Delta Airlines 2002 Annual Report Download - page 121

Download and view the complete annual report

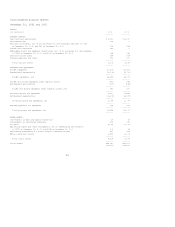

Please find page 121 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management's Discussion and Analysis of Financial Condition and Results of

Operations

- five B-737-800 aircraft deferred from 2003 to 2006;

- 23 B-737-800 aircraft deferred from 2004 to 2007;

- one B-777-200 aircraft deferred from 2004 to 2006; and

- two B-777-200 aircraft deferred from 2005 to 2006.

As a result of these deferrals, we have no mainline aircraft deliveries

scheduled in 2003 or 2004, which will reduce capital expenditures by

approximately $1.3 billion during that two-year period.

Shareowners' equity was $893 million at December 31, 2002 and $3.8 billion at

December 31, 2001. The decrease in our shareowners' equity is primarily due to

the $1.6 billion non-cash charge to equity related to our pension plans (see

Note 11 of the Notes to the Consolidated Financial Statements) and our

consolidated net loss in 2002. These items, as well as an increase in

outstanding debt, have caused our net debt-to-capital ratio, which includes

implied debt from operating leases, to increase to 94% at December 31, 2002 from

80% at December 31, 2001.

For additional information on our liquidity, see the Business Environment

section of Management's Discussion and Analysis on pages 13-15.

WORKING CAPITAL POSITION

As of December 31, 2002, we had negative working capital of $2.6 billion,

compared to negative working capital of $2.8 billion at December 31, 2001.

A negative working capital position is normal for us, typically due to our air

traffic liability and the fact that we primarily generate revenue by providing

air transportation through the utilization of property and equipment, which are

classified as long-term assets. Our negative working capital position also

reflects our losses over the past two years.

CREDIT RATINGS AND COVENANTS

At December 31, 2002, our senior unsecured long-term debt was rated Ba3 by

Moody's and BB- by Standard and Poor's. On February 18, 2003, Standard & Poor's

lowered their ratings on certain of our enhanced equipment trust certificates.

Both Moody's and Standard & Poor's outlooks for our long-term credit ratings are

negative. Our current credit ratings have negatively impacted our ability (1) to

issue unsecured debt, (2) to renew outstanding letters of credit that back

certain of our obligations and (3) to obtain certain financial instruments that

we use in our fuel hedging program. They have also increased the cost of our

financing transactions and the amount of collateral required for certain

financial instruments and insurance coverage. Subsequent to December 31, 2002,

our collateral requirements related to our workers' compensation insurance

increased by $55 million. As discussed in Note 8 of the Notes to the

Consolidated Financial Statements, we may be required to repurchase outstanding

receivables that we sold to a third party ($250 million at December 31, 2002) if

our senior unsecured long-term debt is rated either below Ba3 by Moody's or

below BB- by Standard & Poor's.

We have obtained from a third party unsecured letters of credit totaling $409

million relating to bonds issued by various municipalities to finance

construction at certain airport facilities leased to us. As discussed under

"Letter of Credit Enhanced Municipal Bonds" in Note 6 of the Notes to the

Consolidated Financial Statements, we will be required to accelerate the

repayment of these obligations if we do not extend those letters of credit prior

to their expiration on June 8, 2003.

The Reimbursement Agreement relating to the letters of credit described in the

above paragraph contains covenants that (1) require us to maintain a minimum of

$1 billion of unrestricted cash, cash equivalents and short-term investments at

the end of each month; (2) limit the amount of current debt and convertible

subordinated debt that we may have outstanding; and (3) limit our annual flight

equipment rental expense. It also provides that, upon the occurrence of a change

in control of Delta, we shall, at the request of the banks, deposit cash

collateral with the banks in an amount equal to all letters of credit

outstanding and other amounts we owe under the agreement. We are in compliance

with all of our financial covenants.

PRIOR YEARS

2001

Cash and cash equivalents totaled $2.2 billion at December 31, 2001. Net cash

provided by operations totaled $236 million during 2001, including $556 million

of compensation received under the Stabilization Act. Capital expenditures,

including aircraft acquisitions made under seller financing arrangements, were