Delta Airlines 2002 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

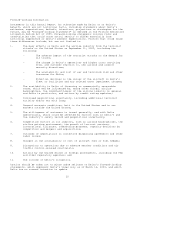

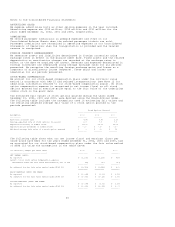

Note 1. Summary of Significant Accounting Policies

BASIS OF PRESENTATION

Delta Air Lines, Inc. (a Delaware corporation) is a major air carrier that

provides air transportation for passengers and cargo throughout the U.S. and

around the world. Our Consolidated Financial Statements include the accounts of

Delta Air Lines, Inc. and our wholly owned subsidiaries, including ASA Holdings,

Inc. (ASA Holdings) and Comair Holdings, Inc. (Comair Holdings), collectively

referred to as Delta. ASA Holdings is the parent company of Atlantic Southeast

Airlines, Inc. (ASA), and Comair Holdings is the parent company of Comair, Inc.

(Comair). We completed our acquisitions of ASA Holdings and Comair Holdings in

April 1999 and in January 2000, respectively. We have eliminated all material

intercompany transactions in our Consolidated Financial Statements. These

Consolidated Financial Statements have been prepared in accordance with

accounting principles generally accepted in the United States of America (GAAP).

We have reclassified certain prior period amounts in our Consolidated Financial

Statements to be consistent with our current period presentation. The effect of

these reclassifications is not material.

We do not consolidate the financial statements of any company in which we have

an ownership interest of 50% or less unless we control that company. During

2002, 2001 and 2000, we did not control any company in which we had an ownership

interest of 50% or less.

CHANGE IN YEAR END

Effective December 31, 2000, we changed our year end from June 30 to December

31. Accordingly, this Annual Report includes audited Consolidated Balance Sheets

as of December 31, 2002 and 2001, and audited Consolidated Statements of

Operations, Cash Flows and Shareowners' Equity for the years ended December 31,

2002, 2001 and 2000.

USE OF ESTIMATES

We are required to make estimates and assumptions when preparing our

Consolidated Financial Statements in accordance with GAAP. These estimates and

assumptions affect the amounts reported in our financial statements and the

accompanying notes. Actual results could differ materially from those estimates.

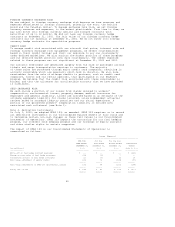

NEW ACCOUNTING STANDARDS

On January 1, 2002, we adopted Statement of Financial Accounting Standards

(SFAS) No. 142, "Goodwill and Other Intangible Assets" (SFAS 142), which

addresses financial accounting and reporting for goodwill and other intangible

assets (see Note 5).

In June 2001, the Financial Accounting Standards Board (FASB) issued SFAS No.

143, "Accounting for Asset Retirement Obligations" (SFAS 143), which is

effective for fiscal years beginning after June 15, 2002. We adopted SFAS 143 on

January 1, 2003. The adoption of SFAS 143 did not have a material impact on our

Consolidated Financial Statements.

On January 1, 2002, we adopted SFAS No. 144, "Accounting for the Impairment or

Disposal of Long-lived Assets" (SFAS 144), which supersedes previous accounting

and reporting standards for (1) testing for impairment or disposal of long-lived

assets and (2) the disposal of segments of a business. Our impairment charges

recorded during 2002 were determined in accordance with SFAS 144 (see Note 16).

On October 1, 2002, we adopted SFAS No. 145, "Rescission of FASB Statements No.

4, 44 and 64, Amendment of FASB Statement No. 13 and Technical Corrections"

(SFAS 145), which, among other things, (1) requires that gains and losses due to

the extinguishment of debt be classified as extraordinary items on the

Consolidated Statements of Operations only if certain criteria are met and (2)

amends the accounting for sale and leaseback transactions. In accordance with

SFAS 145, we recorded a $42 million loss on the extinguishment of ESOP Notes in

other income (expense) on our 2002 Consolidated Statement of Operations (see

Note 6).

In June 2002, the FASB issued SFAS No. 146, "Accounting for Costs Associated

with Exit or Disposal Activities" (SFAS 146), which supersedes previous

accounting and reporting standards for costs associated with exit or disposal

activities by requiring the related liability to be recognized and measured

initially at fair value when the liability is incurred. Under the previous

accounting

31