Delta Airlines 2002 Annual Report Download - page 127

Download and view the complete annual report

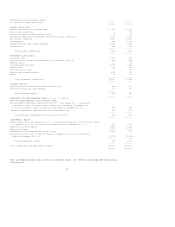

Please find page 127 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.INCOME TAX VALUATION ALLOWANCE

In accordance with SFAS No. 109, "Accounting for Income Taxes" (SFAS 109),

deferred tax assets should be reduced by a valuation allowance if it is more

likely than not that some portion or all of the deferred tax assets will not be

realized. In making this determination, we consider both positive and negative

evidence and make certain assumptions, including projections of taxable income.

Changes in these assumptions may have a material impact on our Consolidated

Financial Statements.

PENSION PLANS

We sponsor defined benefit pension plans (Plans) for eligible employees and

retirees. The impact of the Plans on our Consolidated Financial Statements as of

December 31, 2002 and 2001 and for each of the three years in the period ended

December 31, 2002 is presented in Note 11 of the Notes to the Consolidated

Financial Statements. We currently estimate that our defined benefit pension

expense in 2003 will be approximately $335 million. The effect of our Plans on

our Consolidated Financial Statements is subject to many assumptions. We believe

the most critical assumptions are (1) the weighted average discount rate; (2)

the rate of increase in future compensation levels; and (3) the expected

long-term rate of return on Plan assets.

We determine our weighted average discount rate on our measurement date

primarily by reference to annualized rates earned on high quality fixed income

investments and yield-to-maturity analysis specific to our estimated future

benefit payments. Lowering our discount rate (6.75% at September 30, 2002) by

0.5% would increase our accrued pension cost by approximately $730 million at

December 31, 2002 and increase our estimated pension expense in 2003 by

approximately $80 million.

Our rate of increase in future compensation levels is based primarily on labor

contracts currently in effect with our employees under collective bargaining

agreements and expected future pay rate increases for other employees.

Increasing our estimated rate of increase in future compensation levels (2.67%

at September 30, 2002) by 0.5% would increase our estimated pension expense in

2003 by approximately $40 million.

The expected long-term rate of return on our Plan assets is based primarily on

Plan-specific asset/liability investment studies performed by outside

consultants and recent and historical returns on our Plans' assets. Lowering our

expected long-term rate of return (9% at September 30, 2002) by 0.5% would

increase our estimated pension expense in 2003 by approximately $60 million.

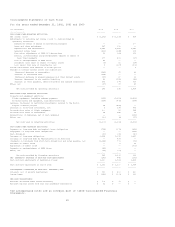

MARKET RISKS ASSOCIATED WITH FINANCIAL INSTRUMENTS

We have market risk exposure related to aircraft fuel prices, stock prices,

interest rates and foreign currency exchange rates. Market risk is the potential

negative impact of adverse changes in these prices or rates on our Consolidated

Financial Statements. To manage the volatility relating to these exposures, we

periodically enter into derivative transactions pursuant to stated policies (see

Notes 3 and 4 of the Notes to the Consolidated Financial Statements). Management

expects adjustments to the fair value of financial instruments accounted for

under SFAS 133 to result in ongoing volatility in earnings and shareowners'

equity.

The following sensitivity analyses do not consider the effects of a decline in

demand for air travel, the economy as a whole or additional actions by

management to mitigate our exposure to a particular risk. For these and other

reasons, the actual results of changes in these prices or rates may differ

materially from the following hypothetical results.

AIRCRAFT FUEL PRICE RISK

Our results of operations may be significantly impacted by changes in the price

of aircraft fuel. To manage this risk, we periodically enter into heating and

crude oil derivative contracts to hedge a portion of our projected annual

aircraft fuel requirements. Heating and crude oil prices have a highly

correlated relationship to fuel prices, making these derivatives effective in

offsetting changes in the cost of aircraft fuel. We do not enter into fuel hedge

contracts for speculative purposes. These contracts are intended to reduce our

exposure to changes in aircraft fuel prices.

The following table shows our fuel hedging position based on instruments held at

December 31, 2002, as supplemented by fuel hedge contracts acquired through

March 12, 2003:

% of Projected

Aircraft Fuel

Requirements Average Hedge

Hedged Price per Gallon

-------------- ----------------

March 2003 Quarter 77% 79.10(cents)