Delta Airlines 2002 Annual Report Download - page 110

Download and view the complete annual report

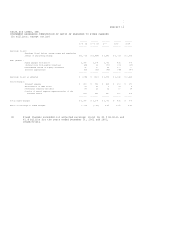

Please find page 110 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management's Discussion and Analysis of Financial Condition and Results of

Operations

savings, with $250 million being realized in 2003. Most of these job

reductions will be complete by May 1, 2003. We recorded a pretax charge

of $127 million in the December 2002 quarter related to these workforce

reduction programs and expect to record a pretax charge of

approximately $43 million in the March 2003 quarter for the associated

cost of curtailing the pension and postretirement obligations for

employees participating in these programs. See Notes 16 and 17 of the

Notes to the Consolidated Financial Statements for additional

information on this charge.

- Investing in technology to improve efficiencies. These initiatives

include installing over 400 additional self-service kiosks in airports

during 2003 and implementing an SAP inventory and supply chain

management system.

- Utilizing our regional jet aircraft to decrease the average number of

available seats per aircraft while increasing the number of flights in

certain locations. This will allow us to better match capacity with

demand.

- Modifying our employee benefits programs through a strategic benefits

review. Beginning in 2003, we implemented changes to our healthcare

benefits which we expect to offset rising healthcare costs in 2003 by

approximately $80 million. In July 2003, we will begin the migration

to a new cash balance pension plan, which we anticipate will result in

cost savings of approximately $600 million over the next five years,

including $120 million in 2003.

- Making significant changes to our fleet plan by (1) reducing costs

through fleet simplification and (2) reducing capital expenditures in

2003 and 2004 by deferring delivery of 31 aircraft, which will result

in no scheduled mainline aircraft deliveries during this two-year

period.

LIQUIDITY

Due to the depressed revenue environment and cost pressures, we borrowed $2.6

billion in 2002. The net proceeds from these transactions were primarily used to

finance aircraft and repay certain debt obligations. All of our borrowings in

2002 were secured by aircraft.

At February 28, 2003, we had cash and cash equivalents totaling $1.9 billion.

This reflects (1) the proceeds from our sale on January 30, 2003 of $392 million

principal amount of insured enhanced equipment trust certificates, which is due

in installments through January 2008 and is secured by 12 mainline aircraft

owned by us, and (2) our purchase on February 25, 2003, of a portion of

outstanding ESOP Notes for $74 million. We also have $500 million of liquidity

available under a secured credit facility which expires on August 21, 2003, and

unencumbered assets available for use in potential financing transactions.

We estimate that the value of our unencumbered aircraft assets at February 28,

2003 is approximately $3.6 billion, (excluding the aircraft that would secure

the $500 million secured credit facility described above), approximately $800

million of which consists of aircraft that are eligible under Section 1110.

Because this provision provides protection to lessors and creditors, and because

Section 1110 aircraft are generally newer, they are more desirable to lenders as

collateral in financing transactions than aircraft that are not eligible under

Section 1110.

The values of our unencumbered aircraft assets were derived by us from published

third-party estimates of the "base value" of similar aircraft using certain

assumptions and may not accurately reflect the current market value of the

aircraft. Base value is an estimate of the underlying economic value of an

aircraft based on historic and future value trends in a stable market

environment, while current market value is the value of the aircraft in the

actual market; both methods assume an aircraft is in average condition and in

its "highest and best use." Given the difficult business environment, there is

no assurance we would have access to financing using these aircraft as

collateral. In any event, the amount we could finance using these aircraft would

likely be significantly less than their base value.

As a result of our revenue and cost initiatives described above, we believe that

our cash flows from operations in 2003 will be sufficient to fund our daily

operations and non-fleet capital expenditures. This expectation reflects the

softness in traffic and advance bookings we are now experiencing as a result of

public concern over possible military action in Iraq. Because we cannot predict

either the occurrence or the scope and duration of events that are beyond our

control, the actual effect on our business of the current geopolitical risks may

differ materially from the level we have assumed.