Delta Airlines 2002 Annual Report Download - page 172

Download and view the complete annual report

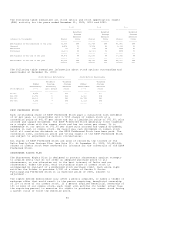

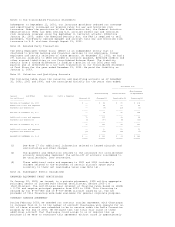

Please find page 172 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 18. Earnings (Loss) per Share

We calculate basic earnings (loss) per share by dividing the income (loss)

available to common shareowners by the weighted average number of common shares

outstanding. Diluted earnings (loss) per share includes the dilutive effects of

stock options and convertible securities. To the extent stock options and

convertible securities are anti-dilutive, they are excluded from the calculation

of diluted earnings (loss) per share. The following table shows our computation

of basic and diluted earnings (loss) per share:

Years Ended December 31,

(in millions, except per share data) 2002 2001 2000

------------------------------------ -------- -------- ------

BASIC:

Net income (loss) excluding cumulative effect of change in

accounting principle $ (1,272) $ (1,216) $ 928

Dividends on allocated Series B ESOP

Convertible Preferred Stock (15) (14) (13)

-------- -------- ------

Net income (loss) available to common shareowners, excluding

cumulative effect of change in accounting principle $ (1,287) $ (1,230) $ 915

Weighted average shares outstanding 123.3 123.1 123.8

-------- -------- ------

Basic earnings (loss) per share excluding cumulative

effect of change in accounting principle $ (10.44) $ (9.99) $ 7.39

======== ======== ======

DILUTED:

Net income (loss) available to common shareowners, excluding

cumulative effect of change in accounting principle $ (1,287) $ (1,230) $ 915

Income tax effect assuming conversion of allocated Series B ESOP

Convertible Preferred Stock -- -- 8

-------- -------- ------

Income (loss) available to common shareowners including

assumed conversion $ (1,287) $ (1,230) $ 923

Weighted average shares outstanding 123.3 123.1 123.8

Additional shares assuming:

Exercise of stock options -- -- 1.6

Conversion of allocated Series B ESOP Convertible Preferred Stock -- -- 5.4

Conversion of performance-based stock units -- -- 0.2

-------- -------- ------

Weighted average shares outstanding, as adjusted 123.3 123.1 131.0

-------- -------- ------

Diluted earnings (loss) per share excluding cumulative

effect of change in accounting principle $ (10.44) $ (9.99) $ 7.05

======== ======== ======

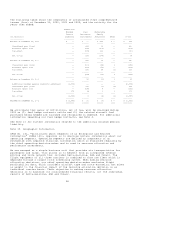

For the years ended December 31, 2002, 2001 and 2000, we excluded from the

diluted earnings (loss) per share computation (1) 54.5 million, 44.3 million and

23.4 million stock options, respectively, because the exercise price of the

options was greater than the average price of common stock and (2) 6.9 million,

6.5 million and zero additional shares, respectively, because their effect on

earnings (loss) per share was anti-dilutive.

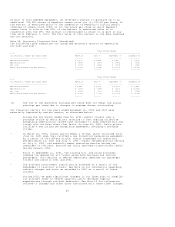

Note 19. Stabilization Act

On September 22, 2001, the Air Transportation Safety and System Stabilization

Act (Stabilization Act) became effective. The Stabilization Act is intended to

preserve the viability of the U.S. air transportation system following the

terrorist attacks on September 11, 2001 by, among other things, (1) providing

for payments from the U.S. Government totaling $5 billion to compensate U.S. air

carriers for losses incurred from September 11, 2001 through December 31, 2001

as a result of the September 11 terrorist attacks and (2) permitting the

Secretary of Transportation to sell insurance to U.S. air carriers.

Our allocated portion of compensation under the Stabilization Act was $668

million. Due to uncertainties regarding the U.S. government's calculation of

compensation, we recognized $634 million of this amount in our 2001 Consolidated

Statement of Operations. We recognized the remaining $34 million of compensation

in our 2002 Consolidated Statement of Operations. We received $112 million and

$556 million in cash for the years ended December 31, 2002 and 2001,

respectively, under the Stabilization Act.

63