Delta Airlines 2002 Annual Report Download - page 137

Download and view the complete annual report

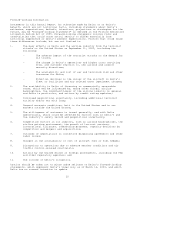

Please find page 137 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

and reporting standards, the liability for exit or disposal costs was recognized

at the date management committed to a plan. The adoption of SFAS 146 will impact

the timing of the recognition of liabilities related to future exit or disposal

activities and is effective for such activities that are initiated after

December 31, 2002.

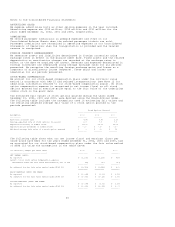

In December 2002, the FASB issued SFAS No. 148, "Accounting for Stock-Based

Compensation - Transition and Disclosure" (SFAS 148), which amends SFAS No. 123,

"Accounting for Stock Based Compensation" (SFAS 123), by revising the methods of

transition for a voluntary change to the fair value based method of accounting

for stock-based employee compensation. SFAS 148 also requires additional

disclosures in annual and interim financial statements related to stock-based

employee compensation. On December 31, 2002, we adopted SFAS 148 as it relates

to the additional disclosures required for registrants that account for employee

stock-based compensation under Accounting Principles Bulletin (APB) Opinion 25,

"Accounting for Stock Issued to Employees" (APB 25) and related interpretations.

For additional information, see our stock-based compensation policy in this Note

on page 36.

In November 2002, the FASB issued FASB Interpretation No. (FIN) 45, "Guarantor's

Accounting and Disclosure Requirements for Guarantees, Including Indirect

Guarantees of Indebtedness of Others" (FIN 45), which expands the disclosures a

guarantor is required to provide in its annual and interim financial statements

regarding its obligations for certain guarantees. Disclosures are required to be

included in financial statements issued after December 15, 2002 (see Note 9).

FIN 45 also requires the guarantor to recognize a liability for the fair value

of an obligation assumed for guarantees issued or modified after December 31,

2002.

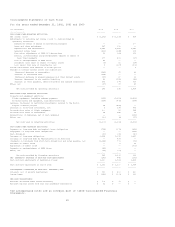

In January 2003, the FASB issued FIN 46, "Consolidation of Variable Interest

Entities" (FIN 46), which addresses how to identify variable interest entities

and the criteria that require a company to consolidate such entities in its

financial statements. FIN 46 is effective on February 1, 2003 for new

transactions and on July 1, 2003 for existing transactions. We are evaluating

the impact of FIN 46 on our Consolidated Financial Statements.

During 2000, we adopted SFAS No. 133, "Accounting for Derivative Instruments and

Hedging Activities" (SFAS 133), as amended (see Note 4 for additional

information), and SFAS No. 140, "Accounting for Transfers and Servicing of

Financial Assets and Extinguishments of Liabilities" (SFAS 140). The adoption of

SFAS 140 did not have a material impact on our Consolidated Financial

Statements.

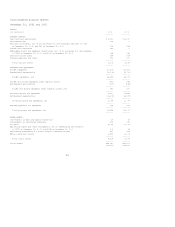

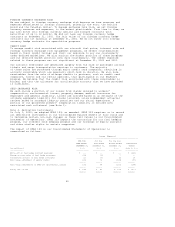

CASH AND CASH EQUIVALENTS

We classify short-term, highly liquid investments with original maturities of

three months or less as cash and cash equivalents. These investments are

recorded at cost, which we believe approximates fair value.

Under our cash management system, we utilize controlled disbursement accounts

that are funded daily. Payments issued by us, which have not been presented to

the bank for payment, are recorded in accounts payable, deferred credits and

other accrued liabilities on our Consolidated Balance Sheets.

RESTRICTED ASSETS

We have restricted cash, which primarily relates to cash held as collateral to

support certain projected insurance obligations. At December 31, 2002,

restricted cash included in current assets on our Consolidated Balance Sheets

totaled $134 million.

We have restricted investments for the redevelopment and expansion of Terminal A

at Boston's Logan International Airport (see Note 6 for additional information

about this project). At December 31, 2002 and 2001, our restricted investments

included in other assets on our Consolidated Balance Sheets totaled $417 million

and $475 million, respectively.

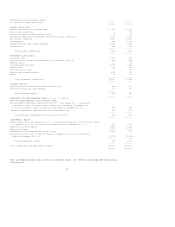

DERIVATIVE FINANCIAL INSTRUMENTS

We account for derivative financial instruments in accordance with SFAS 133.

These derivative instruments include fuel hedge contracts, interest rate swap

agreements and equity warrants and other similar rights in certain companies

(see Note 4).

FUEL HEDGE CONTRACTS

Our fuel hedge contracts qualify as cash flow hedges under SFAS 133. We record

the fair value of our fuel hedge contracts on our Consolidated Balance Sheets

and regularly adjust the balances to reflect changes in the fair values of those

contracts.

32