Delta Airlines 2002 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2000

Cash, cash equivalents and short-term investments totaled $1.6 billion at

December 31, 2000. Net cash provided by operations totaled $2.9 billion during

2000. Capital expenditures were $4.1 billion during 2000 and included the

acquisition of 24 B-737-800, 12 B-757-200, seven B-767-300ER, 12 B-767-400, 11

CRJ-200, 19 CRJ-100 and seven ATR-72 aircraft. We also paid $232 million to

complete our acquisition of Comair Holdings, Inc. Debt and capital lease

obligations, including current maturities and short-term obligations, totaled

$6.0 billion at December 31, 2000. Of this amount, $1.9 billion of long-term

debt was issued during the year (including $1.5 billion of secured debt).

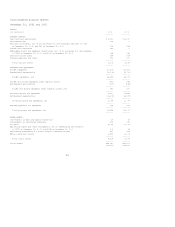

Financial Position

DECEMBER 31, 2002 COMPARED TO DECEMBER 31, 2001

This section discusses certain changes in our Consolidated Balance Sheets which

are not otherwise discussed in this Annual Report.

Prepaid expenses and other current assets increased by 23%, or $66 million,

primarily due to our recognition of an intangible asset in connection with the

recording of an additional minimum pension liability and an increase in prepaid

aircraft rent. Investments in debt and equity securities decreased 66%, or $63

million, primarily due to the partial exercise of our price-line warrants and

the sale of a portion of the related shares, as well as a decrease in fair value

of our equity securities. Restricted investments for the Boston airport terminal

project decreased 12%, or $58 million, due to the capitalization of project

expenditures and interest paid. Other noncurrent assets increased 47%, or $472

million, due to an increase in our deferred tax assets and our recognition of an

intangible asset in connection with the recording of an additional minimum

pension liability.

Taxes payable decreased 18%, or $187 million, primarily due to a decrease in

ticket, transportation and airport taxes payable for which payment was deferred

under the Stabilization Act until January 2002. Accrued salaries and benefits

increased 22%, or $244 million, primarily due to an increase in the number of

retired employees and employees on leave and severance programs.

Pension and related benefits increased $2.9 billion, primarily due to an

additional minimum pension liability recorded at December 31, 2002. For

additional information on our employee benefit plans, see Note 11 of the Notes

to the Consolidated Financial Statements.

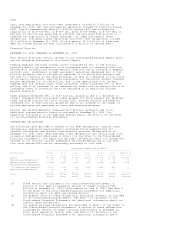

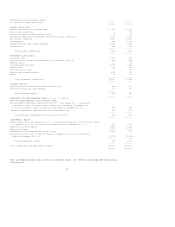

CONTRACTUAL OBLIGATIONS

The following table provides a summary of our debt obligations, capital lease

obligations, operating lease payments, estimated future expenditures for

aircraft and engines and certain other material purchase obligations as of

December 31, 2002. This table excludes other obligations that we may have, such

as pension obligations (discussed in Note 11 of the Notes to the Consolidated

Financial Statements). The table also excludes information about our obligations

related to our contract carrier agreements (discussed below) due to the fact

that costs beyond 2003 are not reasonably estimable at this time.

Contractual Payments Due by Period

----------------------------------------------------------------------------------

(in millions) Total 2003 2004 2005 2006 2007 After 2007

------- ------ ------ ------ ------ ------ ----------

Debt(1) $10,740 $ 666 $ 623 $1,203 $ 602 $ 285 $ 7,361

Capital Lease Obligations(2) 172 40 31 24 16 15 46

Operating Lease Payments(3) 12,744 1,277 1,203 1,176 1,128 1,042 6,918

Estimated Future Expenditures

for Aircraft and Engines(4) 5,027 1,024 672 1,191 1,281 859 --

Other Purchase Obligations 66 33 33 -- -- -- --

------- ------ ------ ------ ------ ------ ---------

Total $28,749 $3,040 $2,562 $3,594 $3,027 $2,201 $14,325

======= ====== ====== ====== ====== ====== =========

(1) These amounts are included on our Consolidated Balance Sheets. A

portion of this debt is backed by letters of credit totaling $305

million at December 31, 2002, which expire on June 8, 2003. See Note 6

of the Notes to the Consolidated Financial Statements for additional

information about our debt and related matters.

(2) The present value of these obligations, excluding interest, is included

on our Consolidated Balance Sheets. See Note 7 of the Notes to the

Consolidated Financial Statements for additional information about our

capital lease obligations.

(3) Our operating lease obligations are described in Note 7 of the Notes to

the Consolidated Financial Statements. A portion of these obligations

is backed by letters of credit totaling $104 million at December 31,

2002, which expire on June 8, 2003. See Note 6 of the Notes to the

Consolidated Financial Statements for additional information about