Delta Airlines 2002 Annual Report Download - page 112

Download and view the complete annual report

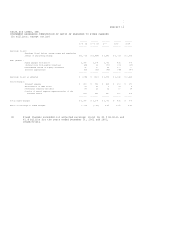

Please find page 112 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have approximately $700 million of current debt maturities and capital lease

obligations due in 2003, including $301 million under a Reimbursement Agreement

and related letters of credit that terminate on June 8, 2003 (see Note 6 of the

Notes to the Consolidated Financial Statements). We will also be required to pay

(1) $102 million related to additional letters of credit under the Reimbursement

Agreement mentioned above and (2) $250 million under a receivables

securitization agreement when it expires on March 31, 2003 (see Note 8 of the

Notes to the Consolidated Financial Statements). We are seeking to renew or

refinance the receivables and letter of credit facilities, but there is no

assurance we will be able to do so. In addition, our estimated pension funding

is approximately $80 million for 2003.

We expect to meet our obligations as they come due through available cash and

cash equivalents, investments, internally generated funds and borrowings under

existing and new financing transactions. We do not expect new financing

transactions to be available on an unsecured basis. While we expect secured

financing to be available to us on commercially reasonable terms, in the current

business environment access to financing cannot be assured. Failure to obtain

new financing could have a material adverse effect on our liquidity.

2003 RESULTS

Based on the difficult business environment discussed above, we anticipate our

net loss for the March 2003 quarter to be greater than our March 2002 quarter

net loss. We also expect to report a net loss for 2003. In addition, the

following significant external risks exist, which could adversely impact our

results of operations, our financial condition and our ability to access capital

markets for additional financing:

- The possibility of a war with Iraq and other geopolitical risks, which

could have a material adverse impact on our results of operations and

cash flows.

- Two major competitors, United and US Airways, are currently operating

under bankruptcy protection. Historically, air carriers involved in

reorganizations have undertaken substantial fare discounts in order to

maintain cash flows and to enhance customer loyalty. Such fare

discounting has lowered, and may continue to lower, yields for all

airlines. Moreover, carriers operating in bankruptcy, or that

successfully emerge from bankruptcy, may be able to achieve reduced

costs which could place us at a competitive disadvantage.

- The possibility that other carriers may file for bankruptcy protection.

2002 Compared to 2001

NET INCOME (LOSS) AND EARNINGS (LOSS) PER SHARE (EPS)

We recorded a consolidated net loss of $1.3 billion ($10.44 diluted EPS) in

2002, compared to a consolidated net loss of $1.2 billion ($9.99 diluted EPS) in

2001.

OPERATING REVENUES

Operating revenues were $13.3 billion in 2002, decreasing 4% from $13.9 billion

in 2001. Passenger revenues fell 5% to $12.3 billion. RPMs were flat on a

capacity decline of 4%, while passenger mile yield decreased 5% to 12.08(cents).

The decreases in operating revenues, passenger revenues and passenger mile yield

from depressed 2001 levels reflect the continuing effects of the September 11

terrorist attacks on our business and other factors negatively impacting the

revenue environment, which are discussed in the Business Environment section of

Management's Discussion and Analysis on pages 13-15.

NORTH AMERICAN PASSENGER REVENUES

North American passenger revenues fell 6% to $10.0 billion. RPMs increased 1% on

a capacity decrease of 3%, while passenger mile yield decreased 7%. The decline

in passenger mile yield reflects the challenging revenue environment, including

significant fare discounting as well as a substantial reduction in high-yield

business traffic after the September 11 terrorist attacks.

INTERNATIONAL PASSENGER REVENUES

International passenger revenues decreased 2% to $2.3 billion. RPMs fell 2% on a

capacity decline of 7%, while passenger mile yield increased 1%. The decline in

our international capacity was primarily driven by reductions in our Pacific

operations due to weak demand.

CARGO AND OTHER REVENUES

Cargo revenues decreased 9% to $458 million. This reflects a 7% decline due to

FAA security measures adopted after September 11, 2001, that prohibit passenger

airlines from transporting mail weighing more than 16 ounces, which previously