Delta Airlines 2002 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

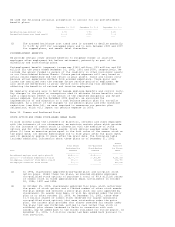

We believe that our insurance coverage would cover most, but not all, of such

liabilities and related indemnities associated with the types of lease and

financing agreements described above, including real estate leases.

Certain of our aircraft and other financing transactions also often include

provisions which require us to make payments to the lenders to preserve an

expected economic return to the lenders if that economic return is diminished

due to certain changes in law or regulations. In certain of these financing

transactions, we also bear the risk of certain changes in tax laws that would

subject payments to non-U.S. lenders to withholding taxes.

We cannot reasonably estimate our potential future payments under the

indemnities and related provisions described above.

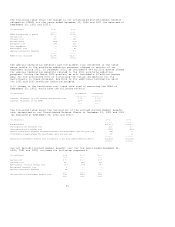

EMPLOYEES UNDER COLLECTIVE BARGAINING AGREEMENTS

At December 31, 2002, Delta, ASA and Comair had a total of approximately 75,100

full-time equivalent employees. Approximately 18% of these employees, including

all of our pilots, are represented by labor unions. Approximately 3% of our

total full-time equivalent employees are covered under collective bargaining

agreements that are either in negotiations or will become amendable by December

31, 2003. ASA is currently in collective bargaining negotiations with the Air

Line Pilots Association, International, which represents ASA's approximately

1,520 pilots. This contract became amendable in September 2002. The outcome of

these collective bargaining negotiations cannot presently be determined. In

addition, ASA's contract with the Association of Flight Attendants, which

represents ASA's approximately 775 flight attendants, becomes amendable in

September 2003.

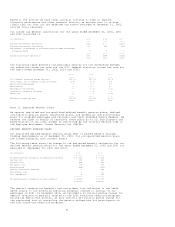

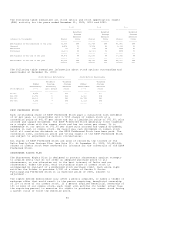

Note 10. Income Taxes

Deferred income taxes reflect the net tax effect of temporary differences

between the carrying amounts of assets and liabilities for financial reporting

purposes and income tax purposes. See Note 1 for information about our

accounting policy for income taxes. At December 31, 2002, we had $349 million of

federal alternative minimum tax (AMT) credit carryforward, which does not

expire. We also had federal and state pretax net operating loss carryforwards of

approximately $3.3 billion at December 31, 2002, substantially all of which will

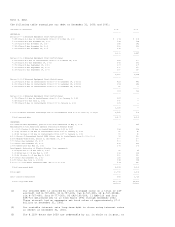

not expire until 2022. The following table shows significant components of our

deferred tax assets and liabilities at December 31, 2002 and 2001:

(in millions) 2002 2001

------- -------

DEFERRED TAX ASSETS:

Net operating loss carryforwards $ 1,256 $ 911

Additional minimum pension liability (see Note 14) 972 --

Postretirement benefits 909 1,025

Other employee benefits 404 254

AMT credit carryforward 349 23

Gains on sale and leaseback transactions, net 217 239

Rent expense 215 220

Other 508 455

Valuation allowance (16) (16)

------- -------

Total deferred tax assets $ 4,814 $ 3,111

======= =======

DEFERRED TAX LIABILITIES:

Depreciation and amortization $ 3,639 $ 2,696

Other 332 362

------- -------

Total deferred tax liabilities $ 3,971 $ 3,058

======= =======

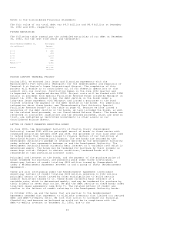

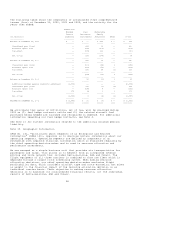

The following table shows the current and noncurrent deferred tax assets

(liabilities) recorded on our Consolidated Balance Sheets at December 31, 2002

and 2001:

(in millions) 2002 2001

---- -----

Current deferred tax assets, net $668 $ 518

Noncurrent deferred tax assets (liabilities), net 175 (465)

---- -----

Total deferred tax assets, net $843 $ 53

==== =====

50