Delta Airlines 2002 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FUEL HEDGING PROGRAM

Because there is not a readily available market for derivatives in aircraft

fuel, we use heating and crude oil derivative contracts to manage our exposure

to changes in aircraft fuel prices. Changes in the fair value of these contracts

(fuel hedge contracts) are highly effective at offsetting changes in aircraft

fuel prices.

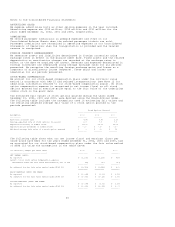

At December 31, 2002, our fuel hedge contracts had an estimated short-term fair

value of $68 million and an estimated long-term fair value of $5 million, with

unrealized gains of $29 million, net of tax, recorded in accumulated other

comprehensive income (loss). At December 31, 2001, our fuel hedge contracts had

an estimated short-term fair value of $55 million and an estimated long-term

fair value of $9 million, with unrealized gains of $25 million, net of tax,

recorded in accumulated other comprehensive income (loss). See Note 1 for

information about our accounting policy for fuel hedge contracts.

INTEREST RATE HEDGING PROGRAM

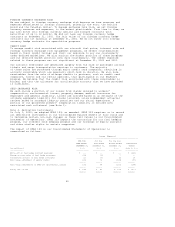

To manage our interest rate exposure, in July 2002, we entered into two interest

rate swap agreements relating to our (1) $300 million principal amount of

unsecured Series C Medium Term Notes due March 15, 2004, which pay interest at a

fixed rate of 6.65% per year and (2) $500 million principal amount of unsecured

Notes due December 15, 2005, which pay interest at a fixed rate of 7.70% per

year.

Under the first interest rate swap agreement, we are paying the London InterBank

Offered Rate (LIBOR) plus a margin per year and receiving 6.65% per year on a

notional amount of $300 million until March 15, 2004. Under the second

agreement, we are paying LIBOR plus a margin per year and receiving 7.70% per

year on a notional amount of $500 million until December 15, 2005.

At December 31, 2002, our interest rate swap agreements had an estimated

long-term fair value of $21 million which was recorded in other noncurrent

assets on our Consolidated Balance Sheets. In accordance with fair value hedge

accounting, we also recorded a $21 million increase to the carrying value of our

long-term debt. We did not have any interest rate swap agreements outstanding at

December 31, 2001. See Note 1 for information about our accounting policy for

interest rate swap agreements.

EQUITY WARRANTS AND OTHER SIMILAR RIGHTS

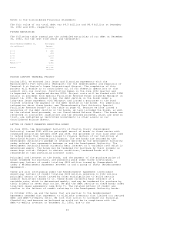

We own equity warrants and other similar rights in certain companies, primarily

Republic and priceline. The total fair value of these rights at December 31,

2002 and 2001, was $14 million and $48 million, respectively. See Notes 1 and 2

for information about our accounting policy for these rights and the significant

rights that we own, respectively.

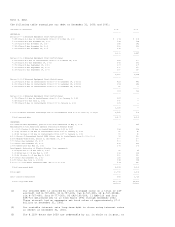

Note 5. Goodwill and Intangible Assets

On January 1, 2002, we adopted SFAS 142, which requires that we discontinue the

amortization of goodwill and other intangible assets with indefinite useful

lives. Instead, we now apply a fair value-based impairment test to the net book

value of goodwill and indefinite-lived intangible assets. See Note 1 for

information about our accounting policy for the impairment tests of goodwill and

other intangible assets.

41