Delta Airlines 2002 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

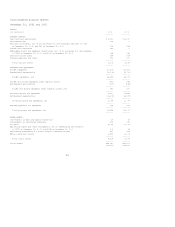

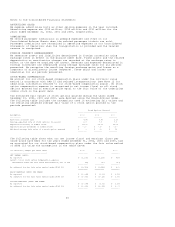

ADVERTISING COSTS

We expense advertising costs as other selling expenses in the year incurred.

Advertising expense was $130 million, $153 million and $151 million for the

years ended December 31, 2002, 2001 and 2000, respectively.

COMMISSIONS

We record passenger commissions in prepaid expenses and other on our

Consolidated Balance Sheets when the related passenger tickets are sold.

Passenger commissions are recognized in operating expenses on our Consolidated

Statements of Operations when the transportation is provided and the related

revenue is recognized.

FOREIGN CURRENCY REMEASUREMENT

We remeasure assets and liabilities denominated in foreign currencies using

exchange rates in effect on the balance sheet date. Fixed assets and the related

depreciation or amortization charges are recorded at the exchange rates in

effect on the date we acquired the assets. Revenues and expenses denominated in

foreign currencies are remeasured using average exchange rates for all periods

presented. We recognize the resulting foreign exchange gains and losses as a

component of miscellaneous income (expense). These gains and losses are

immaterial for all periods presented.

STOCK-BASED COMPENSATION

We account for our stock-based compensation plans under the intrinsic value

method in accordance with APB 25 and related interpretations (see Note 12 for

additional information related to our stock-based compensation plans). No stock

option compensation expense is recognized in net income (loss) as all stock

options granted had an exercise price equal to the fair value of the underlying

common stock on the grant date.

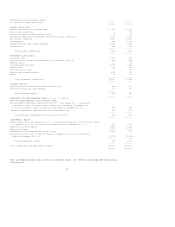

The estimated fair values of stock options granted during the years ended

December 31, 2002, 2001 and 2000, were derived using the Black-Scholes model.

The following table includes the assumptions used in estimating fair values and

the resulting weighted average fair value of a stock option granted in the

periods presented:

Stock Options Granted

--------------------------------------

Assumption 2002 2001 2000

---------- -------- -------- --------

Risk-free interest rate 4.4% 5.8% 6.2%

Average expected life of stock options (in years) 6.7 7.5 7.5

Expected volatility of common stock 38.9% 26.9% 26.9%

Expected annual dividends on common stock $ 0.10 $ 0.10 $ 0.10

Weighted average fair value of a stock option granted $ 9 $ 20 $ 23

-------- -------- --------

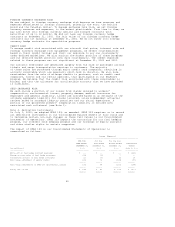

The following table shows what our net income (loss) and earnings (loss) per

share would have been for the years ended December 31, 2002, 2001 and 2000, had

we accounted for our stock-based compensation plans under the fair value method

of SFAS 123 using the assumptions in the table above:

(in millions, except per share data) 2002 2001 2000

------------------------------------ --------- --------- --------

NET INCOME (LOSS):

As reported $ (1,272) $ (1,216) $ 828

Deduct: total stock option compensation expense

determined under the fair value based method, net of tax (47) (30) (27)

--------- --------- --------

As adjusted for the fair value method under SFAS 123 $ (1,319) $ (1,246) $ 801

========= ========= ========

BASIC EARNINGS (LOSS) PER SHARE:

As reported $ (10.44) $ (9.99) $ 6.58

As adjusted for the fair value method under SFAS 123 $ (10.82) $ (10.23) $ 6.36

--------- --------- --------

DILUTED EARNINGS (LOSS) PER SHARE:

As reported $ (10.44) $ (9.99) $ 6.28

As adjusted for the fair value method under SFAS 123 $ (10.82) $ (10.23) $ 6.07

--------- --------- --------

36