Delta Airlines 2002 Annual Report Download - page 129

Download and view the complete annual report

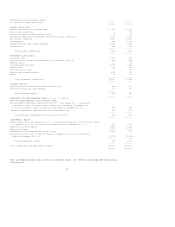

Please find page 129 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management's Discussion and Analysis of Financial Condition and Results of

Operations

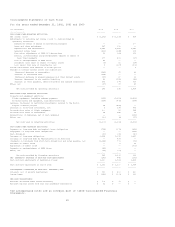

The fair values of our heating and crude oil derivative instruments were $73

million at December 31, 2002 and $64 million at December 31, 2001. A 10%

decrease in the average annual price of heating and crude oil would have

decreased the fair values of these instruments by $70 million at December

31, 2002.

During 2002, aircraft fuel accounted for 12% of our total operating expenses.

Based on our projected aircraft fuel consumption of 2.4 billion gallons for

2003, a 10% rise in our jet fuel prices would increase our aircraft fuel expense

by approximately $46 million in 2003. This analysis includes the effects of fuel

hedging instruments in place at December 31, 2002.

For additional information regarding our aircraft fuel price risk management

program, see Note 4 of the Notes to the Consolidated Financial Statements.

EQUITY SECURITIES RISK

We hold equity-based interests, including warrants and other similar rights, in

certain companies, primarily priceline and Republic Airways Holdings, Inc.

(Republic). The estimated fair values and aggregate unrealized and unrecognized

losses from these investments were $31 million and $9 million, respectively, at

December 31, 2002. At December 31, 2001, the estimated fair values of our

equity-based interests totaled $81 million, with aggregate unrealized and

unrecognized losses of $3 million. The risk associated with these investments is

the potential loss in fair value resulting from a decrease in the price of the

issuer's common stock. Based on the fair value of these equity-based interests

at December 31, 2002, a 10% decline in the price of the underlying common stock

would decrease the fair value of these instruments by approximately $3 million.

For additional information regarding our equity-based interests, see Note 2 of

the Notes to the Consolidated Financial Statements.

INTEREST RATE RISK

Our exposure to market risk due to changes in interest rates primarily relates

to our long-term debt obligations and cash investment portfolio.

Market risk associated with our long-term debt is the potential change in fair

value resulting from a change in interest rates. A 10% decrease in average

annual interest rates would have increased the estimated fair value of our

long-term debt by approximately $395 million at December 31, 2002, and $373

million at December 31, 2001. To manage our interest rate exposure, we have

entered into two interest rate swap agreements. At December 31, 2002, the fair

value of these agreements was $21 million. A 10% increase in average annual

interest rates would have had an immaterial effect on the fair value of these

instruments at December 31, 2002. A 10% increase in average annual interest

rates would have had an approximately $17 million impact on our interest expense

in 2002. For additional information on our interest rate swap and long-term debt

agreements, see Notes 4 and 6 of the Notes to the Consolidated Financial

Statements.

Market risk associated with our cash portfolio is the potential change in

earnings resulting from a change in interest rates. Based on our average balance

of cash and cash equivalents during 2002, a 10% decrease in average annual

interest rates would have decreased our interest income by approximately $4

million.

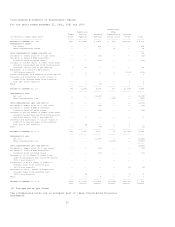

FOREIGN CURRENCY EXCHANGE RATE RISK

We have limited revenues and expenses denominated in foreign currencies. As a

result, we are exposed to limited foreign currency exchange rate risk. The

majority of our exposure results from transactions denominated in the euro,

British pound and Canadian dollar. To manage exchange rate risk, we net foreign

currency revenues and expenses, to the extent practicable, to take advantage of

natural offsets. We may use foreign currency option and forward contracts with

maturities of up to 12 months to manage the remaining net exposure. We did not

have any of these instruments outstanding at December 31, 2002. Based on our

average annual net foreign currency positions during 2002, a 10% adverse change

in average annual foreign currency exchange rates would not have had a material

impact on our Consolidated Financial Statements.

24