Delta Airlines 2002 Annual Report Download - page 159

Download and view the complete annual report

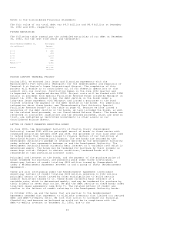

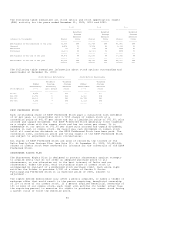

Please find page 159 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.obligation, which totaled $333 million at December 31, 2002. The remaining

portion of the additional minimum pension liability totaling $1.6 billion, net

of tax, was recorded in accumulated other comprehensive income (loss) on our

Consolidated Balance Sheets (see Note 14).

The ABO and the fair value of plan assets for the plans with an ABO in excess of

plan assets were $10.1 billion and $6.8 billion, respectively, as of September

30, 2002, and $303 million and zero, respectively, as of September 30, 2001.

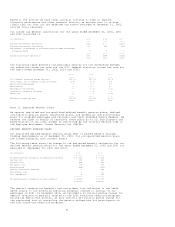

DEFINED CONTRIBUTION PENSION PLANS

DELTA PILOTS MONEY PURCHASE PENSION PLAN (MPPP)

We contribute 5% of covered pay to the MPPP for each eligible Delta pilot. The

MPPP is related to the Delta Pilots Retirement Plan. The defined benefit pension

payable to a pilot is reduced by the actuarial equivalent of the accumulated

account balance in the MPPP. During the years ended December 31, 2002, 2001 and

2000, we recognized expense of $71 million, $69 million and $63 million,

respectively, for this plan.

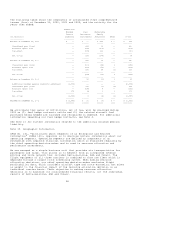

DELTA FAMILY-CARE SAVINGS PLAN

Our Savings Plan includes an employee stock ownership plan (ESOP) feature.

Eligible employees may contribute a portion of their covered pay to the Savings

Plan.

Prior to July 1, 2001, we matched 50% of employee contributions with a maximum

employer contribution of 2% of a participant's covered pay for all participants.

Effective July 1, 2001, the Savings Plan was amended to provide all eligible

Delta pilots with an employer contribution of 3% of their covered pay to replace

their former matching contribution. We make our contributions for non-pilots and

pilots by allocating Series B ESOP Convertible Preferred Stock (ESOP Preferred

Stock), common stock or cash to the Savings Plan. Our contributions, which are

recorded as salaries and related costs in the accompanying Consolidated

Statements of Operations, totaled $85 million, $83 million and $69 million for

the years ended December 31, 2002, 2001 and 2000, respectively.

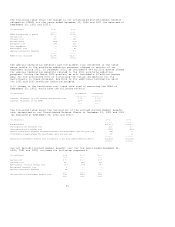

When we adopted the ESOP in 1989, we sold 6,944,450 shares of ESOP Preferred

Stock to the Savings Plan for $500 million. We have recorded unearned

compensation equal to the value of the shares of preferred stock not yet

allocated to participants' accounts. We reduce the unearned compensation as

shares of preferred stock are allocated to participants' accounts. Dividends on

unallocated shares of preferred stock are used for debt service on the Savings

Plan's ESOP Notes and are not considered dividends for financial reporting

purposes. Dividends on allocated shares of preferred stock are credited to

participants' accounts and are considered dividends for financial reporting

purposes. Only allocated shares of preferred stock are considered outstanding

when we compute diluted earnings per share. At December 31, 2002, 3,666,639

shares of ESOP Preferred Stock were allocated to participants' accounts and

2,398,850 shares were held by the ESOP for future allocations.

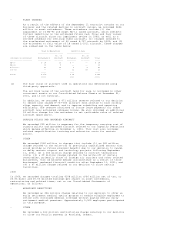

OTHER PLANS

ASA, Comair and DAL Global Services, Inc., three of our wholly owned

subsidiaries, sponsor defined contribution retirement plans for eligible

employees. These plans did not have a material impact on our Consolidated

Financial Statements in 2002, 2001 and 2000.

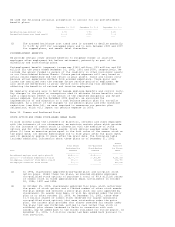

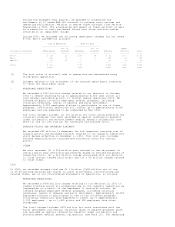

POSTRETIREMENT BENEFITS OTHER THAN PENSIONS

Our medical plans provide medical and dental benefits to substantially all Delta

retirees and their eligible dependents. Benefits are funded from our general

assets on a current basis. Plan benefits are subject to copayments, deductibles

and other limits as described in the plans.

53