Delta Airlines 2002 Annual Report Download - page 115

Download and view the complete annual report

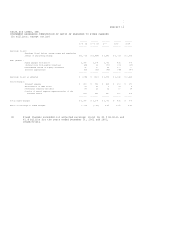

Please find page 115 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other operating expenses decreased 11% primarily due to declines in

miscellaneous expenses such as supplies, utilities, interrupted operation

expenses and professional fees, which were partially offset by a 19% increase in

expenses due to a rise in war and terrorism risk insurance rates.

OPERATING INCOME (LOSS) AND OPERATING MARGIN

We incurred an operating loss of $1.3 billion in 2002, compared to an operating

loss of $1.6 billion in 2001. Operating margin was (10%) and (12%) for 2002 and

2001, respectively. Excluding asset writedowns, restructuring and related items,

net, and Stabilization Act compensation discussed above, we incurred an

operating loss of $904 million in 2002, compared to an operating loss of $1.1

billion in 2001. Operating margin excluding these items was (7%) and (8%) for

2002 and 2001, respectively.

OTHER INCOME (EXPENSE)

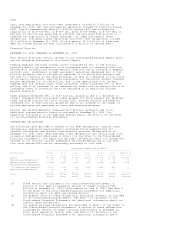

Other expense totaled $693 million during 2002, compared to other expense of

$262 million in 2001. Included in these results are the following:

- A $127 million gain in 2001 on the sale of certain investments. This

primarily relates to a $111 million gain on the sale of our equity

interest in SkyWest, Inc., the parent company of SkyWest Airlines, and

an $11 million gain from the sale of our equity interest in Equant,

N.V., an international data network services company.

- A $39 million charge in 2002 compared to a $68 million gain in 2001 for

fair value adjustments of financial instruments accounted for under

SFAS No. 133, "Accounting for Derivative Instruments and Hedging

Activities" (SFAS 133). This relates to derivative instruments we use

in our fuel hedging program and to our equity warrants and other

similar rights in certain companies.

- A $42 million charge for the extinguishment of debt and a $13 million

loss for the reduction in value of certain investments in 2002.

The change in other income (expense) is also attributable to the following:

- Interest expense increased $147 million in 2002 compared to 2001,

primarily due to higher levels of outstanding debt.

- Interest income decreased $53 million in 2002 due to lower interest

rates and a lower average cash balance compared to 2001.

- Miscellaneous income, net was $1 million in 2002 compared to a $47

million expense in 2001, due primarily to increased earnings from our

equity investment in WORLDSPAN, L.P. (Worldspan), a computer

reservations system partnership.

2001 Compared to 2000

NET INCOME (LOSS) AND EARNINGS (LOSS) PER SHARE

We recorded a consolidated net loss of $1.2 billion ($9.99 diluted EPS) in 2001

and consolidated net income of $828 million ($6.28 diluted EPS) in 2000.

OPERATING REVENUES

Operating revenues were $13.9 billion in 2001, decreasing 17% from $16.7 billion

in 2000. Passenger revenues fell 17% to $13.0 billion. RPMs declined 10% on a

capacity decrease of 5%, while passenger mile yield declined 8% to 12.74(cents).

These decreases were primarily the result of the effects of the terrorist

attacks on September 11, the slowing U.S. and world economies and pilot labor

issues at both Delta and Comair.

NORTH AMERICAN PASSENGER REVENUES

North American passenger revenues fell 19% to $10.6 billion. RPMs decreased 11%

on a capacity decrease of 6%, while passenger mile yield decreased 9%. These

decreases resulted from the September 11 terrorist attacks, the slowing economy

and pilot labor issues.

INTERNATIONAL PASSENGER REVENUES

International passenger revenues decreased 6% to $2.3 billion. RPMs fell 6%

mainly due to the terrorist attacks on September 11 and the slowing U.S. and

world economies. Passenger mile yield remained flat while capacity increased 2%,

reflecting our international expansion, particularly in Latin American markets.

CARGO AND OTHER REVENUES

Cargo revenues decreased 13% to $506 million. This reflects an 8% decline due to

lower mail revenues resulting from the implementation of new FAA restrictions on