Delta Airlines 2002 Annual Report Download - page 164

Download and view the complete annual report

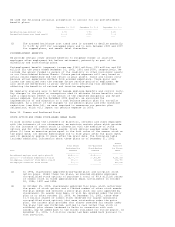

Please find page 164 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.If a person acquires beneficial interest of 15% or more of our common stock and

(1) we are involved in a merger or other business combination in which we are

not the surviving corporation, or (2) we sell more than 50% of our assets or

earning power, then each right will entitle its holder (other than the acquiring

person) to exercise their rights to purchase common stock of the acquiring

company having a market value of twice the exercise price.

The rights expire on November 4, 2006. We may redeem the rights for $0.01 per

right at any time before a person becomes the beneficial owner of 15% or more of

our common stock. At December 31, 2002, 2,250,000 shares of preferred stock were

reserved for issuance under the Shareowner Rights Plan.

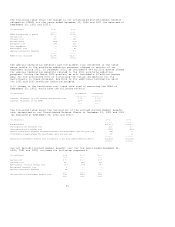

PAYMENT OF DIVIDENDS

The determination to pay cash dividends on our ESOP Preferred Stock and our

common stock is at the discretion of our Board of Directors, and is also subject

to the provisions of Delaware General Corporation Law, which authorizes the

payment of dividends from (1) surplus, defined as the excess of net assets

(total assets minus total liabilities) over the amount determined to be capital,

or (2) if there is no surplus, out of net profits for the current fiscal year or

the previous fiscal year. The terms of the ESOP Preferred Stock discussed above

provide for cumulative dividends and also limit our ability to pay cash

dividends to our common shareowners in certain circumstances. Our debt

agreements do not limit the payment of dividends on our capital stock.

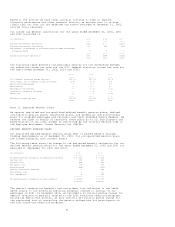

Note 13. Common Stock Repurchases

We repurchased 10.6 million shares of common stock for $502 million in 2000.

These repurchases were made under certain now-completed stock buyback programs,

and the ongoing common stock repurchase authorization described below.

In 1996, our Board of Directors authorized us to repurchase up to 49.4 million

shares of common stock issued under our broad-based employee stock option plans

(see Note 12). As of December 31, 2002, we had repurchased a total of 21.6

million shares of common stock under this authorization. We are authorized to

repurchase the remaining shares as employees exercise their stock options under

those plans. Repurchases are subject to market conditions and may be made in the

open market or privately negotiated transactions.

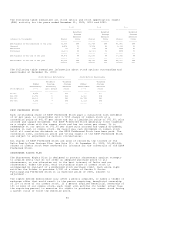

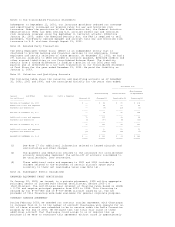

Note 14. Comprehensive Income (Loss)

Comprehensive income (loss) includes (1) reported net income (loss); (2) the

additional minimum pension liability; and (3) unrealized gains and losses on

marketable equity securities and fuel derivative instruments that qualify for

hedge accounting. The following table shows our comprehensive income (loss)

for the years ended December 31, 2002, 2001 and 2000:

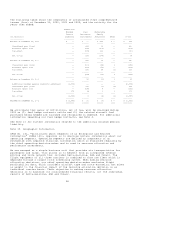

{in millions) 2002 2001 2000

------------- --------- ------- ----

Net income $ (1,272) $(1,216) $828

Other comprehensive income (loss) (1,587) (335) 94

--------- ------- ----

Comprehensive income (loss) $ (2,859) $(1,551) $922

========= ======= ====

57