Delta Airlines 2002 Annual Report Download - page 138

Download and view the complete annual report

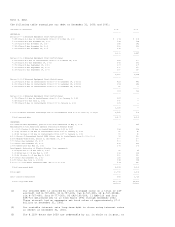

Please find page 138 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Effective gains or losses related to the fair value adjustments of the fuel

hedge contracts are recorded in shareowners' equity as a component of

accumulated other comprehensive income (loss). These gains or losses are

recognized in aircraft fuel expense in the period in which the related aircraft

fuel purchases being hedged are consumed and when the fuel hedge contract is

settled. However, to the extent that the change in fair value of a fuel hedge

contract does not perfectly offset the change in the value of the aircraft fuel

being hedged, the ineffective portion of the hedge is immediately recognized as

a fair value adjustment of SFAS 133 derivatives in other income (expense) on our

Consolidated Statements of Operations. In calculating the ineffective portion of

our hedges under SFAS 133, we include all changes in the fair value attributable

to the time value component and recognize the amount in income during the life

of the contract. Prior to the adoption of SFAS 133, the fuel hedge gains or

losses that were netted against fuel expense included the total fuel-related

hedge premiums.

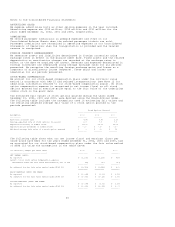

INTEREST RATE SWAP AGREEMENTS

Our interest rate swap agreements qualify as fair value hedges under SFAS 133.

We record the fair value of these interest rate swap agreements on our

Consolidated Balance Sheets and regularly adjust these amounts and the related

debt to reflect changes in their fair values. Net periodic interest rate swap

settlements are recorded as adjustments to interest expense in other income

(expense) on our Consolidated Statements of Operations.

EQUITY WARRANTS AND OTHER SIMILAR RIGHTS

We record our equity warrants and other similar rights in certain companies at

fair value at the date of acquisition in investments in debt and equity

securities on our Consolidated Balance Sheets. In accordance with SFAS 133, we

regularly adjust our Consolidated Balance Sheets to reflect the changes in the

fair values of the equity warrants and other similar rights, and recognize the

related gains or losses as fair value adjustments of SFAS 133 derivatives in

other income (expense) on our Consolidated Statements of Operations.

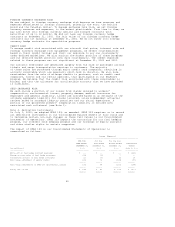

REVENUE RECOGNITION

PASSENGER REVENUES

We record sales of passenger tickets as air traffic liability on our

Consolidated Balance Sheets. Passenger revenues are recognized when we provide

the transportation, reducing the related air traffic liability. We periodically

evaluate the estimated air traffic liability and record any resulting

adjustments in the Consolidated Statements of Operations in the period that the

evaluations are completed.

We sell mileage credits in the SkyMiles(R) frequent flyer program to

participating partners such as credit card companies, hotels and car rental

agencies. A portion of the revenue from the sale of mileage credits is deferred

until the credits are redeemed for travel. For accounting purposes, we amortize

the deferred revenue on a straight-line basis over a 30-month period. The

majority of the revenue from the sale of mileage credits, including the

amortization of deferred revenue, is recorded in passenger revenue; the

remaining portion is recorded as an offset to other selling expenses.

CARGO REVENUES

Cargo revenues are recognized in our Consolidated Statements of Operations when

we provide the transportation.

OTHER, NET

We are party to codeshare agreements with certain foreign airlines. Under these

agreements, we sell seats on these airlines' flights, and they sell seats on our

flights, with each airline separately marketing its respective seats. The

revenue from our sale of codeshare seats flown by certain foreign airlines and

the direct costs incurred in marketing the codeshare flights are recorded in

other, net in operating revenues on our Consolidated Statements of Operations.

Our revenue from certain foreign airlines' sale of codeshare seats flown by us

is recorded in passenger revenue on our Consolidated Statements of Operations.

We record revenues under our contract carrier agreements, reduced by related

expenses, in other, net in operating revenues on our Consolidated Statements of

Operations (see Note 9).

33