Delta Airlines 2002 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Republic offers for sale in its initial public offering at a price per share

equal to the initial public offering price; and (4) the right to receive a

warrant to purchase up to an additional 60,000 shares of Republic common stock

for each additional aircraft Chautauqua operates for us above the 22 aircraft

under the original contract carrier agreement.

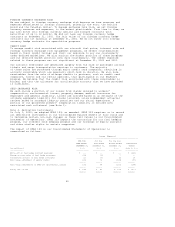

The 2002 Warrant is exercisable in whole or in part at any time until June 7,

2012. The fair value of the 2002 Warrant on the date received was approximately

$11 million, and will be recognized in income ratably over a five-year period.

The carrying value of the 2002 Warrant was approximately $10 million at December

31, 2002. The 2002 Warrant is accounted for in the same manner as the priceline

warrants described above.

The IPO Warrant is exercisable in whole or in part at any time (1) beginning on

the closing date of Republic's initial public offering of common stock and (2)

subject to earlier cancellation if the contract carrier agreement is terminated

in certain circumstances, ending on the tenth anniversary of that closing date.

We will record the fair value of the IPO Warrant on the closing date of

Republic's initial public offering of common stock.

The 2002 Warrant, the IPO Warrant and the shares of Republic common stock

underlying these securities are not registered under the Securities Act of 1933;

however, we have certain demand and piggyback registration rights relating to

the underlying shares of Republic common stock.

OTHER

Our equity interest in SkyWest, Inc., the parent company of SkyWest Airlines,

was classified as an available-for-sale equity security under SFAS 115. During

2001, we sold our equity interest in SkyWest, Inc. for $125 million and recorded

a pretax gain of $111 million. We recorded this gain in our 2001 Consolidated

Statement of Operations in gain (loss) from sale of investments, net.

During 2001, we also sold our remaining equity interest in Equant, N.V.

(Equant), an international data services company, recognizing a pretax gain of

$11 million. We recorded this gain in our 2001 Consolidated Statement of

Operations in gain (loss) from sale of investments, net.

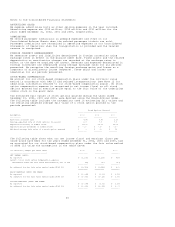

Note 3. Risk Management

AIRCRAFT FUEL PRICE RISK

Our results of operations can be significantly impacted by changes in the price

of aircraft fuel. To manage this risk, we periodically purchase options and

other similar non-leveraged derivative instruments and enter into forward

contracts for the purchase of fuel. These contracts may have maturities of up to

36 months. We may hedge up to 80% of our expected fuel requirements on a

12-month rolling basis. See Note 4 for additional information about our fuel

hedge contracts. We do not enter into fuel hedge contracts for speculative

purposes.

INTEREST RATE RISK

Our exposure to market risk due to changes in interest rates primarily relates

to our long-term debt obligations and cash portfolio. Market risk associated

with our long-term debt relates to the potential change in fair value resulting

from a change in interest rates as well as the potential increase in interest we

would pay on variable rate debt. At December 31, 2002 and 2001, approximately

26% and 25%, respectively, of our total debt was variable rate debt. Market risk

associated with our cash portfolio relates to the potential change in our

earnings resulting from a decrease in interest rates.

From time to time, we may enter into interest rate swap agreements, provided

that the notional amount of these transactions does not exceed 50% of our

long-term debt. See Note 4 for additional information about our interest rate

swap agreements. We do not enter into interest rate swap agreements for

speculative purposes.

39