Delta Airlines 2002 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.- FLEET CHANGES

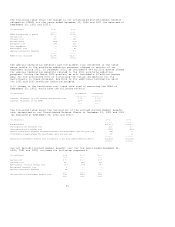

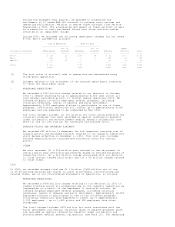

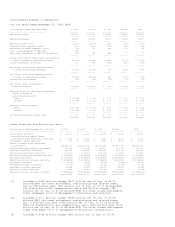

As a result of the effects of the September 11 terrorist attacks on our

business and the related decline in aircraft values, we recorded $286

million in asset writedowns. These writedowns include (1) the

impairment of 16 MD-90 and eight MD-11 owned aircraft, which reflects

further reductions in the estimated future cash flows and fair values

of these aircraft since our impairment review in 1999, as well as a

revised schedule for retiring these aircraft; (2) charges related to

the accelerated retirement of 40 owned B-727 aircraft by 2003; and (3)

the writedown to fair value of 18 owned L-1011 aircraft. These charges

are summarized in the table below:

Used in Operations Held for Sale

------------------------ ----------------------

No. of No. of

(dollars in millions) Writedown(1) Aircraft Writedown Aircraft Total

--------------------- ------------ -------- --------- -------- -----

MD-90 $ 98 16 $ -- -- $ 98

MD-11 93 8 -- -- 93

B-727-200 81 36 2 4 83

L-1011 -- -- 12 18 12

----- ---- -----

Total $ 272 $ 14 $ 286

===== ==== =====

(1) The fair value of aircraft used in operations was determined using

third-party appraisals.

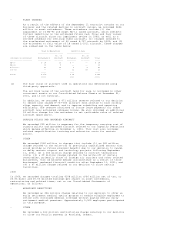

The net book value of the aircraft held for sale is included in other

noncurrent assets on our Consolidated Balance Sheets at December 31,

2001, and is not material.

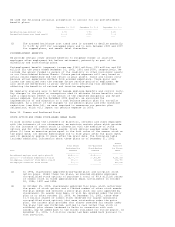

In addition, we recorded a $71 million reserve related to our decision

to remove nine leased B-737-300 aircraft from service to more closely

align capacity and demand, and to improve scheduling and operating

efficiency. The reserve consisted of future lease payments for these

aircraft less estimated sublease income. We also recorded an additional

$6 million charge for the writedown to net realizable value of related

aircraft spare parts.

- SURPLUS PILOTS AND GROUNDED AIRCRAFT

We recorded $30 million in expenses for the temporary carrying cost of

surplus pilots and grounded aircraft related to our capacity reductions

which became effective on November 1, 2001. This cost also includes

related requalification training and relocation costs for certain

pilots.

- OTHER

We recorded $160 million in charges that include (1) an $81 million

charge related to the write-off of previously capitalized amounts that

would provide no future economic benefit due to our decision to cancel

or delay certain airport and technology projects following September

11, 2001; (2) a $63 million charge related to contract termination

costs; (3) a $9 million charge related to the write-off of certain

receivables, primarily those of foreign air carriers and other related

businesses, that we believe became uncollectible as a result of those

businesses' weakened financial condition after September 11, 2001; and

(4) a $7 million charge related to our decision to close certain

facilities.

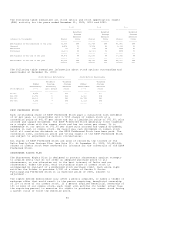

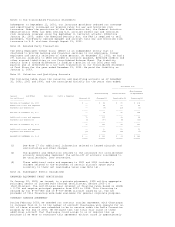

2000

In 2000, we recorded charges totaling $108 million ($66 million net of tax, or

$0.53 basic and $0.50 diluted earnings per share) in asset writedowns,

restructuring and related items, net on our Consolidated Statements of

Operations, as follows:

- WORKFORCE REDUCTIONS

We recorded an $86 million charge relating to our decision to offer an

early retirement medical option program to enable eligible employees to

retire with continued medical coverage without paying certain early

retirement medical premiums. Approximately 2,500 employees participated

in this program.

- OTHER

We recorded a $22 million restructuring charge relating to our decision

to close our Pacific gateway in Portland, Oregon.