Delta Airlines 2002 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Based on the actions we have taken and will continue to take to improve

financial performance and other relevant factors, we believe that it is more

likely than not that our net deferred tax assets recorded at December 31, 2002,

will be fully realized.

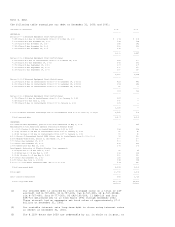

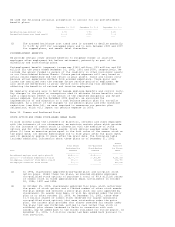

Our income tax benefit (provision) for the years ended December 31, 2002, 2001

and 2000 consisted of:

(in millions) 2002 2001 2000

---- ---- -----

Current tax benefit (provision) $319 $ -- $(230)

Deferred tax benefit (provision) 407 644 (396)

Tax benefit of dividends on allocated Series B ESOP Convertible

Preferred Stock 4 4 5

---- ---- -----

Income tax benefit (provision) $730 $648 $(621)

==== ==== =====

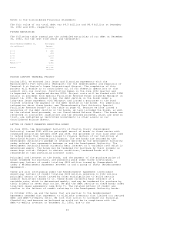

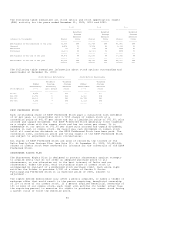

The following table presents the principal reasons for the difference between

our effective income tax rate and the U.S. federal statutory income tax rate for

the years ended December 31, 2002, 2001 and 2000:

2002 2001 2000

----- ----- ----

U.S. federal statutory income tax rate (35.0)% (35.0)% 35.0%

State taxes, net of federal income tax effect (2.4) (2.6) 3.4

Meals and entertainment 0.7 1.0 1.1

Amortization -- 1.0 1.0

Municipal bond interest -- (0.1) (0.2)

Increase in valuation allowance -- 0.8 --

Other, net 0.2 0.1 (0.2)

----- ----- ----

Effective income tax rate (36.5)% (34.8)% 40.1%

===== ===== ====

Note 11. Employee Benefit Plans

We sponsor qualified and non-qualified defined benefit pension plans, defined

contribution pension plans, healthcare plans, and disability and survivorship

plans for eligible employees and retirees, and their eligible family members. We

reserve the right to modify or terminate these plans as to all participants and

beneficiaries at any time, except as restricted by the Internal Revenue Code or

the Employee Retirement Income Security Act (ERISA).

DEFINED BENEFIT PENSION PLANS

Our qualified defined benefit pension plans meet or exceed ERISA's minimum

funding requirements as of December 31, 2002. Our non-qualified pension plans

are funded primarily with current assets.

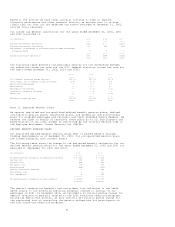

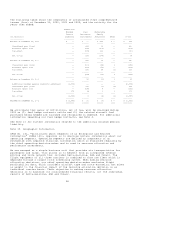

The following table shows the change in the projected benefit obligation for our

defined benefit pension plans for the years ended December 31, 2002 and 2001 (as

measured at September 30, 2002 and 2001):

(in millions) 2002 2001

-------- --------

Projected benefit obligation at beginning of period $ 10,657 $ 9,263

Service cost 282 246

Interest cost 825 763

Actuarial loss 798 531

Benefits paid (888) (623)

Special termination benefits -- 185

Curtailment loss -- 30

Plan amendments 8 262

-------- --------

Projected benefit obligation at end of period $ 11,682 $ 10,657

======== ========

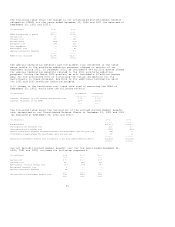

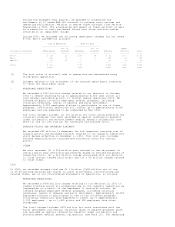

The special termination benefits and curtailment loss reflected in the table

above relate to the workforce reduction programs offered to certain of our

employees in 2001. In December 2002, we recorded a $7 million pretax charge for

special termination benefits related to the 2002 workforce reduction programs.

During the March 2003 quarter, we will record a $47 million pretax charge for

the associated cost of curtailing the pension obligations for participants in

the 2002 workforce reduction programs.

51