Delta Airlines 2002 Annual Report Download - page 142

Download and view the complete annual report

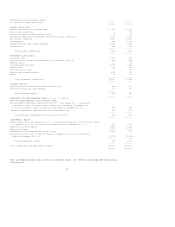

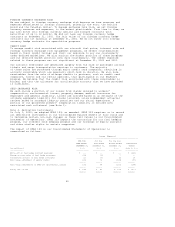

Please find page 142 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FAIR VALUE OF FINANCIAL INSTRUMENTS

We record our cash equivalents and short-term investments at cost, which we

believe approximates their fair values. The estimated fair values of other

financial instruments, including debt and derivative instruments, have been

determined using available market information and valuation methodologies,

primarily discounted cash flow analyses and the Black-Scholes model.

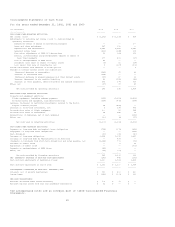

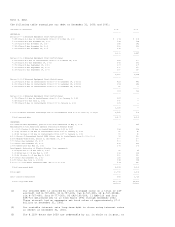

Note 2. Marketable and Other Equity Securities

PRICELINE.COM INCORPORATED (PRICELINE)

We are party to an agreement with priceline under which we (1) provide ticket

inventory that may be sold through priceline's Internet-based e-commerce system

and (2) received certain equity interests in priceline. We are required to

provide priceline access to unpublished fares.

2000

At January 1, 2000, our equity interests in priceline included (1) a warrant to

purchase up to 5.5 million shares of priceline common stock for $56.63 per share

(1999 Warrant) (see discussion below); (2) a right to exchange six million

shares of priceline common stock for six million shares of priceline convertible

preferred stock (Exchange Right); and (3) 7.2 million shares of priceline common

stock. During 2000, we (1) exercised the Exchange Right in full, receiving six

million shares of priceline Series A Convertible Preferred Stock (Series A

Preferred Stock); (2) sold 1.2 million shares of priceline common stock; and (3)

received 549,764 shares of priceline common stock as a dividend on the Series A

Preferred Stock. In our 2000 Consolidated Statement of Operations, we recognized

(1) a pretax gain of $301 million from the exercise of the Exchange Right and

the sale of priceline common stock and (2) other income of $14 million, pretax,

from the dividend.

The fair value of the 1999 Warrant on the date received was determined to be $61

million based on an independent third-party appraisal. This amount was

recognized in income ratably from November 1999 through November 2002.

On November 2, 2000, the 1999 Warrant was amended to reduce (1) the number of

shares underlying the warrant from 5.5 million to 4.7 million and (2) our per

share purchase price for those shares from $56.63 to $4.72 (Amended 1999

Warrant). The Amended 1999 Warrant became exercisable in full on January 1,

2001, and expires on November 17, 2004. The amendment of the 1999 Warrant did

not have a material impact on our Consolidated Financial Statements.

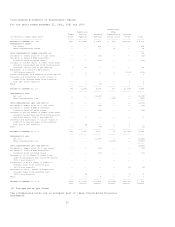

2001

On February 6, 2001, we and priceline agreed to restructure our investment in

priceline. We exchanged our six million shares of Series A Preferred Stock for

(1) 80,000 shares of priceline Series B Redeemable Preferred Stock (Series B

Preferred Stock) and (2) a warrant to purchase up to 26.9 million shares of

priceline common stock for $2.97 per share (2001 Warrant).

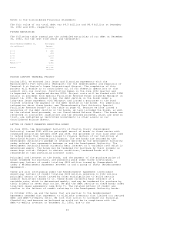

The Series B Preferred Stock (1) bears an annual per share dividend of

approximately 36 shares of priceline common stock; (2) has a liquidation

preference of $1,000 per share plus any dividends accrued or accumulated but not

yet paid (Liquidation Preference); (3) is subject to mandatory redemption on

February 6, 2007, at a price per share equal to the Liquidation Preference; and

(4) is subject to redemption in whole, at the option of us or priceline, if

priceline completes any of certain business combination transactions (Optional

Redemption).

Based on an independent third-party appraisal, at February 6, 2001, the fair

value of (1) the Series B Preferred Stock was estimated to be $80 million and

(2) the 2001 Warrant was estimated to be $46 million. The total fair value of

these securities equaled the carrying amount of the Series A Preferred Stock,

including its conversion feature and accumulated dividends on the date the

Series A Preferred Stock was exchanged for the Series B Preferred Stock and the

2001 Warrant. Accordingly, we did not recognize a gain or loss on this

transaction.

37