Delta Airlines 2002 Annual Report Download - page 145

Download and view the complete annual report

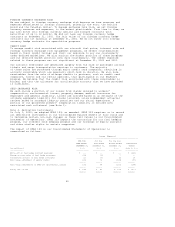

Please find page 145 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FOREIGN CURRENCY EXCHANGE RISK

We are subject to foreign currency exchange risk because we have revenues and

expenses denominated in foreign currencies, primarily the euro, the British

pound and the Canadian dollar. To manage exchange rate risk, we net foreign

currency revenues and expenses, to the extent practicable. From time to time, we

may also enter into foreign currency options and forward contracts with

maturities of up to 12 months. We did not have any foreign currency hedge

contracts at December 31, 2002. The fair value of our foreign currency hedge

contracts was not material at December 31, 2001. We do not enter into foreign

currency hedge contracts for speculative purposes.

CREDIT RISK

To manage credit risk associated with our aircraft fuel price, interest rate and

foreign currency exchange risk management programs, we select counterparties

based on their credit ratings and limit our exposure to any one counterparty

under defined guidelines. We also monitor the market position of these programs

and our relative market position with each counterparty. The credit exposure

related to these programs was not significant at December 31, 2002 and 2001.

Our accounts receivable are generated largely from the sale of passenger airline

tickets and cargo transportation services to customers. The majority

of these sales are processed through major credit card companies, resulting in

accounts receivable which are generally short-term in duration. We also have

receivables from the sale of mileage credits to partners, such as credit card

companies, hotels and car rental agencies, that participate in our SkyMiles

program. We believe that the credit risk associated with these receivables is

minimal and that the allowance for uncollectible accounts that we have provided

is sufficient.

SELF-INSURANCE RISK

We self-insure a portion of our losses from claims related to workers'

compensation, environmental issues, property damage, medical insurance for

employees and general liability. Losses are accrued based on an estimate of the

ultimate aggregate liability for claims incurred, using independent actuarial

reviews based on standard industry practices and our actual experience. A

portion of our projected workers' compensation liability is secured with

restricted cash collateral (see Note 1).

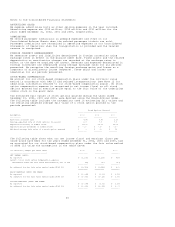

Note 4. Derivative Instruments

On July 1, 2000, we adopted SFAS 133, as amended. SFAS 133 requires us to record

all derivative instruments on our Consolidated Balance Sheets at fair value and

to recognize certain non-cash changes in these fair values in our Consolidated

Statements of Operations. SFAS 133 impacts the accounting for our fuel hedging

program, our interest rate hedging program and our holdings of equity warrants

and other similar rights in certain companies.

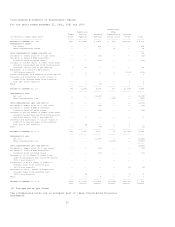

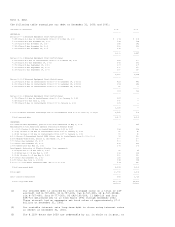

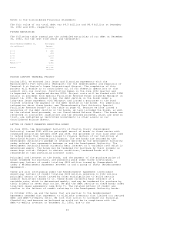

The impact of SFAS 133 on our Consolidated Statements of Operations is

summarized as follows:

Income (Expense)

------------------------------------------------------------

FOR THE For the For the Six

YEAR ENDED Year Ended Months Ended Cumulative

DECEMBER 31, December 31, December 31, Effect

(in millions) 2002 2001 2000 July 1, 2000

------------- ------------ ------------ ------------ ------------

Write-off of fuel hedge contract premiums $ -- $ -- $ -- $ (143)

Change in time value of fuel hedge contracts (23) (1) 7 --

Ineffective portion of fuel hedge contracts 13 (3) (2) 16

Fair value adjustment of equity rights (29) 72 (164) (37)

------ ------ ------- -------

Fair value adjustments of SFAS 133 derivatives, pretax (39) 68 (159) (164)

------ ------ ------- -------

Total, net of tax $ (25) $ 41 S (97) $ (100)

====== ====== ======= =======

40