Delta Airlines 2002 Annual Report Download - page 147

Download and view the complete annual report

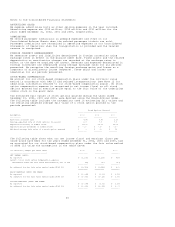

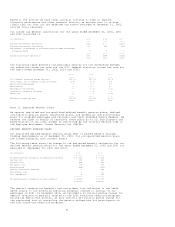

Please find page 147 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The adoption of SFAS 142 decreased our operating expenses on our Consolidated

Statements of Operations by approximately $60 million, net of tax, for the year

ended December 31, 2002, due to the discontinuance of amortization of goodwill

and indefinite-lived intangible assets. The following table reconciles our

reported net income (loss) and earnings (loss) per share to adjusted net income

(loss) and earnings (loss) per share as if the non-amortization provisions of

SFAS 142 had been applied to prior year periods:

For the Years Ended December 31,

--------------------------------------

(in millions, except per share data) 2002 2001 2000

------------------------------------ --------- --------- ---------

Net income (loss) before cumulative effect of change in accounting principle $ (1,272) $ (1,216) $ 928

Net income (loss) $ (1,272) $ (1,216) $ 828

--------- --------- -------

Add back: goodwill and international route amortization, net of tax -- 60 60

--------- --------- -------

Adjusted net income (loss) before cumulative effect of change in accounting principle $ (1,272) $ (1,156) $ 988

Adjusted net income (loss) $ (1,272) $ (1,156) $ 888

--------- --------- -------

BASIC EARNINGS PER SHARE:

Net income (loss) before cumulative effect of change in accounting principle $ (10.44) $ (9.99) $ 7.39

Net income (loss) $ (10.44) $ (9.99) $ 6.58

--------- --------- -------

Add back: goodwill and international route amortization, net of tax -- 0.49 0.49

--------- --------- -------

Adjusted net income (loss) before cumulative effect of change in accounting principle $ (10.44) $ (9.50) $ 7.88

Adjusted net income (loss) $ (10.44) $ (9.50) $ 7.07

--------- --------- -------

DILUTED EARNINGS PER SHARE:

Net income (loss) before cumulative effect of change in accounting principle $ (10.44) $ (9.99) $ 7.05

Net income (loss) $ (10.44) $ (9.99) $ 6.28

--------- --------- -------

Add back: goodwill and international route amortization, net of tax -- 0.49 0.46

--------- --------- -------

Adjusted net income (loss) before cumulative effect of change in accounting principle $ (10.44) $ (9.50) $ 7.51

Adjusted net income (loss) $ (10.44) $ (9.50) $ 6.74

--------- --------- -------

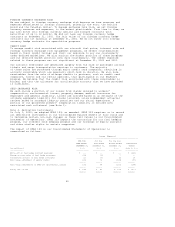

During the March 2002 quarter, we completed the required initial test of

potential impairment of indefinite-lived intangible assets, other than goodwill;

that test indicated no impairment at the date of adoption of SFAS 142. The

following table presents information about our intangible assets, other than

goodwill, at December 31, 2002 and 2001:

2002 2001

------------------------------- -------------------------------

GROSS CARRYING ACCUMULATED Gross Carrying Accumulated

(in millions) AMOUNT AMORTIZATION Amount Amortization

------------- -------------- ------------ -------------- ------------

Amortized intangible assets:

Leasehold and operating rights $ 125 $ (86) $ 113 $ (81)

Other 3 (1) 2 (1)

------ ------ ------ ------

Total $ 128 $ (87) $ 115 $ (82)

====== ====== ====== ======

NET CARRYING Net Carrying

AMOUNT Amount

------------ ------------

Unamortized intangible assets:

International routes $ 60 $ 60

Other 1 1

---- ----

Total $ 61 $ 61

==== ====

During the June 2002 quarter, we completed our transitional goodwill impairment

test, which indicated no impairment at the date of adoption of SFAS 142. At

December 31, 2002, we performed the required annual impairment test of our

goodwill and indefinite-lived intangible assets, which also indicated no

impairment.

42