Delta Airlines 2002 Annual Report Download - page 140

Download and view the complete annual report

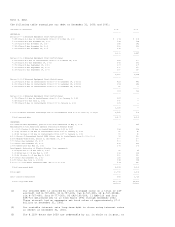

Please find page 140 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.interest rate related to specific asset financings. Interest capitalization ends

when the equipment or facility is ready for service or its intended use.

Capitalized interest totaled $15 million, $32 million and $45 million for the

years ended December 31, 2002, 2001 and 2000, respectively.

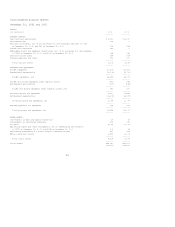

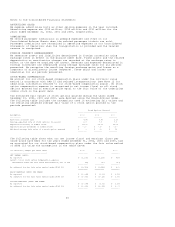

EQUITY METHOD INVESTMENTS

We use the equity method to account for our 40% ownership interest in WORLD-

SPAN, L.P. (Worldspan), a computer reservations system partnership. Our equity

earnings from this investment totaled $43 million, $19 million and $59 million

for the years ended December 31, 2002, 2001 and 2000, respectively. We also

received cash dividends from Worldspan of $40 million, $70 million and $32

million for the years ended December 31, 2002, 2001 and 2000, respectively.

Worldspan provides computer reservation and related services for us, which

totaled approximately $180 million for the year ended December 31, 2002. At

December 31, 2002, we had a liability to Worldspan for $15 million which is

included in accounts payable, deferred credits and other accrued liabilities on

our Consolidated Balance Sheet.

We account for our 18% ownership interest in Orbitz, LLC (Orbitz), an on-line

travel agency, under the equity method. We use the equity method of accounting

for this investment because we believe we have the ability to exercise

significant influence, but not control, over the financial and operating

policies of Orbitz. This influence is evidenced by, among other things, our

right to appoint two of our senior officers to the 11 member Board of Managers

of Orbitz, which allows us to participate in Orbitz's financial and operating

decisions.

Our investments in Worldspan and Orbitz are recorded in investments in

associated companies on our Consolidated Balance Sheets.

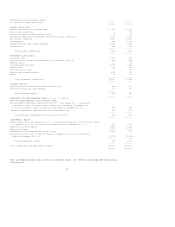

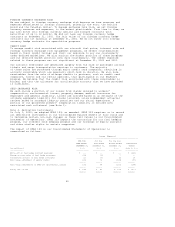

INCOME TAXES

We account for deferred income taxes under the liability method in accordance

with SFAS No. 109, "Accounting for Income Taxes" (SFAS 109). Under this method,

we recognize deferred tax assets and liabilities based on the tax effects of

temporary differences between the financial statement and tax bases of assets

and liabilities, as measured by current enacted tax rates. A valuation allowance

is recorded to reduce deferred tax assets when determined necessary in

accordance with SFAS 109. Deferred tax assets and liabilities are recorded net

as current and noncurrent deferred income taxes on our Consolidated Balance

Sheets.

FREQUENT FLYER PROGRAM

We record an estimated liability for the incremental cost associated with

providing free transportation under our SkyMiles frequent flyer program when a

free travel award is earned. The liability is recorded in accounts payable,

deferred credits and other accrued liabilities on our Consolidated Balance

Sheets. It is adjusted periodically based on awards earned, awards redeemed,

changes in the SkyMiles program and changes in estimated incremental costs.

DEFERRED GAINS ON SALE AND LEASEBACK TRANSACTIONS

We amortize deferred gains on the sale and leaseback of property and equipment

under operating leases over the lives of these leases. The amortization of these

gains is recorded as a reduction in rent expense. Gains on the sale and

leaseback of property and equipment under capital leases reduce the carrying

value of the related assets.

MANUFACTURERS' CREDITS

We periodically receive credits in connection with the acquisition of aircraft

and engines. These credits are deferred until the aircraft and engines are

delivered, then applied on a pro rata basis as a reduction to the cost of the

related equipment.

MAINTENANCE COSTS

We record maintenance costs in operating expenses as they are incurred.

INVENTORIES

Inventories of expendable parts related to flight equipment are carried at cost

and charged to operations as consumed. An allowance for obsolescence for the

cost of these parts is provided over the remaining useful life of the related

fleet.

35