed exercised if

the closing sales price of priceline common stock exceeds $8.91 for 20

consecutive trading days. In that event, our rights in the shares of Series B

Preferred Stock necessary to pay the exercise price of the 2001 Warrant would

automatically be converted into the right to receive shares of priceline common

stock pursuant to the 2001 Warrant.

During 2001, we (1) exercised the 2001 Warrant in part to purchase 18.4 million

shares of priceline common stock, paying the exercise price by surrendering to

priceline 54,656 shares of Series B Preferred Stock; (2) sold 18.7 million

shares of priceline common stock; and (3) received 986,491 shares of priceline

common stock as a dividend on the Series B Preferred Stock. In our 2001

Consolidated Statement of Operations, we recognized (1) other income of $9

million, pretax, from the dividend and (2) a pretax gain of $4 million from the

exercise of the 2001 Warrant and the sale of priceline common stock.

2002

During 2002, we (1) exercised the 2001 Warrant in part to purchase 4.0 million

shares of priceline common stock, paying the exercise price by surrendering to

priceline 11,875 shares of Series B Preferred Stock; (2) sold 3.9 million shares

of priceline common stock; and (3) received 695,749 shares of priceline common

stock as dividends on the Series B Preferred Stock. In our 2002 Consolidated

Statement of Operations, we recognized (1) a pretax loss of $3 million from the

exercise of the 2001 Warrant and the sale of priceline common stock and (2)

other income of $2 million, pretax, from the dividends.

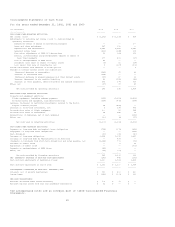

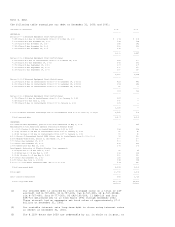

The following table represents our equity interests in priceline and their

respective carrying values at December 31, 2002 and 2001:

Number of Shares(1) Carrying Values

--------------------- ---------------------

(in millions, except shares of Series B Preferred Stock) 2002 2001 2002 2001

-------------------------------------------------------- ------ ------ ----- -----

Series B Preferred Stock 13,469 25,344 $ 13 $ 25

2001 Warrant 4.5 8.5 3 31

Amended 1999 Warrant 4.7 4.7 -- 13

priceline common stock 2.1 1.3 3 7

------ ------ ----- -----

(1) We have certain registration rights relating to shares of priceline

common stock we acquire from the exercise of the Amended 1999 Warrant

or the 2001 Warrant or receive as dividends on the Series B Preferred

Stock.

The Series B Preferred Stock and priceline common stock are accounted for as

available-for-sale securities. In accordance with SFAS No. 115, "Accounting for

Certain Investments in Debt and Equity Securities" (SFAS 115), the Series B

Preferred Stock and the priceline common stock are recorded at fair value in

investments in debt and equity securities on our Consolidated Balance Sheets.

Any changes in fair value of these assets are recorded, net of tax, in

accumulated other comprehensive income (loss). The Series B Preferred Stock is

recorded at face value, which we believe approximates fair value. The warrants

are recorded at fair value in investments in debt and equity securities on our

Consolidated Balance Sheets and any changes in fair value are recorded in other

income (expense) on our Consolidated Statements of Operations in accordance with

SFAS 133.

REPUBLIC AIRWAYS HOLDINGS, INC. (REPUBLIC)

On June 7, 2002, we entered into a contract carrier agreement with Chautauqua

Airlines, Inc. (Chautauqua), a regional air carrier which is a subsidiary of

Republic (see Note 9). In conjunction with this agreement, we received from

Republic (1) a warrant to purchase up to 1.5 million shares of Republic common

stock for $12.50 per share (2002 Warrant); (2) a warrant to purchase up to 1.5

million shares of Republic common stock at a price per share equal to 95% of the

public offering price per share in Republic's initial public offering of common

stock (IPO Warrant); (3) the right to purchase up to 5% of the shares of common

stock that

38