Delta Airlines 2002 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

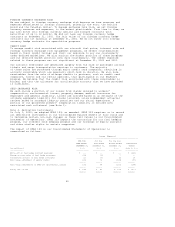

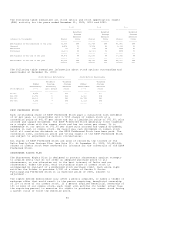

The program fees related to this agreement are paid to the third party based on

the amounts invested by the third party. These fees were $4 million, $14 million

and $22 million for the years ended December 31, 2002, 2001 and 2000,

respectively, and are recorded in miscellaneous income (expense), net included

in other income (expense) on our Consolidated Statements of Operations.

This agreement, as amended during the June 2002 quarter, expires on March 31,

2003. However, the third party may terminate this agreement prior to its

scheduled termination date if our senior unsecured long-term debt is rated

either below Ba3 by Moody's or below BB- by Standard & Poor's. If this agreement

is terminated under these circumstances or upon expiration, we would be required

to repurchase the funded receivables, which totaled $250 million at December 31,

2002. At December 31, 2002, our senior unsecured long-term debt was rated Ba3 by

Moody's and BB- by Standard & Poor's. Both Moody's and Standard & Poor's ratings

outlook for our long-term debt is negative.

Note 9. Purchase Commitments and Contingencies

AIRCRAFT & ENGINE ORDER COMMITMENTS

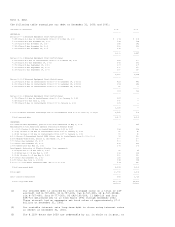

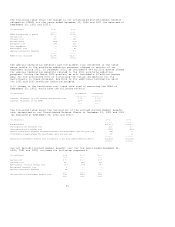

Future expenditures for aircraft and engines on firm order as of December 31,

2002 are estimated to be $5.0 billion. The following table shows the timing of

these commitments:

Year Ending December 31,

(in billions) Amount

------

2003 $1.0

2004 0.7

2005 1.2

2006 1.3

2007 0.8

After 2007 --

----

Total $5.0

====

CONTRACT CARRIER AGREEMENT COMMITMENTS

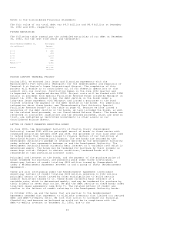

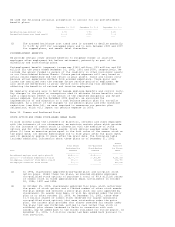

We have contract carrier agreements with two regional air carriers, Atlantic

Coast Airlines (ACA) and SkyWest Airlines, Inc. (SkyWest), which expire in 2010.

During the June 2002 quarter, we entered into a contract carrier agreement with

a third regional air carrier, Chautauqua Airlines, which expires in 2012.

Chautauqua began operations under our Delta Connection program in November 2002.

Under these contract carrier agreements, we schedule certain aircraft that are

operated by those airlines using our flight code, sell the seats on those

flights and retain the related revenues. We pay those airlines an amount that is

based on their cost of operating those flights plus a specified margin. The

following table shows the number of aircraft and available seat miles (ASMs)

operated for us by the regional air carriers, and our expenses related to the

contract carrier agreements for the years ended December 31, 2002, 2001 and

2000:

(in millions, except aircraft) 2002 2001 2000

------ ------ ----

Number of aircraft operated(1) 100 72 23

ASMs(1,2) 3,513 1,562 328

Expenses $ 561 $ 240 $ 89

------ ------ ----

(1) These amounts are unaudited.

(2) These ASMs are not included in our ASMs on pages 11 and 68.

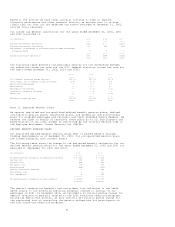

We expect to incur approximately $780 million in expenses related to these

contract carrier agreements in 2003. We anticipate that the number of aircraft

operated for us by these regional air carriers will increase to 136 by December

31, 2003, including the 12 additional Chautauqua aircraft discussed in Note 22.

See Note 1 for information about our accounting policy for revenues and expenses

related to our contract carrier agreements.

48