Delta Airlines 2002 Annual Report Download - page 161

Download and view the complete annual report

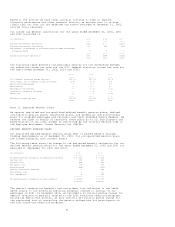

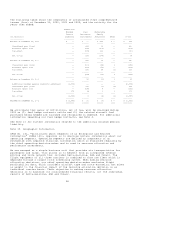

Please find page 161 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We used the following actuarial assumptions to account for our postretirement

benefit plans:

September 30, 2002 September 30, 2001 September 30, 2000

------------------ ------------------ ------------------

Weighted average discount rate 6.75% 7.75% 8.25%

Assumed healthcare cost trend rate(1) 10.00% 6.25% 7.00%

----- ---- ----

(1) The assumed healthcare cost trend rate is assumed to decline gradually

to 5.25% by 2007 for noncapped plans and to zero between 2005 and 2007

for capped plans, and remain level thereafter.

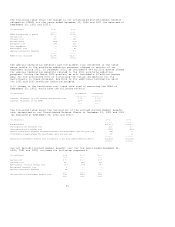

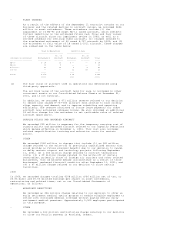

POSTEMPLOYMENT BENEFITS

We provide certain other welfare benefits to eligible former or inactive

employees after employment but before retirement, primarily as part of the

disability and survivorship plans.

Postemployment benefit (expense) income was $(62) million, $23 million and $51

million for the years ended December 31, 2002, 2001 and 2000, respectively. We

include the amount funded in excess of the liability in other noncurrent assets

on our Consolidated Balance Sheets. Future period expenses will vary based on

actual claims experience and the return on plan assets. Gains and losses occur

because actual experience differs from assumed experience. These gains and

losses are amortized over the average future service period of employees. We

also amortize differences in prior service costs resulting from amendments

affecting the benefits of retired and inactive employees.

We regularly evaluate ways to better manage employee benefits and control costs.

Any changes to the plans or assumptions used to estimate future benefits could

have a significant effect on the amount of the reported obligation and future

annual expense. During the December 2002 quarter, we announced the

implementation of and migration to a cash balance pension plan for non-pilot

employees. As a result of the changes to our pension plans and 2002 workforce

reductions (see Note 16), we were required to remeasure our pension plan

obligations, which will impact our pension expense in 2003.

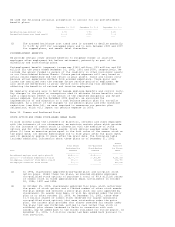

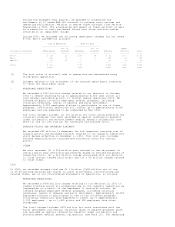

Note 12. Common and Preferred Stock

STOCK OPTION AND OTHER STOCK-BASED AWARD PLANS

To more closely align the interests of directors, officers and other employees

with the interests of our shareowners, we maintain certain plans which provide

for the issuance of common stock in connection with the exercise of stock

options and for other stock-based awards. Stock options awarded under these

plans (1) have an exercise price equal to the fair value of the common stock on

the grant date; (2) become exercisable one to five years after the grant date;

and (3) generally expire 10 years after the grant date. The following table

includes additional information about these plans as of December 31, 2002:

Shares

Total Shares Non-Qualified Reserved

Authorized for Stock Options for Future

Plan Issuance Granted Grant

-------------- ------------- ----------

Broad-based employee stock option plans(1) 49,400,000 49,400,000 --

Delta 2000 Performance Compensation Plan(2) 16,000,000 10,802,850 4,963,183

Non-Employee Directors' Stock Option Plan(3) 250,000 119,245 132,755

Non-Employee Directors' Stock Plan(4) 500,000 -- 457,272

---------- ---------- ---------

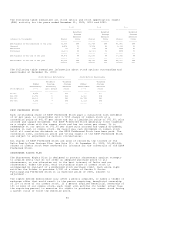

(1) In 1996, shareowners approved broad-based pilot and non-pilot stock

option plans. Under these two plans, we granted eligible employees

non-qualified stock options to purchase a total of 49.4 million shares

of common stock in three approximately equal installments on October

30, 1996, 1997 and 1998.

(2) On October 25, 2000, shareowners approved this plan, which authorizes

the grant of stock options and a limited number of other stock awards.

The plan amends and restates a prior plan which was also approved by

shareowners. No awards have been, or will be, granted under the prior

plan on or after October 25, 2000. At December 31, 2002, there were

11.0 million shares of common stock reserved for awards (primarily

non-qualified stock options) that were outstanding under the prior

plan. The current plan provides that shares reserved for awards under

the plans that are forfeited, settled in cash rather than stock or

withheld, plus shares tendered to Delta in connection with such

awards, may be added back to the shares available for future grants. At

December 31, 2002, 1.5 million shares had been added back pursuant to

that provision.