Delta Airlines 2002 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management's Discussion and Analysis of Financial Condition and Results of

Operations

Results of Operations

BUSINESS ENVIRONMENT

Since September 11, 2001, Delta and the airline industry have faced

unprecedented challenges. Our industry has experienced substantial revenue

declines and cost increases, creating industry-wide liquidity issues which have

resulted in two major airlines filing for bankruptcy. The following discussion

was prepared as of March 12, 2003.

REVENUES

The depressed revenue environment is the result of various factors, including

(1) a sharp decline in high-yield business travel after the September 11, 2001

terrorist attacks; (2) industry capacity exceeding demand, which has resulted in

heavy fare discounting to stimulate demand; (3) a government-imposed passenger

security fee adopted after September 11, 2001, which we have not been able to

pass on to our customers because of the weak demand situation; and (4) a

reduction in traffic due to the real and perceived "hassle factor" resulting

from increased airport security measures. Additionally, our revenues have been

adversely impacted by the continuing weakness of the U.S. and world economies,

the growth of low-cost carriers and increased price-sensitivity in customers'

purchasing behavior.

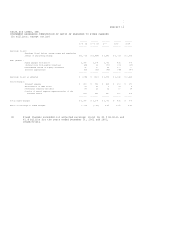

The following table shows the change in our traffic, capacity and yield for the

year ended December 31, 2002, compared to the years ended December 31, 2001 and

2000:

2002 vs. 2001(1) 2002 vs. 2000

---------------- -------------

Traffic 0% (10%)

Capacity(2) (4%) (9%)

Yield (5%) (13%)

(1) During 2001, our financial performance was materially adversely

affected by (i) the September 11, 2001 terrorist attacks; (ii) the

slowing U.S. and world economies; (iii) the cancellation of a

substantial number of flights due to a job action by some Delta pilots

and public concern over a possible strike by Delta pilots; and (iv) the

Comair, Inc. (Comair) pilot strike, which resulted in Comair's

suspension of operations between March 26, 2001 and July 1, 2001, and

its gradual return to prestrike service levels following the strike.

(2) We currently have 25 mainline aircraft that remain temporarily grounded

as a result of capacity reductions implemented since September 11,

2001.

Operating revenues in 2002 were $13.3 billion, a 4% decrease from $13.9 billion

in 2001 and a 21% decrease from $16.7 billion in 2000. We have announced

initiatives to mitigate revenue pressures, such as our plans to implement a

marketing agreement with Continental Airlines and Northwest Airlines, and the

launch in April 2003 of a low-fare carrier, Song. Because of the difficult

revenue environment, however, we do not expect significant improvement in our

revenues in 2003.

COSTS

Our cost pressures in 2002 included increases in (1) pension expense due

primarily to increased obligations resulting from declining interest rates, a

decrease in fair value of our pension plan assets, as well as scheduled pilot

pay increases; (2) interest expense primarily due to an increase in debt

outstanding; (3) war and terrorism risk insurance premiums; and (4) security

costs. These costs increased by a total of approximately $645 million from 2001

to 2002. In addition, aircraft fuel prices began to rise significantly beginning

in November 2002, reflecting both the Middle East uncertainty and the Venezuelan

political crisis.

To mitigate these cost pressures, we implemented cost savings initiatives after

September 11, 2001 and throughout 2002 which resulted in approximately $1

billion in savings in 2002. These initiatives included (1) a decrease in salary

expense related to our 2001 workforce reduction programs, partially offset by

pilot and mechanic rate increases; (2) a decrease in passenger commission

expense due to the elimination of travel agent base commissions for tickets sold

in the U.S. and Canada; and (3) declines in contract work, aircraft maintenance

materials volume, advertising expenditures, passenger service expense and

professional fees. While these savings were significant, and resulted in a net

decrease in unit costs compared to 2001, our unit cost remained higher than our

unit revenue.