Delta Airlines 2002 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management's Discussion and Analysis of Financial Condition and Results of

Operations

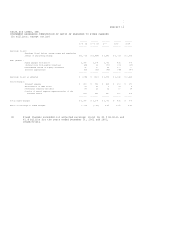

OPERATING EXPENSES

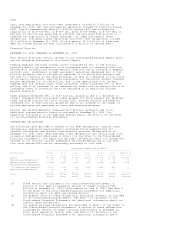

Operating expenses for 2002 totaled $14.6 billion, decreasing 6% from $15.5

billion in 2001. Operating capacity decreased 4% to 142 billion ASMs. CASM fell

2% to 10.31(cents), while fuel price neutralized CASM fell 1% to 10.34(cents).

Operating expenses include asset writedowns, restructuring and related items,

net totaling a $439 million charge in 2002 and a $1.1 billion charge in 2001, as

well as Stabilization Act compensation of $34 million in 2002 and $634 million

in 2001 (see Notes 16 and 19, respectively, of the Notes to the Consolidated

Financial Statements). Excluding these items, operating expenses decreased 5% to

$14.2 billion, CASM fell 1% to 10.03(cents), and fuel price neutralized CASM

fell 1% to 10.06(cents).

Salaries and related costs totaled $6.2 billion in 2002, a 1% increase from $6.1

billion in 2001. This reflects a 6% increase from higher pension expense and a

5% increase due to higher salary and benefit rates, primarily for pilots and

mechanics. These increases were largely offset by decreases due to workforce

reductions implemented after we reduced capacity following September 11, 2001.

Aircraft fuel expense totaled $1.7 billion during 2002, a 7% decrease from $1.8

billion during 2001. Total gallons consumed decreased 5% mainly due to capacity

reductions. The average fuel price per gallon fell 2% to 66.94(cents). Our fuel

cost is shown net of fuel hedge gains of $136 million for 2002 and $299 million

for 2001. Approximately 56% and 58% of our aircraft fuel requirements were

hedged during 2002 and 2001, respectively. For additional information about our

fuel hedge contracts, see Note 4 of the Notes to the Consolidated Financial

Statements.

Depreciation and amortization expense fell 11% in 2002, reflecting a 6% decrease

due to a change in our asset base and a 5% decrease due to our adoption on

January 1, 2002, of Statement of Financial Accounting Standards (SFAS) No. 142,

"Goodwill and Other Intangible Assets" (SFAS 142). SFAS 142 requires that

goodwill and certain other intangible assets no longer be amortized (see Note 5

of the Notes to the Consolidated Financial Statements).

Contracted services expense declined 1% primarily due to a 4% decrease from

fewer contract workers across all workgroups, partially offset by a 3% increase

due to higher security costs. Landing fees and other rents rose 7%, of which 3%

was related to an increase in landing fee rates and 2% was due to lower costs in

2001 resulting from Comair's reduced operations in 2001 due to its pilot strike

and gradual return to previous levels of service after the strike. Aircraft

maintenance materials and outside repairs expense fell 11%, primarily reflecting

a reduction in maintenance volume and materials consumption due to the timing of

maintenance events. Aircraft rent expense decreased 4%, primarily due to lower

numbers of leased aircraft during the March, June and September 2002 quarters

resulting from our fleet simplification efforts. Other selling expenses fell

13%, of which 6% was due to lower costs associated with our mileage partnership

programs and 4% was due to reduced advertising and promotion spending.

Passenger commission expense declined 40%, primarily due to a change in our

commission rate structure. On March 14, 2002, we eliminated travel agent base

commissions for tickets sold in the U.S. and Canada. Passenger service expense

decreased 20%, primarily due to meal service reductions.

Asset writedowns, restructuring and related items, net totaled $439 million in

2002 compared to $1.1 billion in 2001. Our 2002 charge consists of $251 million

in asset writedowns, $127 million related to our 2002 workforce reduction

programs, $93 million for the temporary carrying cost of surplus pilots and

grounded aircraft, $30 million due to the deferred delivery of certain mainline

aircraft, $14 million for the closure of certain leased facilities and $3

million related to other items, partially offset by a $79 million reversal of

certain reserves. Our 2001 charge consists of $566 million related to our 2001

workforce reduction programs, $363 million from a decrease in value of certain

aircraft and other fleet-related charges, $160 million related primarily to

discontinued contracts, facilities and information technology projects and $30

million for the temporary carrying cost of surplus pilots and grounded aircraft.

See Note 16 of the Notes to the Consolidated Financial Statements for additional

information on these asset writedowns, restructuring and related items, net.

Stabilization Act compensation totaled $34 million in 2002 compared to $634

million in 2001, representing amounts we recognized as compensation in the

applicable period under the Air Transportation Safety and System Stabilization

Act (Stabilization Act). See Note 19 of the Notes to the Consolidated Financial

Statements for additional information.

16