Delta Airlines 2002 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

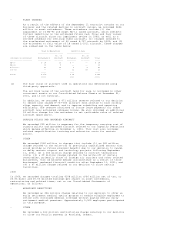

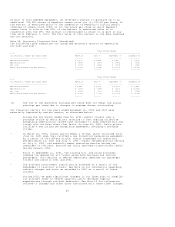

Subsequent to September 11, 2001, our insurance providers reduced our coverage

and significantly increased our premium rates for war and terrorism risk

insurance. Under the provisions of the Stabilization Act, the Federal Aviation

Administration (FAA) has been selling U.S. airlines excess war and terrorism

risk insurance coverage since the September 11 terrorist attacks. Effective

January 24, 2003, under the Homeland Security Act, the FAA is required to sell

passenger, third-party (ground damage) and aircraft hull war and terrorism risk

insurance to U.S. airlines through August 31, 2003.

Note 20. Related Party Transaction

The Delta Employees Credit Union (DECU) is an independent entity that is

chartered to provide banking and financial services to our employees, former

employees and certain relatives of these persons. At December 31, 2002, we had a

$71 million liability to DECU recorded in accounts payable, deferred credits and

other accrued liabilities on our Consolidated Balance Sheet. The liability

results from a timing difference in funding a portion of our 2002 year end

payroll and is reflected as a non-cash transaction on our Consolidated Statement

of Cash Flows for the year ended December 31, 2002. We paid the liability on

January 2, 2003.

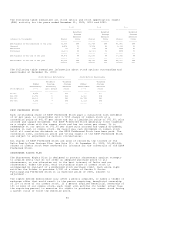

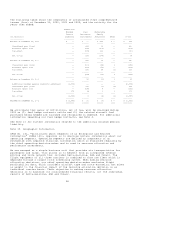

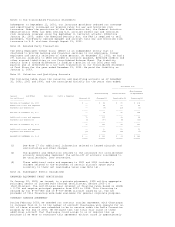

Note 21. Valuation and Qualifying Accounts

The following table shows the valuation and qualifying accounts as of December

31, 2002, 2001 and 2000, and the associated activity for the years then ended:

Allowance for:

------------------------------

Obsolescence

Restructuring Uncollectible of Expendable

Leased and Other Accounts Parts & Supplies

(in millions) Aircraft(1) Charges(1) Receivable(2) Inventory(3)

------------- ----------- ------------- -------------- ----------------

Balance at December 31, 1999 $ -- $ 41 $ 39 $ 104

Additional costs and expenses -- 22 15 22

Payments and deductions -- (7) (23) (2)

----- ------ ------ ------

Balance at December 31, 2000 -- 56 31 124

----- ------ ------ ------

Additional costs and expenses 71 115 18 38

Payments and deductions (1) (50) (6) (23)

----- ------ ------ ------

Balance at December 31, 2001 70 121 43 139

----- ------ ------ ------

Additional costs and expenses -- 90 21 51

Payments and deductions (70) (72) (31) (7)

----- ------ ------ ------

BALANCE AT DECEMBER 31, 2002 $ -- $ 139 $ 33 $ 183

===== ====== ====== ======

(1) See Note 17 for additional information related to leased aircraft and

restructuring and other charges.

(2) The payments and deductions related to the allowance for uncollectible

accounts receivable represent the write-off of accounts considered to

be uncollectible, less recoveries.

(3) These additional costs and expenses in 2001 and 2002 include the

charges related to the writedown of certain aircraft spare parts

inventory to their net realizable value (see Note 16).

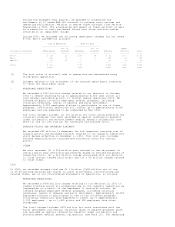

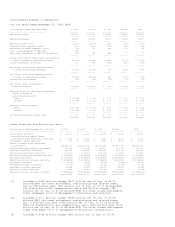

Note 22. Subsequent Events (Unaudited)

ENHANCED EQUIPMENT TRUST CERTIFICATES

On January 30, 2003, we issued, in a private placement, $392 million aggregate

principal amount of insured Pass Through Certificates, Series 2003-1 G

(Certificates). The certificates bear interest at floating rates based on LIBOR

+ 0.75% and require principal payments from 2003 to 2008. This financing is

secured by two B-737-800 and 10 B-767-300ER aircraft owned by us. The net

proceeds of this financing were made available for general corporate purposes.

CONTRACT CARRIER AGREEMENT

During February 2003, we amended our contract carrier agreement with Chautauqua

to increase from 22 to 34 the number of aircraft Chautauqua will operate for us.

All of these aircraft are scheduled to be in service under the Delta Connection

program by the end of 2003. We estimate that the total fair value of these

additional aircraft that Chautauqua could assign to us or require that we

purchase if we were to terminate this agreement without cause is approximately