Delta Airlines 2002 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 7. Lease Obligations

We lease aircraft, airport terminal and maintenance facilities, ticket offices

and other property and equipment. Rental expense for operating leases, which is

recorded on a straight-line basis over the life of the lease, totaled

$1.3 billion for each year ended December 31, 2002, 2001 and 2000. Amounts due

under capital leases are recorded as liabilities. Our interest in assets

acquired under capital leases is recorded as property and equipment on our

Consolidated Balance Sheets. Amortization of assets recorded under capital

leases is included in depreciation and amortization expense on our Consolidated

Statements of Operations. Our leases do not include residual value guarantees.

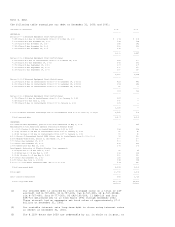

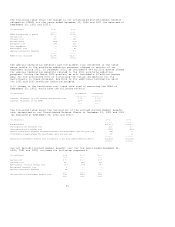

The following table summarizes, as of December 31, 2002, our minimum rental

commitments under capital leases and noncancelable operating leases with initial

or remaining terms in excess of one year:

Years Ending December 31, Capital Operating

(in millions) Leases Leases

------- ---------

2003 $ 40 $ 1,277

2004 31 1,203

2005 24 1,176

2006 16 1,128

2007 15 1,042

After 2007 46 6,918

---- -------

Total minimum lease payments 172 $12,744

Less: lease payments that represent interest 45 -------

----

Present value of future minimum capital lease payments 127

Less: current obligations under capital leases 27

----

Long-term capital lease obligations $100

====

The total minimum rental commitments under operating leases in the table above

do not include approximately $144 million in future minimum lease payments which

we expect to receive under noncancelable subleases.

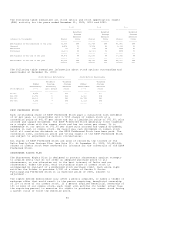

As of December 31, 2002, we operated 313 aircraft under operating leases and 45

aircraft under capital leases. These leases have remaining terms ranging from

one month to 15 years.

Certain municipalities have issued special facilities revenue bonds to build or

improve airport and maintenance facilities leased to us. The facility lease

agreements require us to make rental payments sufficient to pay principal and

interest on the bonds. The above table includes $1.8 billion of operating lease

rental commitments for such payments.

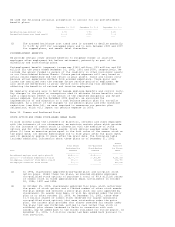

Note 8. Sale of Receivables

We are party to an agreement, as amended, under which we sell a defined pool of

our accounts receivable, on a revolving basis, through a special-purpose, wholly

owned subsidiary, which then sells an undivided interest in the defined pool of

accounts receivable to a third party. In accordance with SFAS 140, this

subsidiary is not consolidated in our Consolidated Financial Statements. We

retain servicing and record-keeping responsibilities for the receivables sold,

the fair value of which is not material at December 31, 2002 and 2001.

In exchange for the sale of receivables, we receive (1) cash up to a maximum of

$250 million from the subsidiary's sale of an undivided interest in the pool of

receivables to the third party and (2) a subordinated promissory note from the

subsidiary, less certain program fees. Proceeds from new securitizations under

this agreement were approximately $38 million for the year ended December 31,

2002, which are recorded as cash flows from operations on our Consolidated

Statements of Cash Flows. The amount of the promissory note fluctuates because

it represents the portion of the purchase price payable for the volume of

receivables sold. The principal amount of the promissory note was $67 million

and $144 million at December 31, 2002 and 2001, respectively, and is included in

accounts receivable on our Consolidated Balance Sheets. Additionally, our

investment in the subsidiary, which represents our funding of the entity,

totaled $117 million at December 31, 2002, and is recorded in investments in

associated companies on our Consolidated Balance Sheets.

47