Delta Airlines 2002 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

See Note 16 for additional information about our 2002 and 2001 workforce

reduction programs.

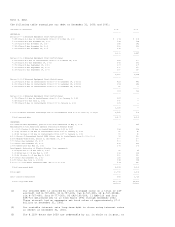

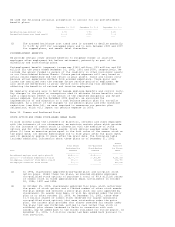

The following table shows the change in the fair value of our defined benefit

pension plan assets for the years ended December 31, 2002 and 2001 (as measured

at September 30, 2002 and 2001):

(in millions) 2002 2001

------ -------

Fair value of plan assets at beginning of period $8,304 $10,398

Actual loss on plan assets (718) (1,521)

Employer contributions 77 50

Benefits paid (888) (623)

------ -------

Fair value of plan assets at end of period $6,775 $ 8,304

====== =======

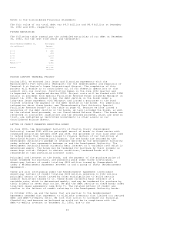

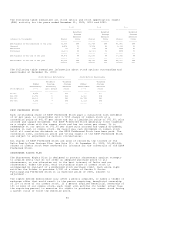

The accrued pension cost recognized for these plans on our Consolidated Balance

Sheets at December 31, 2002 and 2001 is computed as follows:

(in millions) 2002 2001

------- -------

Funded status $(4,907) $(2,353)

Unrecognized net actuarial loss 4,092 1,584

Unrecognized transition obligation 41 49

Unrecognized prior service cost 292 308

Contributions made between the measurement date and year end 10 12

Special termination benefits recognized between the measurement date and year end (7) --

Intangible asset (333) (7)

Accumulated other comprehensive loss (2,558) (12)

------- -------

Accrued pension cost recognized on the Consolidated Balance Sheets $(3,370) $ (419)

======= =======

Net periodic pension cost for the years ended December 31, 2002, 2001 and 2000

included the following components:

(in millions) 2002 2001 2000

----- ------- -----

Service cost $ 282 $ 246 $ 250

Interest cost 825 763 686

Expected return on plan assets (984) (1,040) (924)

Amortization of prior service cost 24 5 4

Recognized net actuarial gain (8) (51) (22)

Amortization of net transition obligation 8 4 2

Settlement costs 1 -- --

Special termination benefits 7 -- --

----- ------- -----

Net periodic pension cost $ 155 $ (73) $ (4)

===== ======= =====

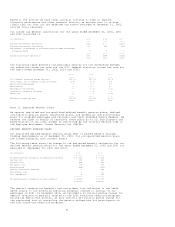

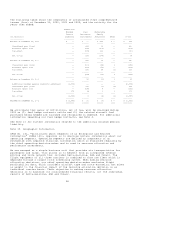

We used the following actuarial assumptions to account for our defined benefit

pension plans:

September 30, 2002 September 30, 2001 September 30, 2000

------------------ ------------------ ------------------

Weighted average discount rate 6.75% 7.75% 8.25%

Rate of increase in future compensation levels 2.67% 4.67% 5.35%

Expected long-term rate of return on plan assets 9.00% 10.00% 10.00%

---- ----- -----

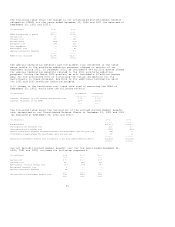

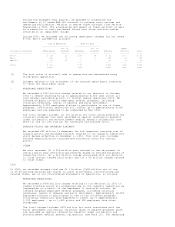

At December 31, 2002, we recorded a non-cash charge to accumulated other

comprehensive income (loss) to recognize a portion of our additional minimum

pension liability in accordance with SFAS No. 87, "Employers' Accounting for

Pensions" (SFAS 87). SFAS 87 requires that this liability be recognized at year

end in an amount equal to the amount by which the accumulated benefit obligation

(ABO) exceeds the fair value of the defined benefit pension plan assets. The

additional minimum pension liability was recorded by recognizing an intangible

asset to the extent of any unrecognized prior service costs and transition

52