Delta Airlines 2002 Annual Report Download - page 135

Download and view the complete annual report

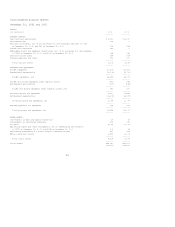

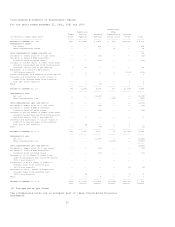

Please find page 135 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consolidated Statements of Shareowners' Equity

For the years ended December 31, 2002, 2001 and 2000

Accumulated

Additional Other

Common Paid-in Retained Comprehensive Treasury

(in millions, except share data) Stock Capital Earnings Income (Loss) Stock Total

------------------------------- ------ ---------- -------- ------------- -------- -------

BALANCE AT DECEMBER 31, 1999 $270 $ 3,222 $ 3,377 $ 266 $(2,227) $ 4,908

COMPREHENSIVE INCOME:

Net income -- -- 828 -- -- 828

Other comprehensive income -- -- -- 94 -- 94

-------

TOTAL COMPREHENSIVE INCOME (SEE NOTE 14) 922

Dividends on common stock ($0.10) per share) -- -- (12) -- -- (12)

Dividends on Series B ESOP Convertible

Preferred Stock allocated shares -- -- (13) -- -- (13)

Issuance of 729,426 shares of common stock under

dividend reinvestment and stock purchase plan

and stock options ($44.86 per share(1)) 1 32 -- -- -- 33

Repurchase of 10,626,104 common shares

($47.26 per share(1)) -- -- -- -- (502) (502)

Income tax benefit from exercise of stock options -- 5 -- -- -- 5

Transfers and forfeitures of 16,580 shares of

common from Treasury under stock incentive

plan ($52.61 per share(1)) -- -- -- -- 1 1

Other -- 5 (4) -- -- 1

---- ------- ------- ------- ------- -------

BALANCE AT DECEMBER 31, 2000 271 3,264 4,176 360 (2,728) 5,343

---- ------- ------- ------- ------- -------

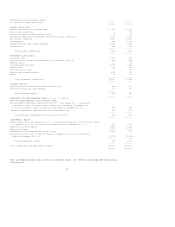

COMPREHENSIVE LOSS:

Net loss -- -- (1,216) -- -- (1,216)

Other comprehensive loss -- -- -- (335) -- (335)

-------

TOTAL COMPREHENSIVE LOSS (SEE NOTE 14) -- -- -- -- -- (1,551)

Dividends on common stock ($0.10 per share) -- -- (12) -- -- (12)

Dividends on Series B ESOP Convertible

Preferred Stock allocated shares -- -- (14) -- -- (14)

Issuance of 126,299 shares of common stock under

dividend reinvestment and stock purchase plan

and stock options ($38.10 per share(1)) -- 5 -- -- -- 5

Transfers and forfeitures of 105,995 shares of

common from Treasury under stock incentive

plan ($37.10 per share(1)) -- (4) -- -- 4 --

Other -- 2 (4) -- -- (2)

---- ------- ------- ------- ------- -------

BALANCE AT DECEMBER 31, 2001 271 3,267 2,930 25 (2,724) 3,769

---- ------- ------- ------- ------- -------

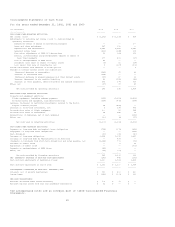

COMPREHENSIVE LOSS:

Net loss -- -- (1,272) -- -- (1,272)

Other comprehensive loss -- -- -- (1,587) -- (1,587)

-------

TOTAL COMPREHENSIVE LOSS (SEE NOTE 14) (2,859)

Dividends on common stock ($0.10 per share) -- -- (12) -- -- (12)

Dividends on Series B ESOP Convertible

Preferred Stock allocated shares -- -- (15) -- -- (15)

Issuance of 13,017 shares of common stock

under stock purchase plan and stock options

($15.70 per share(1)) -- -- -- -- -- --

Forfeitures of 82,878 shares of common to

Treasury under stock incentive plan

($27.31 per share(1)) -- -- -- -- (2) (2)

Transfers of 183,400 shares of common from

Treasury under stock incentive plan

($47.11 per share(1)) -- (5) -- -- 8 3

Other -- 1 8 -- -- 9

---- ------- ------- ------- ------- -------

BALANCE AT DECEMBER 31, 2002 $271 $ 3,263 $ 1,639 $(1,562) $(2,718) $ 893

==== ======= ======= ======= ======= =======

(1) Average price per share

The accompanying notes are an integral part of these Consolidated Financial

Statements.

30