Delta Airlines 2002 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

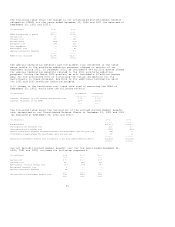

COVENANTS AND CHANGE IN CONTROL PROVISIONS

The Reimbursement Agreement, as amended, contains covenants that (1) require us

to maintain a minimum of $1 billion of unrestricted cash, cash equivalents and

short-term investments at the end of each month; (2) limit the amount of current

debt and convertible subordinated debt that we may have outstanding; and (3)

limit our annual flight equipment rental expense. It also provides that, upon

the occurrence of a change in control of Delta, we shall, at the request of the

banks, deposit cash collateral with the banks in an amount equal to all letters

of credit outstanding and other amounts we owe under the Reimbursement

Agreement.

As is customary in the airline industry, our aircraft lease and financing

agreements require that we maintain certain levels of insurance coverage. We

were in compliance with all of the covenants and requirements discussed above at

December 31, 2002 and 2001.

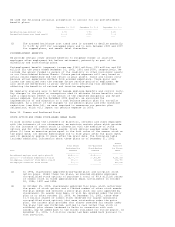

OTHER FINANCING ARRANGEMENTS

On December 12, 2001, we entered into an agreement under which we were able to

borrow, prior to July 1, 2002, up to $935 million on a secured basis. Upon

completion of the Series 2002-1 enhanced equipment trust certificates financing

on April 30, 2002, this facility terminated. No borrowings were outstanding

under this facility during its term.

On December 28, 2001, we entered into a credit facility with certain banks under

which, as amended, we may borrow up to $500 million on a secured basis until

August 21, 2003, subject to certain conditions. The banks' lending commitment

under this facility is reduced, however, to the extent we receive net cash

proceeds from the issuance of certain financings. The interest rate under this

facility is, at our option, LIBOR or a specified base rate plus a margin that

varies depending on the period during which borrowings are outstanding. Any

borrowings under this facility will be secured by certain aircraft owned by us.

At December 31, 2002 and 2001, no borrowings were outstanding under this

facility.

On January 31, 2002, we entered into a facility under which we were able to

borrow up to approximately $350 million secured by certain regional jet aircraft

which we purchased for cash. This facility was scheduled to expire on February

1, 2003, except that amounts borrowed prior to that date were due between 366

days and 18 months after the date of borrowing. In December 2002, we utilized as

security for longer-term financings all of the regional jet aircraft that served

as collateral under this facility. As a result, we terminated this facility on

December 19, 2002. No borrowings were outstanding under this facility on that

date.

Also on January 31, 2002, we entered into a facility to finance, on a secured

basis at the time of acquisition, certain future deliveries of regional jet

aircraft. At December 31, 2002, the total borrowings available to us under this

facility, as amended, were $197 million, of which $31 million was outstanding.

Borrowings under this facility (1) are due between 366 days and 18 months after

the date of borrowing (subject to earlier repayment if certain longer-term

financing is obtained for these aircraft) and (2) bear interest at LIBOR plus a

margin.

We have available to us long-term, secured financing commitments from a third

party that we may elect to use for a substantial portion of the commitments for

regional jet aircraft to be delivered to ASA and Comair through 2004 (see Note

9). Any borrowings under these commitments would be at a fixed interest rate

determined by reference to 10-year U.S. Treasury Notes and would have various

repayment dates.

46